The price of XRP, the native token of RippleNet, has been caught in the crosshairs of a bearish crypto market. Currently trading below the crucial $0.50 mark, XRP seems to be following the broader market trend. However, a recent analysis by market analyst Tylie Eric throws a glimmer of hope for XRP holders, predicting a potential price surge based on a technical indicator.

Understanding Elliott Wave Theory

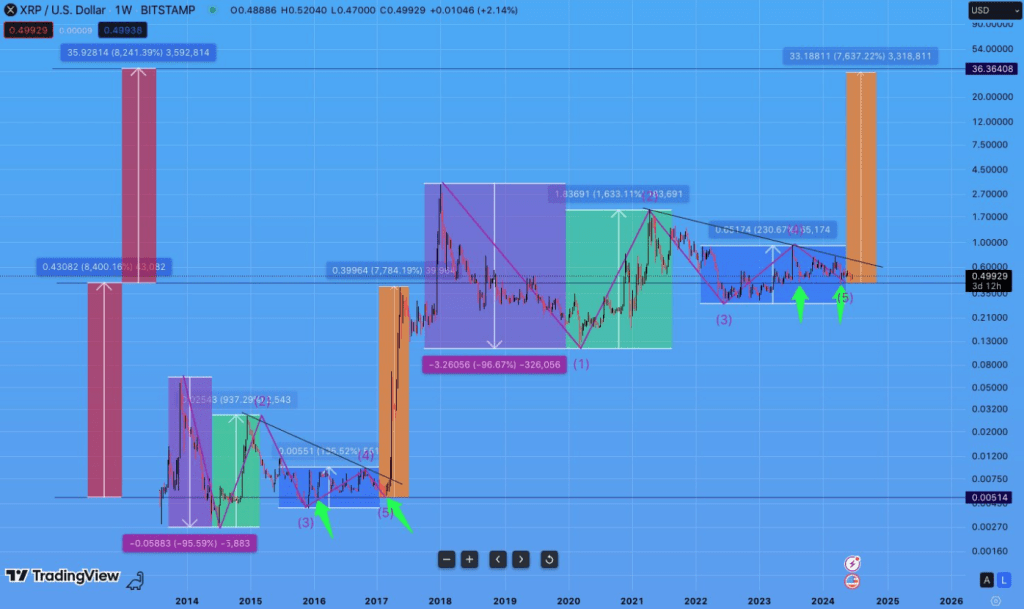

Eric argues that XRP’s price movements might be following a historical pattern known as the Elliott Wave theory. This theory proposes that market trends unfold in a specific five-wave structure, with each wave representing a distinct phase in the price cycle.

According to Eric, XRP has exhibited this five-wave structure on multiple occasions in the past on its weekly chart. Notably, each time this pattern materialized, the fifth and final wave culminated in a significant price increase.

#XRP.

BEAT BY BEAT

I think XRP has ticked all the boxes and held all requirements to continue with wave 3 of wave 5,

Same way it did in 2017! pic.twitter.com/qqexAC7b1X— Tylie E (@TylieEric) June 20, 2024

Eric cites the example of early 2017, where the completion of the fifth wave triggered a surge that propelled XRP to a high of $0.39, a staggering 7,700% increase. This upswing was followed by a brief consolidation period before another decisive rally to $3.30.

A Potential Fifth Wave?

Building on this historical precedent, Eric believes XRP is nearing the conclusion of another five-wave structure that began its formation after the 2017 price drop. His analysis suggests that all four preceding waves have unfolded over the past six years, paving the way for a potential fifth wave that could mirror the dramatic rise witnessed in 2017.

Eric’s audacious prediction hinges on the assumption that the fifth wave will again translate to a substantial price increase. His chart projects a potential upsurge of a staggering 7,630%, which would propel XRP to a price target of a phenomenal $36. This prediction aligns with forecasts from other analysts like CryptoInsightUK, who projected an XRP price surge to $34 last September.

Long Way Ahead

Eric’s prediction hinges on the completion of the Elliott Wave structure, a technical theory that remains a subject of debate among financial experts. Furthermore, the $36 price target appears highly ambitious. It’s important to remember that achieving such a price point would require XRP to surpass the current market capitalization of all cryptocurrencies combined.

Featured image from Getty Images, chart from TradingView