A new report from ivezz.com reveals that every year, an estimated 2-5% of the global GDP is laundered, translating to up to $5.05 trillion by 2024.

Reflecting on these numbers reveals a significant point of analysis: despite the rising focus on crypto as a tool for illicit financial activities, its actual share in global money laundering remains minimal. The United Nations Office on Drugs and Crime provides a standard method for estimating money laundering volumes. This approach suggests annual laundering figures ranging between $2.22 trillion and $5.54 trillion in 2024. However, Chainalysis reports that only $23.8 billion in crypto was laundered in 2022. This amount is merely 0.47% of the lower bound of the total estimated global money laundering.

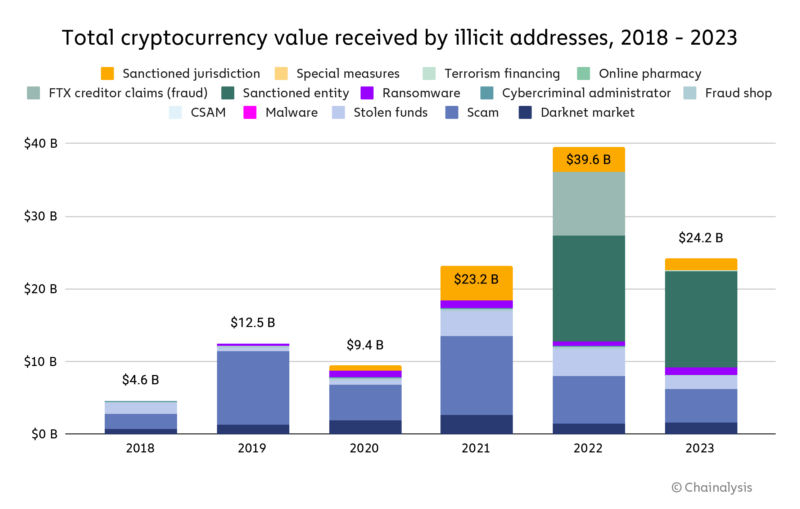

Further, Chainalysis’ 2024 report showed that overall illicit activities related to crypto fell from $39.6 billion to $24.2 billion last year for a total of 0.34% of on-chain activity. Money laundered through sanctioned entities was also reduced to $14.9 billion, a reduction of almost 50%.

This proportion emphasizes that while crypto facilitates some laundering activities, traditional financial systems continue to dominate the landscape. Thus, these statistics challenge the narrative that cryptocurrency is a primary tool for money laundering. For instance, in the United States, about $300 billion is laundered annually, representing a more substantial share of the country’s GDP than the $23.8 billion globally attributed to crypto laundering.

The focus on crypto, though growing, reflects a relatively small segment of overall laundering activities. While the increase in crypto-related laundering by 68% from the previous year highlighted its rising use, it has since fallen, and it remains a fraction compared to the entire spectrum of illicit financial flows. Similarly, in the UK, over £100 billion is laundered yearly, a stark contrast to the global crypto laundering figure.

Moreover, traditional financial systems still see significant laundering activities. The US Treasury Department’s data and other country-specific studies reveal that banking and payment systems remain primary conduits for illicit funds. For example, Germany sees approximately €100 billion laundered annually through various sectors, including real estate and art dealerships, sectors with relatively low awareness of anti-money laundering measures.

In Russia, dark money hidden abroad is estimated at $1 trillion, showcasing the scale of traditional money laundering mechanisms compared to the relatively minuscule cryptocurrency-related activities. China’s annual laundering figures stand at about $154 billion, further illustrating the dominant role of conventional systems.

Additionally, global anti-money laundering risk assessments reflect ongoing challenges. The Basel Institute of Governance indicates a slow improvement in mitigating these risks, emphasizing the need for robust supervisory frameworks and better prosecution of laundering cases.

Thus, invezz.com’s most recent analysis highlights that while crypto’s role in money laundering cannot be dismissed, its impact is relatively minor in the broader context of global financial crimes. The report states,

No matter where you live, offenders launder up to 5% of the GDP that you produce and hide it away. Money laundering steals from the taxes you pay, making rich people richer and poor people poorer.”

Understanding these forces is crucial for developing effective anti-money laundering strategies that encompass both traditional and emerging financial systems and for effectively assessing the popular narratives related to digital assets.

The post Only 0.47% of money laundering uses Bitcoin and crypto out of $5 trillion globally appeared first on CryptoSlate.