On-chain data suggests this signal that has historically occurred around Ethereum peaks has yet to appear in the current cycle.

Ethereum Foundation Wallets Haven’t Made Large Outflows This Cycle So Far

In a new post on X, the market intelligence platform IntoTheBlock has discussed a pattern that Ethereum has witnessed alongside its previous market peaks.

The pattern in question is related to the netflows for the wallets associated with the Ethereum Foundation. The ETH Foundation is a non-profit entity supporting the cryptocurrency and its ecosystem.

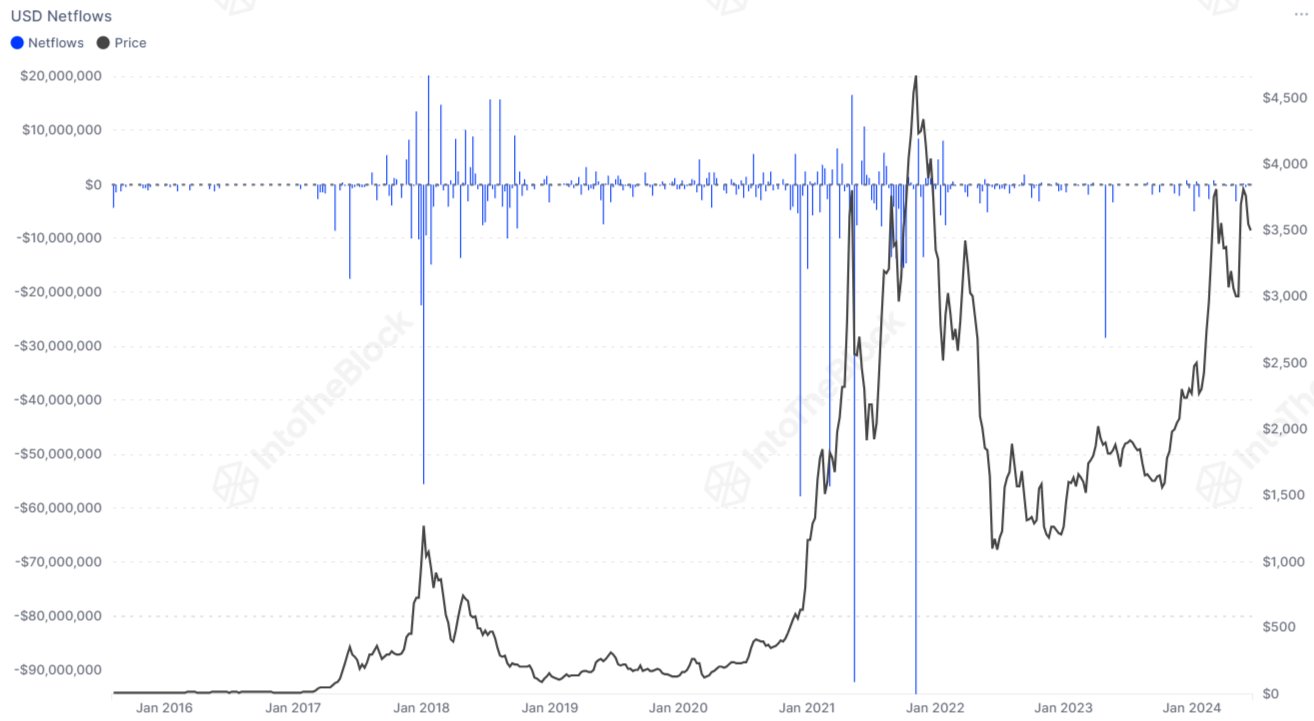

Below is the chart shared by the analytics firm that shows the trend in the net amount of ETH (in USD) moving in or out of the wallets connected to this organization.

As is visible in the above graph, the netflows for the Ethereum Foundation have generally taken negative values during the past bull markets. Negative netflows naturally correlate to a net amount of ETH movement away from the wallets connected to the company.

Interestingly, the indicator has seen especially large red spikes around the tops of the cryptocurrency. As IntoTheBlock explains,

Historically, during each bull market, the Foundation has strategically sold substantial amounts, often aligning these sales almost perfectly with market peaks.

The chart shows that the indicator’s value has been more or less neutral during the past few months, even though the asset’s price has increased significantly.

This suggests that the Ethereum Foundation hasn’t been making any major sales during this bull market. Given the historical pattern, this may be a sign that a top isn’t yet here for the cryptocurrency, or at least the organization doesn’t judge it to be so.

Another explanation, however, could be that the non-profit entity has changed its strategy for this new cycle, meaning that the past trend would no longer hold the same weight.

In some other news, the official email of the Ethereum Foundation was recently compromised, as Tim Beiko, one of the ETH developers, had revealed in an X post.

The developer had noted that the organization was trying to reach out to SendPulse, an email automation service used by the firm, to resolve the problem.

In a follow-up post, Beiko confirmed that the team sent out an update to subscribers of the Ethereum Foundation blog, warning them that the previous email, announcing a “staking platform” by the organization, resulted from the compromise.

“We should have locked down all external access, but we are still confirming,” said the developer in the post.

ETH Price

Ethereum plunged under the $3,300 level yesterday, but the asset has since recovered above $3,400.