Quick Take

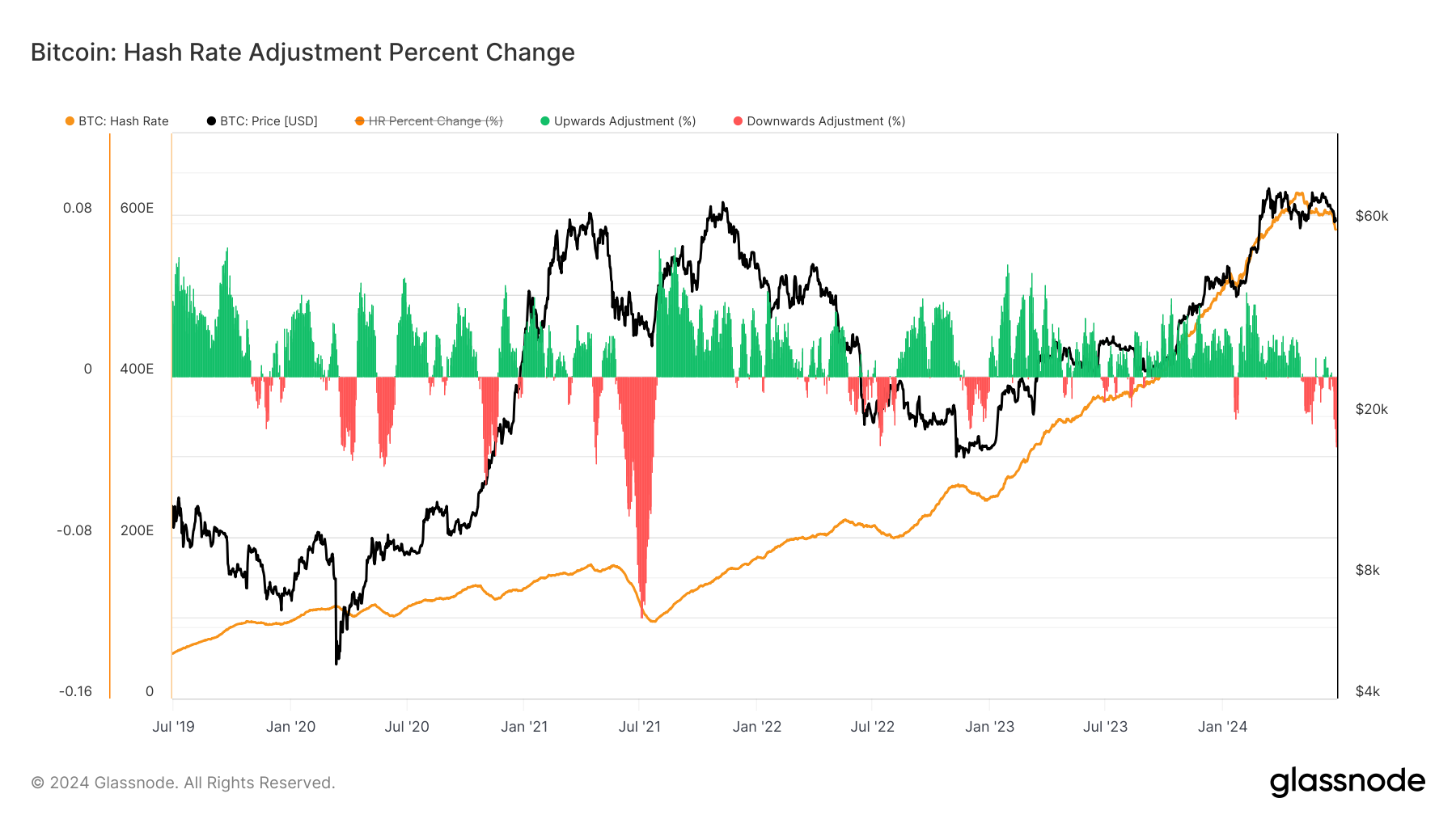

Glassnode data shows that the Bitcoin network’s hash rate has plummeted to 555 EH/s, marking a significant 16.5% decline or a 100 EH/s drop from its all-time high on a seven-day moving average. On a 30-day moving average, this is the steepest decline in hash rate since the Chinese mining ban in the summer of 2021.

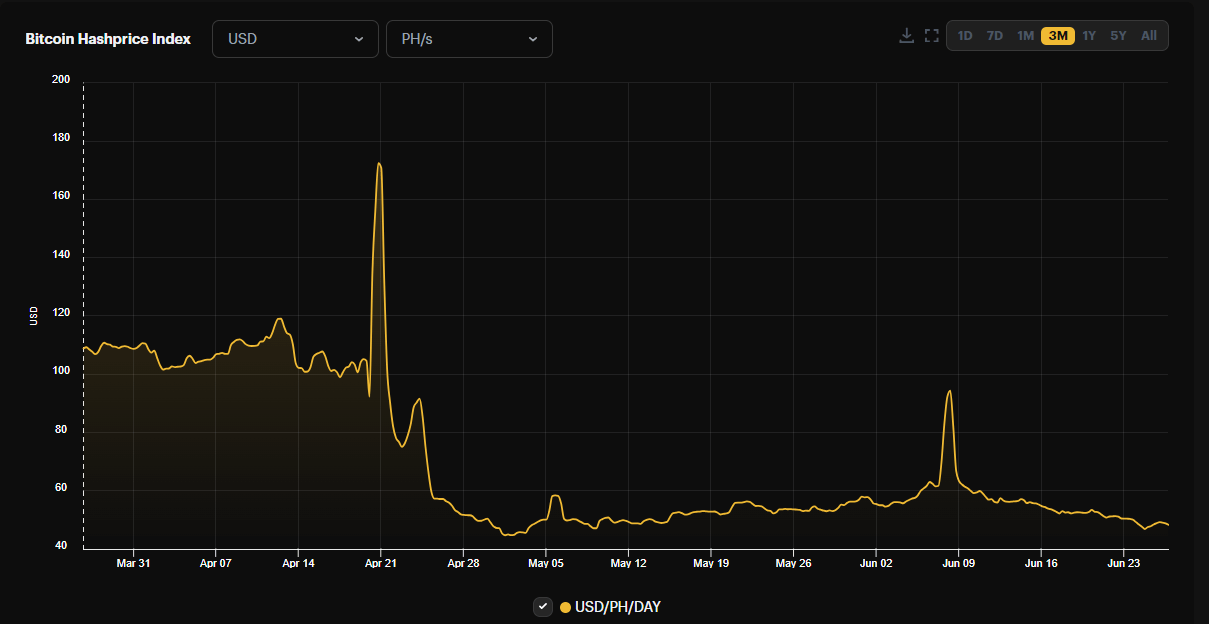

Hashprice, a term coined by Luxor, measures the expected earnings per terahash per second of hashing power per day. Currently, the hash price stands at $48 PH/s, hovering near all-time lows set on May 1, when Bitcoin dropped to $56,500.

Luxor COO Ethan Vera provided CryptoSlate with an exclusive comment on the current mining conditions, forecasting further declines in hash rate through the summer.

“After months of relentless hashrate growth, Bitcoin mining market participants are predicting a slowdown, the summer months are expected to put pressure on Texas and adjacent miners, leading to a potential curtailment of operations.”

Vera goes on further to say:

“Based on current estimates, miners across North America are likely to shut down their machines due to increased power rates and the opportunity to sell power back to the grid.”

Vera also noted the uncertainty surrounding transaction fees, a critical variable for miner revenue.

“A significant uncertainty remains in transaction fees, which have become an increasingly important factor in mining revenue.

According to the Glassnode hash-ribbon metric, miner capitulation is ongoing, reaching day 44, indicating continued stress within the mining community.

In the current Bitcoin difficulty epoch, which is approximately halfway through, the difficulty level is projected to decrease by around 7%.

The post Luxor COO forecasts further hash rate decline amid rising summer power rates appeared first on CryptoSlate.