Onchain Highlights

DEFINITION: The Estimated Leverage Ratio is the ratio of the open interest in futures contracts to the balance of the corresponding exchange.

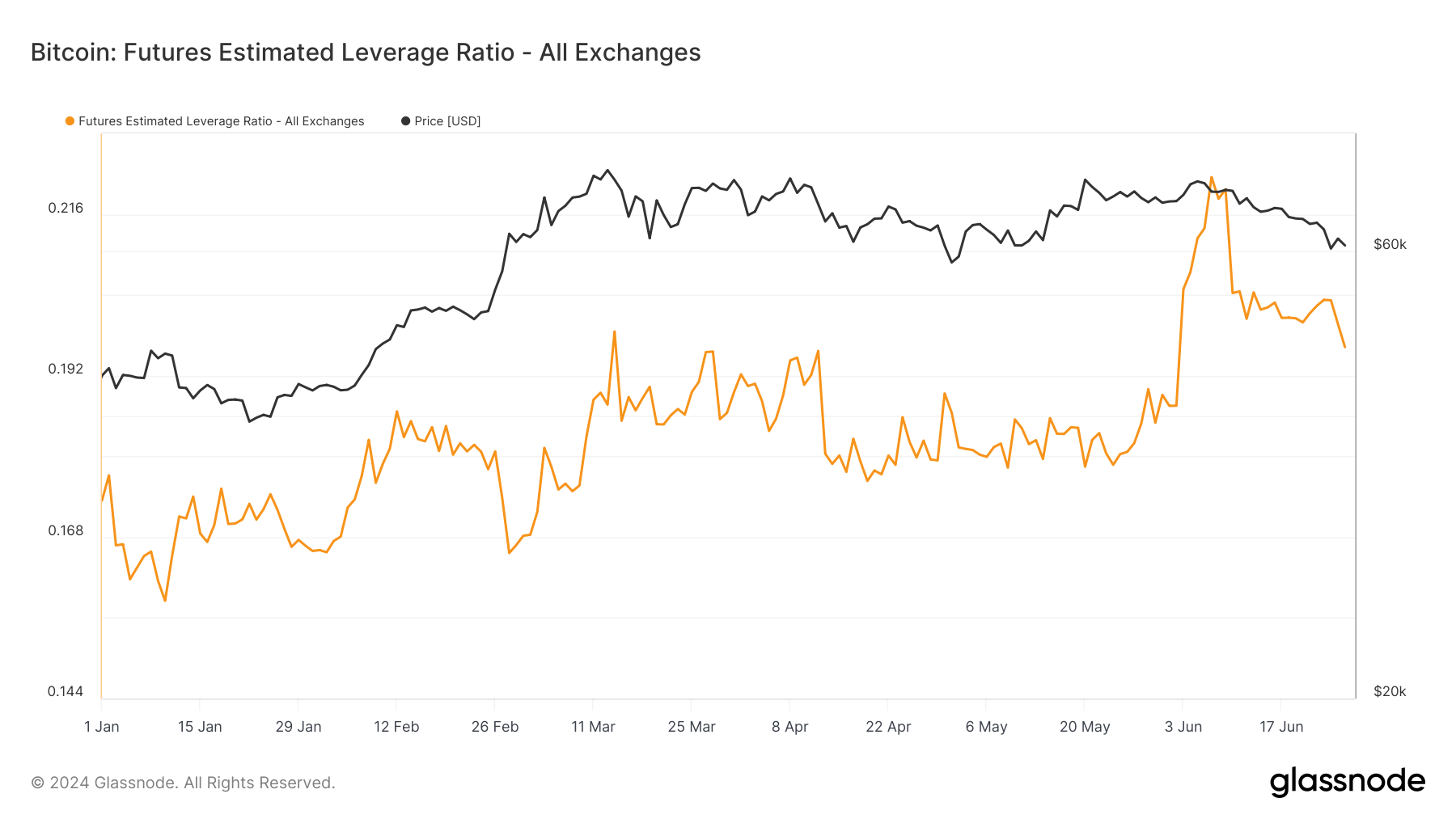

Bitcoin’s futures estimated leverage ratio indicates shifts in market sentiment. Since January 2024, the ratio exhibited volatility, initially fluctuating around 0.17 before rising to 0.216 in early June. This increase coincided with Bitcoin’s price moving back toward $60,000. However, a sharp decline in the ratio and price was observed just after, suggesting a potential deleveraging phase among traders as Bitcoin continued downward.

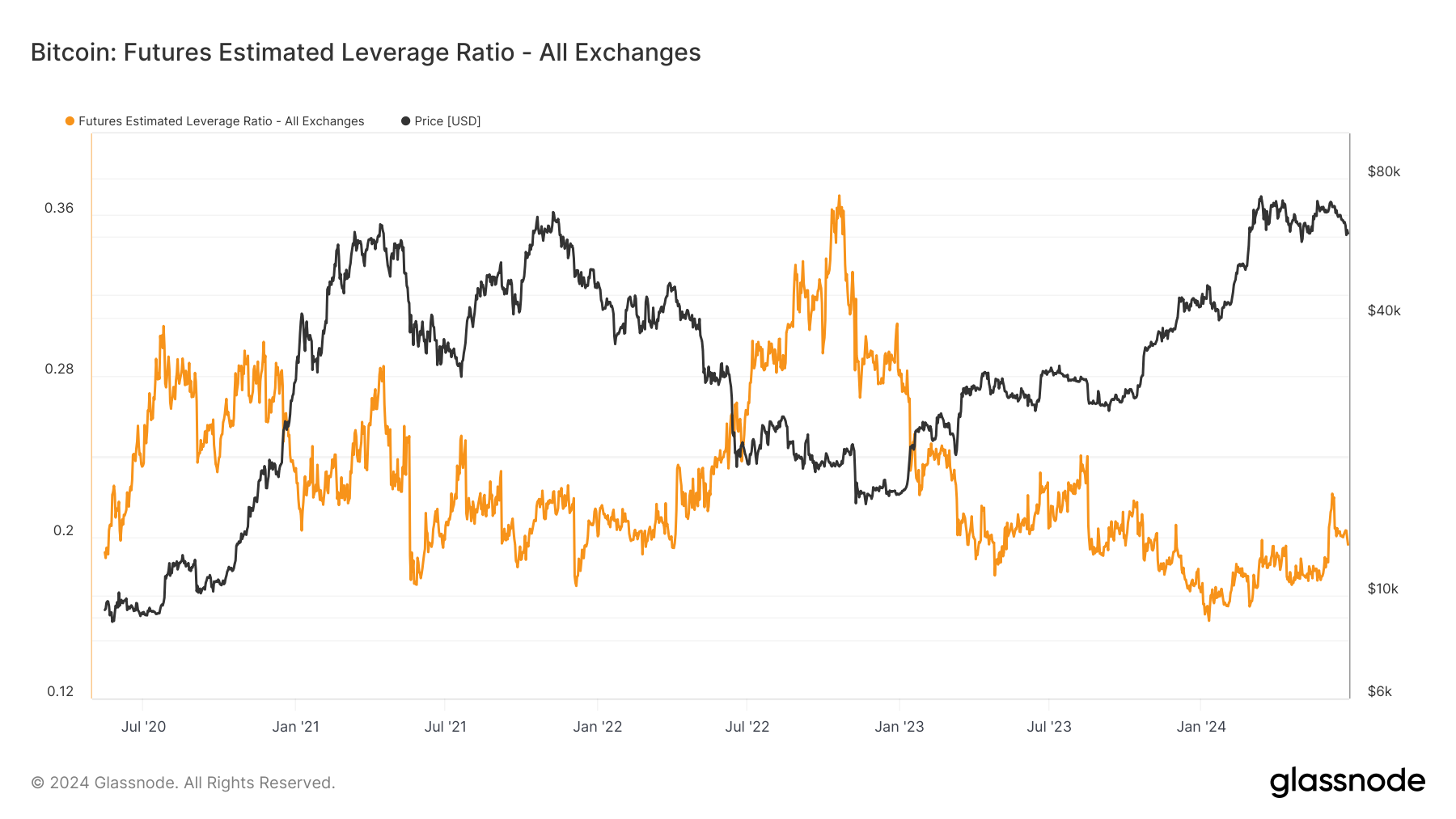

Historical data reveals that similar leverage spikes have preceded significant price movements. Notably, during the bear market of 2022, the leverage ratio peaked above 0.36 as Bitcoin approached $15,000. Conversely, lower leverage ratios aligned with Bitcoin’s subdued price action, reflecting cautious market behavior.

Current trends imply high leverage ratios could signal impending volatility, while declines may indicate market stabilization. As the market adapts post-halving, monitoring these leverage conditions will be crucial for anticipating future price trajectories.

At present, levels at 0.2 are below that seen at the peak of the 2021 bull run and below the average recorded since 2020.

The post Bitcoin futures leverage ratio’s sharp June fluctuation hints at market deleverage phase appeared first on CryptoSlate.