Onchain Highlights

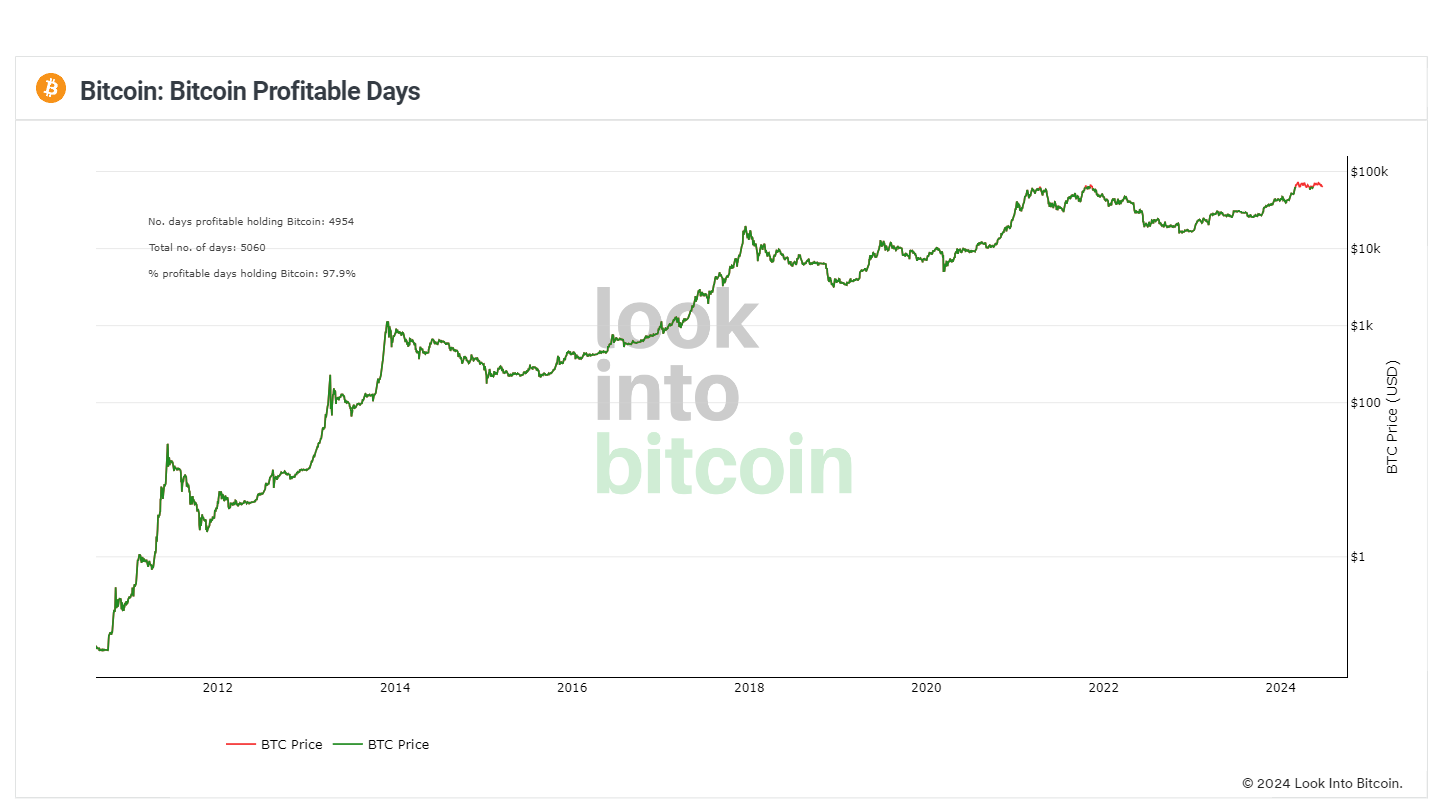

DEFINITION: Number of days in Bitcoin’s traded history where holding Bitcoin has been profitable relative to today’s price.

Bitcoin’s market history reveals a high percentage of profitable holding days, indicating strong long-term value retention. Glassnode data shows that out of 5,060 days since its inception, holding Bitcoin has been profitable on 4,954 days, representing 97.9% of its total trading days. This metric highlights the consistent upward trajectory of Bitcoin’s value over time.

The near-universal profitability of holding Bitcoin highlights its resilience and attractiveness as a long-term investment. Even amidst volatility, the crypto has demonstrated a remarkable capacity to recover and surpass previous price levels. This trend may be driven by factors such as increasing institutional adoption, technological advancements, and growing acceptance of Bitcoin as a store of value.

Per Lookintobitcoin, the data suggests that investors who have held Bitcoin for extended periods have largely experienced gains, reinforcing the narrative of Bitcoin as a reliable asset. This insight provides context for understanding Bitcoin’s performance and potential future digital asset market trends.

The post Bitcoin profitable on 4,954 days since inception, 97.9% of its history appeared first on CryptoSlate.