On-chain data shows the Bitcoin mining hashrate has declined to the lowest since early March.

7-Day Average Bitcoin Mining Hashrate Has Continued To Go Down Recently

The “mining hashrate” refers to an indicator that keeps track of the total computing power the miners have currently connected to the Bitcoin blockchain. This metric’s value could be considered a proxy for the sentiment among the miners.

When the indicator’s value increases, the existing miners expand their mining farms, and new ones enter the space. Such a trend suggests the blockchain is looking attractive to these chain validators.

On the other hand, the metric registering a decline implies some miners have decided to bring their machines offline, potentially because they are no longer finding the cryptocurrency profitable.

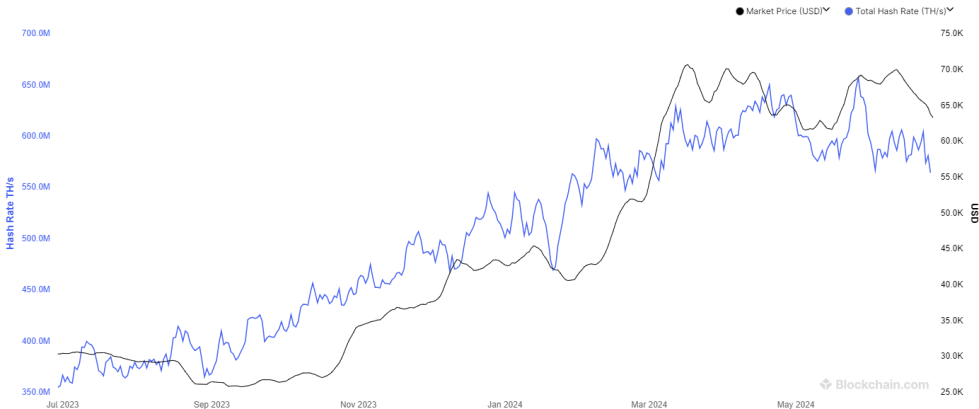

Now, here is a chart that shows the 7-day average Bitcoin mining hashrate over the past year:

As displayed in the above graph, the 7-day average Bitcoin mining hashrate set a new all-time high (ATH) last month, but the metric has since been going through a drawdown. This decline will likely be the bearish momentum the cryptocurrency’s price has been observing.

Miners make most of their revenue through the BTC block rewards they receive as compensation for solving blocks. These rewards are fixed in value and more or less fixed in frequency. As such, the only variable related to them is the spot price of BTC.

When the price of the asset drops, so does the value of the rewards these miners are getting, which naturally leads to a decrease in revenue. Bitcoin has taken a sizeable hit recently, so it makes sense that some miners have gone underwater.

Following the most recent leg down in the mining hashrate, its value has plunged to its lowest since early March. If BTC persists at its current lows or declines further, the indicator will likely extend its fall.

Because of the miners’ distress, they have also been selling their stored-up rewards recently, as an analyst pointed out in a CryptoQuant Quicktake post.

The above chart shows the trend in the Bitcoin balance for the over-the-counter (OTC) desks. It would appear that this metric has observed a notable increase recently. According to the quant, the selling moves from the BTC miners have been a factor behind this growth.

BTC Price

Bitcoin is trading near the lower end of its recent consolidation range as its price is around $61,700.