Quick Take

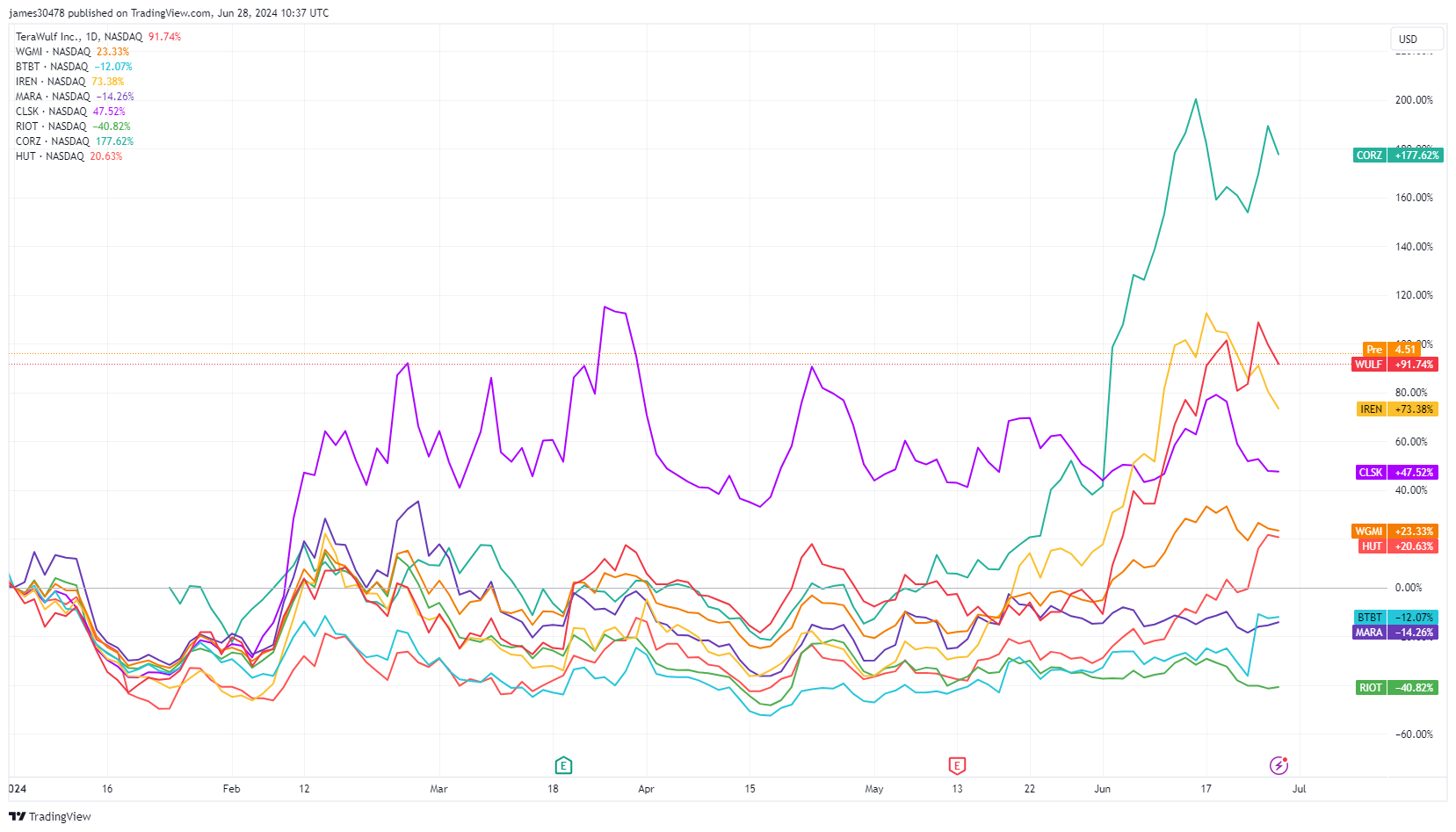

The ongoing miner capitulation, driven by a falling Bitcoin price, declining hash rate, and a meager hash price, has significantly impacted publicly traded Bitcoin miners. Despite this challenging environment, public miners have shown resilience post-halving, with a total market cap exceeding $25 billion and WGMI experiencing a 24% rise in June and a 23% year-to-date increase.

Amidst these difficulties, a silver lining has emerged in the form of the AI boom. This surge in artificial intelligence has positively influenced the mining sector. NVIDIA’s rise to becoming the largest company globally exemplifies this trend, benefiting miners. Core Scientific has expanded its CoreWeave infrastructure to 270 MW, while Hut 8 received a $150 million boost for AI data center expansion. Bit Digital, another Bitcoin miner, now derives an estimated 27% of its revenue from AI, according to CNBC.

The sector’s acquisition trend is expected to continue, as evidenced by Cleanspark’s activities and the ongoing rivalry between Riot and Bitfarms. A recent analysis by JP Morgan highlights that the success of these Bitcoin miners can be attributed to their diversification into AI data center ventures, providing a much-needed buffer against a depressed Bitcoin price.

Additionally, Marathon Digital has diversified its revenue by mining Kaspa, a proof-of-work (PoW) layer 1 blockchain network.

This highlights the intense and competitive nature of the industry, especially in the wake of the halving, with miners exploring various strategies to boost their revenues.

The post Public Bitcoin miners diversify into AI as market cap exceeds $25 billion appeared first on CryptoSlate.