A crypto expert has predicted a bullish price reversal for Bitcoin, the world’s largest cryptocurrency. The analyst suggested that Bitcoin’s price may have bottomed in, potentially signaling the start of market stabilization after a prolonged downturn.

Bitcoin Price Reversal On The Horizon

Crypto expert and Bitcoin analyst, Willy Woo has taken to X (formerly Twitter) to shed light on Bitcoin’s current price performance and its future outlook as market conditions stabilize. The analyst disclosed that there may be a good chance that “Bitcoin has cleared all price lows” for this market cycle.

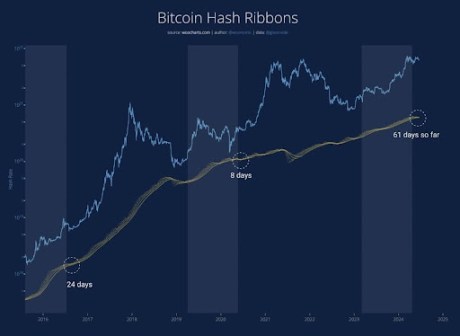

The crypto expert disclosed that miner capitulation was one of the most reliable indicators for a subsequent price reversal in a cryptocurrency, typically ending periods of sideways or bearishness. Sharing a price chart of Bitcoin’s performance, the analyst has stated that short-term technicals point to a possible price reversal for the pioneer cryptocurrency.

He disclosed that the market was approaching a TD9 reversal signal on the daily candles, which is expected to occur in two hours. A TD9 reversal is a technical indicator that usually signals a possible change in a cryptocurrency’s market trend.

The crypto expert has revealed that if this scenario plays out, Bitcoin could start correcting upwards, compensating for the recent price declines triggered by excessive selling from miners and significant liquidations driven by speculators. However, Woo has cautioned that Bitcoin’s path to recovery remains uncertain, as substantial speculative activity still needs to be flushed out of the market.

The analyst has revealed that Bitcoin can only recover when weak miners die and hash rates recover. He also disclosed that liquidations were necessary for a major price pump in Bitcoin.

Is BTC’s Bottom In?

Woo suggested in his post that Bitcoin may have reached its bottom price. The cryptocurrency is currently trading at $61,481, reflecting a 3.86% decline over the past week, according to CoinMarketCap.

In an earlier post, the crypto expert disclosed a price target for Bitcoin at $62,000, highlighting that an increase in liquidations has triggered substantial downward momentum for Bitcoin. He revealed that the $62,000 threshold was the most optimal price point to flush out excessive leverage in Bitcoin.

However, as speculators continued to open new long positions, it inadvertently led to more liquidations as Bitcoin’s price fell. The long squeeze triggered additional downward pressure for the cryptocurrency, pushing Woo’s initial price target down towards $58,000.

Adding to the market pressure, Woo disclosed that a post-halving miner’s capitalization was ongoing. He disclosed that after Bitcoin’s halving event on April 20, numerous miners sold off their Bitcoin holdings, exacerbating the cryptocurrency’s downward spiral as selling pressures increased.

Woo revealed that $54,000 may be the next layer of liquidations for Bitcoin, predicting that if the cryptocurrency reaches these lows, it could potentially tip it into a bearish phase.