On-chain data shows that selling pressure from Bitcoin miners has recently slowed down. This is significant considering the impact it could have on Bitcoin’s price heading into the third quarter of the year.

Bitcoin Miners’ Selling Pressure Has Significantly Declined

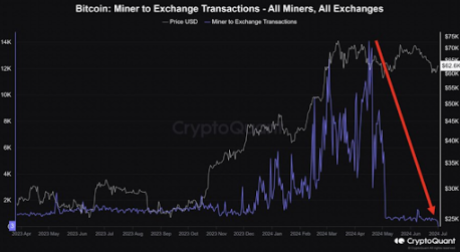

Referencing data from the on-chain analytics platform CryptoQuant, crypto analyst Crypto Dan noted that selling pressure from miners has significantly declined for two reasons. One is that the quantity of Bitcoin these miners sent to exchanges to sell has reduced drastically since May.

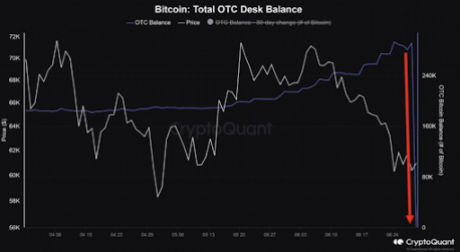

Secondly, the crypto analyst mentioned that the volume of the OTC Desk that miners use for selling has been consumed, suggesting that someone recently bought up all the available Bitcoin supply from these miners. The volume of the OTC Desk is said to have piled up until June 29th, as there was no willing buyer to purchase these crypto tokens.

Bitcoin miners greatly contributed to the price crashes the flagship crypto suffered in June. Data from the market intelligence platform IntoTheBlock showed that these miners sold 30,000 BTC ($2 billion) throughout the month. This put significant selling pressure on Bitcoin, which caused it to drop below $60,000 at some point.

As such, the decline in selling pressure presents a bullish development for Bitcoin and could continue the bull run for the flagship crypto. Crypto Dan noted that this development has created “sufficient conditions” to continue the upward rally for Bitcoin in this third quarter of the year.

Crypto analyst Willy Woo had also previously predicted that Bitcoin’s price would recover once miners capitulate. With that out of the way, Bitcoin could enjoy an upward trend this month and make massive moves to the upside.

BTC’s Uptrend Has Begun

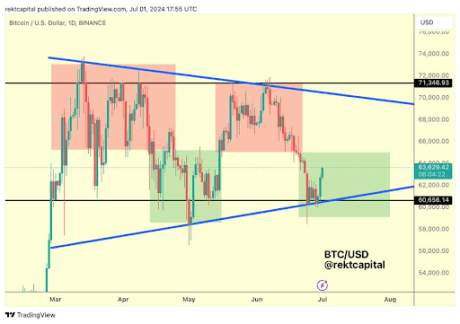

Crypto analyst Rekt Capital noted in a recent X (formerly Twitter) post that Bitcoin’s uptrend has begun. He claimed that the macro higher low has been confirmed, and Bitcoin is now rallying to the upside. He added that the flagship crypto is developing a macro bull flag, providing a bullish outlook for the crypto token.

In another X post, the crypto analyst remarked that the goal for Bitcoin following its strong start to July is to build a “foundation from which it will be able to springboard to the Range High area at $71,500 over time.”

Crypto analyst Michaël van de Poppe also suggested that Bitcoin’s downtrend is over and a bullish reversal was underway as the flagship crypto makes significant moves to the upside. He also mentioned that he believes that Bitcoin has bottomed out and has found support at $60,000, meaning a decline below that price level anytime soon was unlikely.

At the time of writing, Bitcoin is trading at around $62,900, down in the last 24 hours, according to data from CoinMarketCap.