On-chain data shows a PEPE whale has withdrawn a large amount of the memecoin from Binance today, a sign that could be bullish for its price.

PEPE Whale Has Made A Large Outflow From Binance In The Past Day

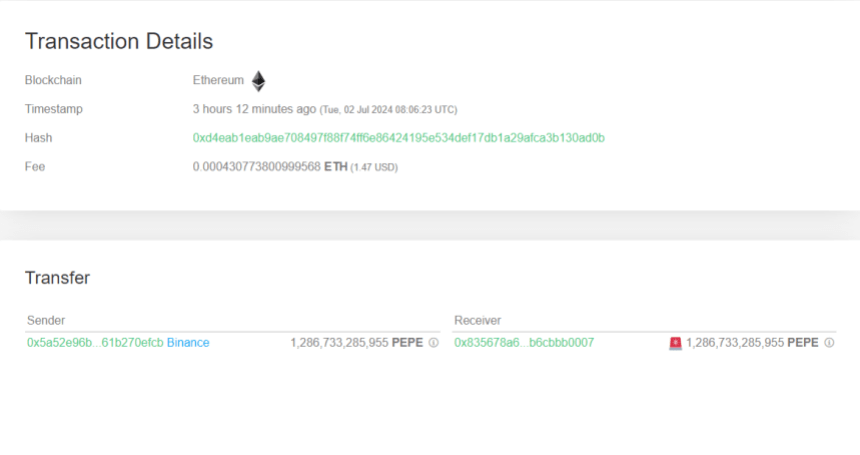

According to data from the cryptocurrency transaction tracker service Whale Alert, a massive Pepe transaction has been spotted on the blockchain during the last 24 hours.

The transfer involved the movement of 1,286,733,285,955 tokens on the network, worth more than $14.7 million when the transaction went through.

Given this large scale, it’s likely that a whale entity was responsible for the move. Whales are humongous investors who carry large amounts in their wallets. As they can make huge single-transaction movements like this latest one, they are considered influential beings on the market.

Therefore, their moves can be worth keeping an eye on, as they may have implications for the price. Generally, though, it’s hard to say how exactly a move might reflect on the market, but sometimes, the addresses involved can provide some hints.

Below are the address details for the latest Pepe whale transaction.

As is visible, the sending address for this PEPE transaction was one attached to the cryptocurrency exchange Binance. Conversely, the receiver wasn’t affiliated with any centralized platform, suggesting that it was likely an investor’s self-custodial wallet.

Transfers that move from exchanges to personal addresses are called “exchange outflows.” Generally, investors make outflows from these platforms when they plan to hold in the long term, so these transfers can potentially carry bullish benefits for the cryptocurrency.

The whale may have made this latest transfer out of Binance for a similar purpose. It could also be that these coins were just freshly purchased by this large investor, thus making a move even more positive for the memecoin.

However, there also exists a bearish scenario where the whale has taken out their PEPE stack to sell through an over-the-counter (OTC) desk instead. As it’s impossible to say with any certainty which of these scenarios this transaction follows, it only remains to be seen what effects this transfer ends up having on the coin’s price, if any.

PEPE Price

Pepe had recently recovered towards the $0.0000121 level, but the asset has since seen a plunge of almost 5% as its price is now back at around $0.0000115. The chart below shows what the memecoin’s performance has looked like over the last few days.