Lido has reported a rise in staked Ethereum on its platform despite the US Securities and Exchange Commission (SEC) classifying its staking programs as securities in its lawsuit against Consensys.

Staked Ethereum increase

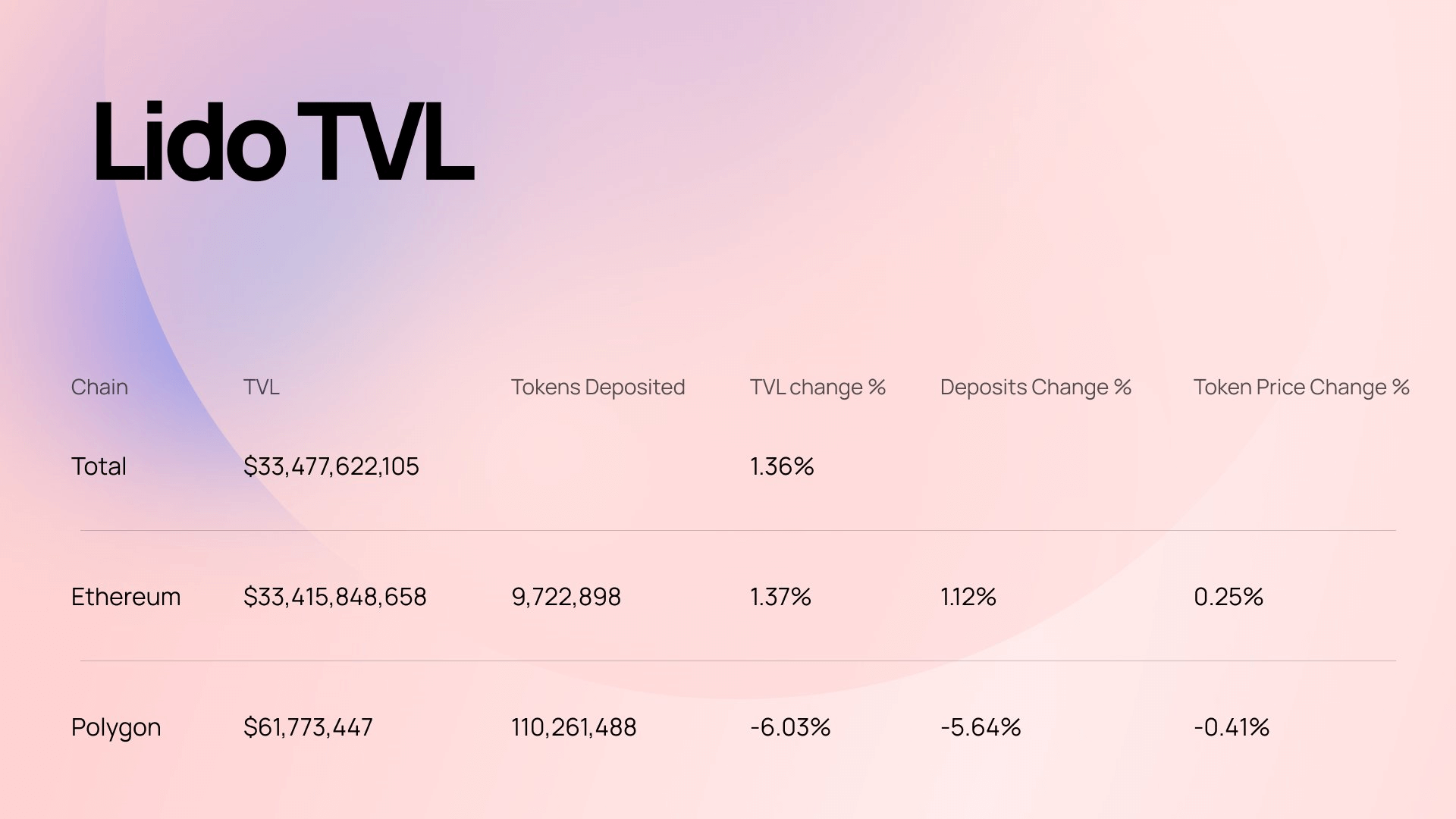

A July 2 report showed that Lido users staked an additional 95,616 ETH between June 24 and July 1. This increased the total value of assets staked on the platform by 1.26%, reaching $33.48 billion.

During this period, Lido led in net Ethereum deposit inflows, surpassing centralized exchanges like Binance and Gate.io and the rapidly growing liquid restaking project Ether.fi.

The platform also revealed significant activity in its wrapped staked ETH (wstETH) on Layer 2 networks like Scroll, Base, Arbitrum, Optimism, etc. The total number of assets on these blockchains increased by 7.19% to 141,586, bringing the 7-day trading volume to $1.23 billion.

However, the Annual Percentage Rate (APR) for staked ETH decreased slightly, dropping 0.04% to 2.96%.

Node decentralization

Lido is enhancing decentralization efforts by launching a Community Staking Module (CSM) to promote more decentralized Ethereum node operations.

According to official documentation, CSM will integrate a diverse range of Node Operators, including Solo stakers, into the network. The module will also allow permissionless entry for node operators. It added:

“The ultimate goal for this module is to allow for permissionless entry to the Lido on Ethereum Node Operator set and enfranchise solo-staker participation in the protocol, increasing the total number of independent Node Operators in the overall Ethereum network.”

This move would mark a clear departure from its previous approach, which required its DAO to approve a new node operator before its addition to the platform. However, its current initiative would allow solo staking to become more attractive and accessible for interest validators by introducing “reasonably low bond for Node Operators” and requiring “no secondary token collateral.”

The module is in early adoption mode on the Holesky testnet and is expected to transition to a permissionless state on July 11, 2024.

The post Lido sees around 100k increase in staked Ethereum amid SEC scrutiny appeared first on CryptoSlate.