Quick Take

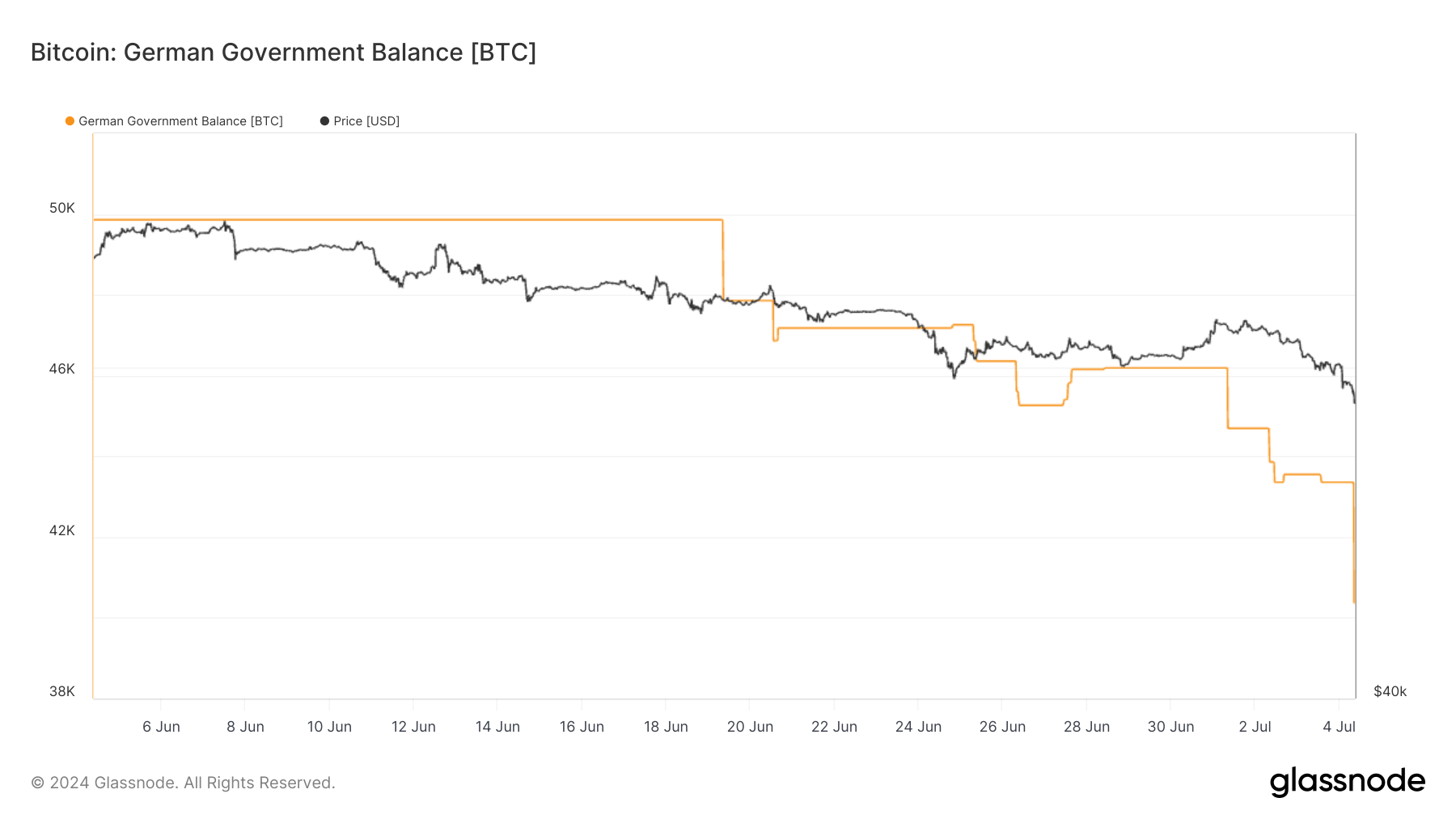

Bitcoin’s price has dropped below $58,000, marking its lowest level since May 1, when it traded around $56,500. This decline is driven by continued selling pressure, most notably from the German government, which has offloaded an additional 3,000 BTC.

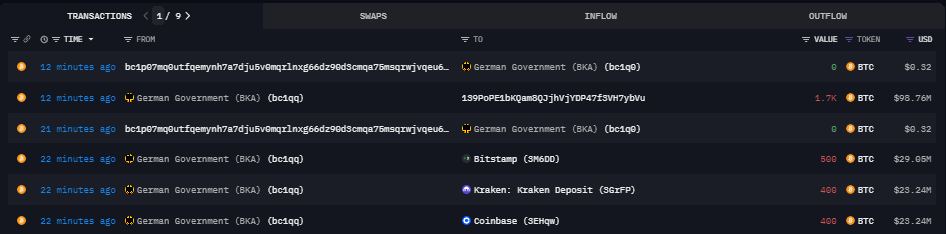

Data from Arkham Intelligence shows significant movements, including 1,300 BTC being transferred to major exchanges: 400 BTC (worth $23.24 million) to Coinbase, 400 BTC (worth $23.24 million) to Kraken, and 500 BTC (worth $29.05 million) to Bitstamp. Additionally, 1,700 BTC, valued at $98.76 million, were sent to an external address.

Glassnode data shows that the German government now holds a balance of 40,358 BTC, currently worth approximately $2.3 billion. This substantial reduction in their holdings has contributed to the downward pressure on Bitcoin’s market price. Investors are closely monitoring these developments as the market responds to the increased supply and the potential for further sales by large holders.

The post German government sell-off continues, pressures Bitcoin below $58,000, lowest since May appeared first on CryptoSlate.