According to a report by Standard Chartered, the market for tokenized real-world assets is projected to reach $30.1 trillion by 2034.

This significant market growth highlights the increasing role of tokenization in transforming global trade and finance by enhancing liquidity, accessibility, and efficiency. The report emphasizes the shift towards integrating digital assets into mainstream finance, reflecting the broader adoption and scalability of blockchain technology and DeFi applications.

Kai Fehr, Global Head of Trade, Standard Chartered, commented,

“We see the next three years as a critical junction for tokenisation, with trade finance assets coming to the fore as a new asset class. To unlock this trillion-dollar opportunity, industry-wide collaboration among all stakeholders, from investors and financial institutions to governments and regulators is critical.”

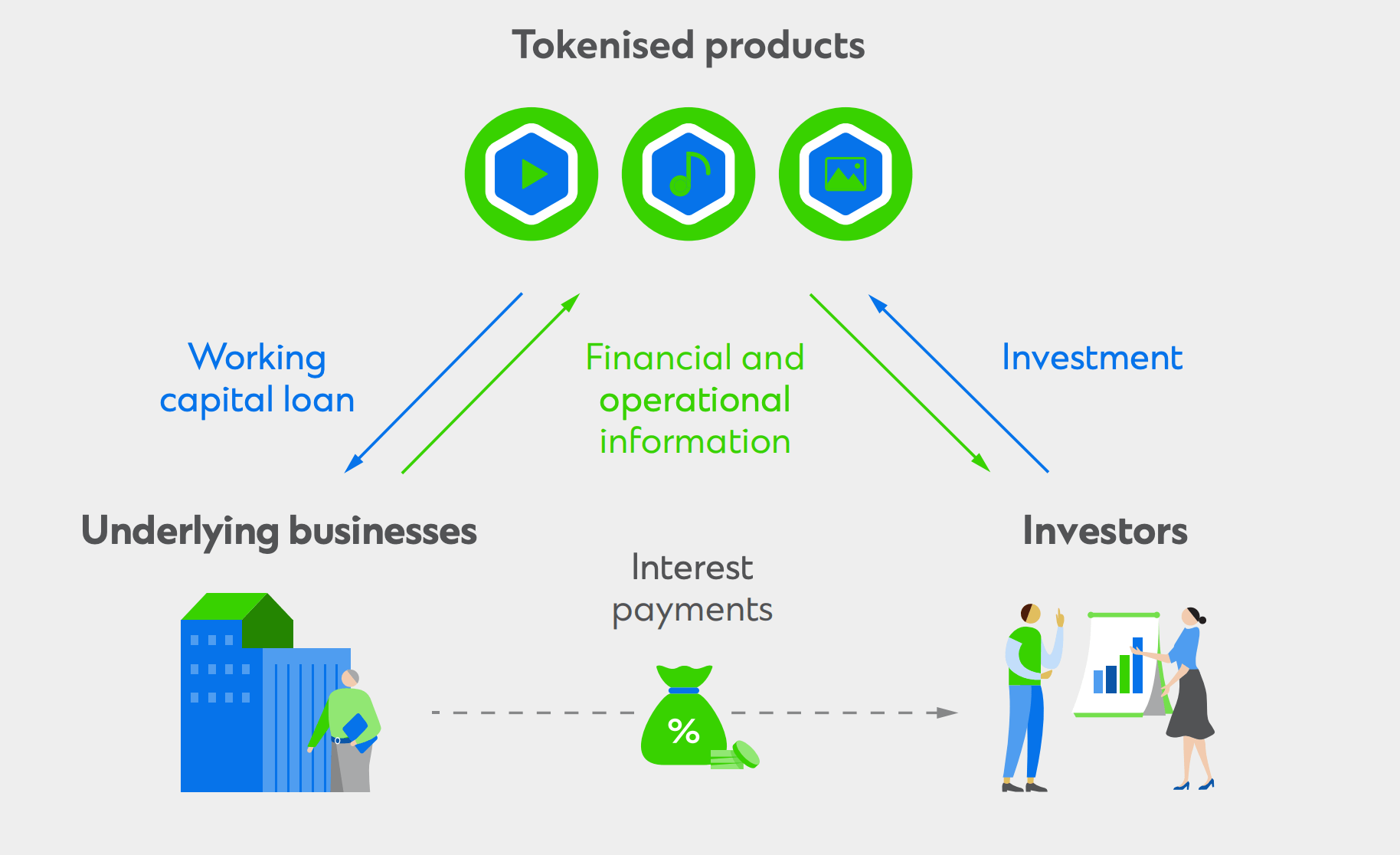

Standard Chartered’s analysis emphasizes the transformative impact of tokenizing trade finance assets, which are traditionally underinvested but offer strong risk-adjusted returns and low default rates. Tokenization enables fractional ownership, operational efficiency, and improved financial market infrastructure, which analysts state will unlock new opportunities for investors and help to bridge the $2.5 trillion global trade finance gap.

The report highlights the evolution of tokenization has been rapid, with significant milestones such as the introduction of Bitcoin in 2009 and Ethereum in 2015, which brought smart contracts and decentralized applications into the financial ecosystem. It further cites, regulatory frameworks and industry collaborations, such as Project Guardian, led by the Monetary Authority of Singapore, have further demonstrated the viability and benefits of tokenized assets.

As the market for tokenized assets expands, Standard Charter expects demand to soar, with projections indicating that 69% of buy-side firms plan to invest in tokenized assets by 2024. This growing interest is driven by the potential for reduced transaction costs, enhanced liquidity, and access to new asset classes. Despite the current market size of tokenized real-world assets being around $5 billion, excluding stablecoins, the potential addressable market, including trade finance gaps, is estimated to be $14 trillion.

Standard Chartered’s initiatives, such as the successful pilot of asset-backed security tokens on the Ethereum blockchain, highlight the practical applications of tokenization in improving market access and operational efficiency. The report advocates for increased collaboration among financial institutions, regulators, and technology providers to create a supportive environment for tokenization, emphasizing the need for standardized processes, regulatory compliance, and interoperability.

The report concludes that the financial industry stands at a critical juncture, with tokenization poised to revolutionize asset management, trade finance, and global economic activities. By embracing tokenization, Standard Chartered believes stakeholders can enhance capital efficiency, broaden market access, and drive innovation, paving the way for a more inclusive and resilient financial ecosystem.

The post Standard Charter reports $30 trillion tokenised real-world asset market by 2034 appeared first on CryptoSlate.