Bitcoin is fast selling off. At spot rates, the world’s most valuable coin dropped by over 5% on the last day of trading and continues to spiral lower, easily breaking $60,000. The psychological round number has been level to watch out for over the previous few days, especially following gains over the weekend.

Bitcoin Is Down: Is It Time To Buy?

While Bitcoin is edging lower and sellers are relentless, one analyst thinks this is the right time to stack up. In a post on X, the analyst argues that Bitcoin is on the cusp of the “Spring” phase within the Wyckoff re-accumulation model.

The Wyckoff model is a technical analysis tool used by traders and chartists. Traditionally, it uses price and volume patterns to identify potential price movements.

While Wyckoff describes multiple phases when it comes to price patterns, the “Spring” stage is what most traders always track. When prices “spring” higher from this stage, the coin tends to break out from the current range at the back of rising trading volume.

Looking at the Bitcoin daily chart, it is evident that prices have been consolidating. Thus far, the primary support is around the May and June 2024 lows. Then, prices broke lower, sinking below $57,000 and bottoming at around $56,500 in May. Resistance lies between $72,000 and March 2024 highs on the upper end.

As it is, Bitcoin is retesting the primary support, with the July 4 bar piercing $60,000 and dropping to as low as $56,900 earlier today. Based on the Wyckoff model, prices are priming for the spring phase. This preview will hold, especially if there is no confirmation of today’s losses.

Miner Capitulating Though Long-Term Holders Are Not Selling

Though the analyst is upbeat, not everyone is bullish. According to Willy Woo, an on-chain analyst, the current sell-off is primarily driven by miner capitulation. Looking at the Bitcoin Hash Ribbons, the drop appears to be getting started as the market culls off “weak” miners.

Since the April 20 Halving, the Bitcoin network automatically slashed BTC rewards by half to 3.125 BTC. This automated move heaped more pressure on miners, who must invest capital to buy gear and operate efficiently. With falling revenue, only the most efficient miners stand a chance to operate profitably.

As a result, those who can’t upgrade their gear are forced to exit the scene. If they don’t, they stand operating without a chance of consistently winning block rewards. Over the last eight months, on-chain data shows that miners have been offloading BTC, countering the uptrend of Q1 2024 and worsening the correction from April.

Amid this, long-term holders, mostly institutions and whales, stopped selling in mid-January 2024. Then, the United States Securities and Exchange Commission (SEC) approved the first spot for the Bitcoin exchange-traded fund (ETF).

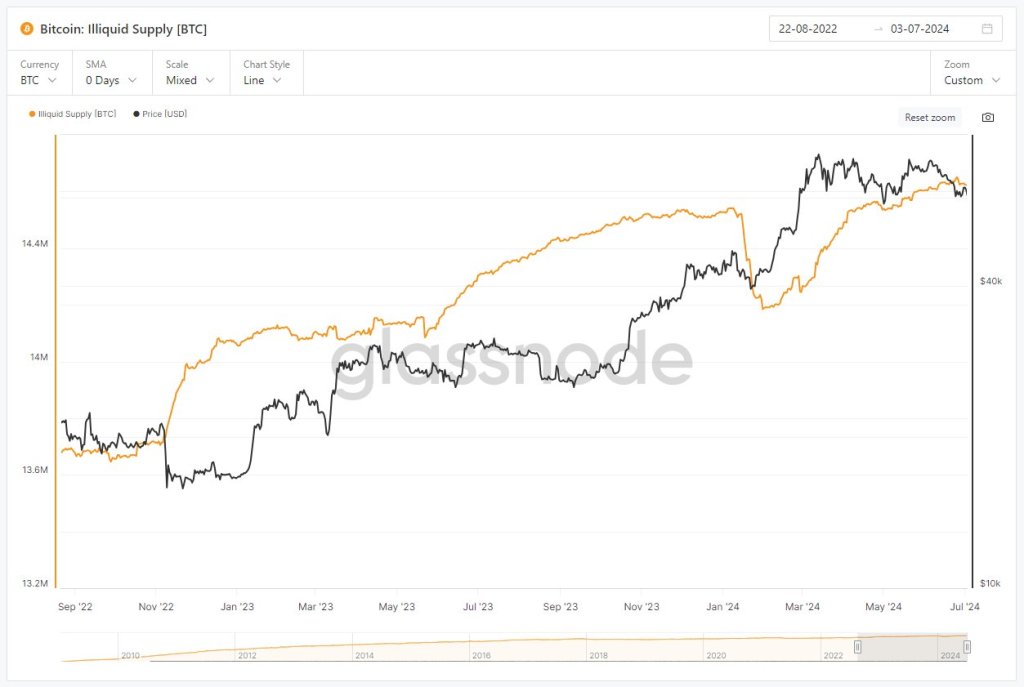

As proof, the Bitcoin “illiquid supply,” which shows the number of coins that haven’t been moved for over two years, is at a near all-time high.