On-chain data shows that Shiba Inu (SHIB) has witnessed a massive decline in whale activity. This is significant for the meme coin’s ecosystem, considering the impact these investors usually have on Shiba Inu’s price.

Shiba Inu’s Whale Activity Declines By Over 100%

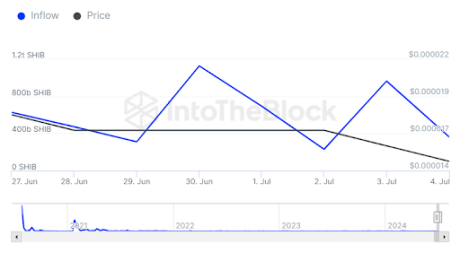

Data from the market intelligence platform IntoTheBlock shows that Shiba Inu’s whale activity has declined by over 100% in the last seven days. This is based on the large holders’ netflow metric, which indicates when these whales are adding to their positions or offloading their tokens.

The 100% decline in large holders’ netflow points to these whales opting against accumulating and selling their Shiba Inu tokens instead. The large holders’ outflow metric also points to these whales offloading their tokens, as there has been an 18% increase in the amount of Shiba Inu tokens leaving these whales’ addresses in the last seven days.

Meanwhile, in the same period, there has been an almost 23% drop in the large holder inflows, which suggests that more whales are opting against adding their Shiba Inu positions. This is evidently bad for the Shiba Inu ecosystem as significant selling pressure from these whales could further make the meme coin’s price tumble.

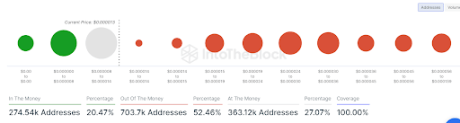

Other on-chain metrics also paint a bearish outlook for the meme coin. For instance, data from IntoTheBlock shows that the ‘In The Money’ metric is bearish, as 52.46% of Shiba Inu addresses are currently at a loss. This could pile more selling pressure on the meme coin as more investors look to cut their loss, fearing that Shiba Inu could further decline from its current price level.

Shiba Inu also risks losing most of the gains it made earlier this year if it fails to hold above its current support level. The In the Money metric shows that most addresses currently invested in Shiba Inu bought the meme coin at its current price range. As such, a decline below this range could send the crypto token on a free fall to levels not seen in a while.

Bitcoin Making Matters Worse For Shiba Inu

Data from IntoTheBlock shows that Shiba Inu has a strong positive price correlation with Bitcoin. This has also significantly contributed to the downtrend that the meme coin is currently facing. SHIB’s price correlation with Bitcoin seems to be why the second-largest meme coin by market cap has been one of the most affected since the flagship crypto dropped below its crucial support level at $60,000.

Shiba Inu’s price correlation with Bitcoin suggests that things could get worse for the meme coin. The flagship crypto is still facing intense selling pressure and is at risk of further price declines in the coming days.

SHIB is currently trading at around $0.00001327, down over 14% in the last 24 hours, according to data from CoinMarketCap.