Crypto analyst Rekt Capital has provided insights into when the price of Bitcoin will reach its cycle highs. His analysis has provided reassurance that the flagship crypto is still far from a market top despite its recent decline to new lows this week.

When Will Bitcoin Peak In This Bull Run

Rekt Capital mentioned in an X (formerly Twitter) post that Bitcoin could peak in this cycle sometime in mid-September or mid-October 2025 if history were to repeat itself. The analyst noted that Bitcoin peaked 518 days after the halving event during the 2017 bull run and 546 days after the halving event during the 2021 bull run.

Based on this, the analyst predicts that Bitcoin’s market top in this bull could occur between 518 and 546 days after the halving event, which happened earlier in April. This timeline puts the projected peak for Bitcoin sometime in September or October next year. Meanwhile, Rekt Capital again alluded to the fact that Bitcoin was accelerating in this cycle by 260 days earlier this year.

However, that is no longer the case thanks to the over three-month consolidation period the flagship crypto has experienced since the halving event. Rekt Capital claimed that the rate of acceleration has “drastically dropped and is now approximately 150 days.” He added that Bitcoin will likely resynchronize with the traditional halving cycle the longer it consolidates.

The crypto analyst has also refused to be deterred by Bitcoin’s current price action, which some claim suggests that the bull run is over. However, Rekt Capital has repeatedly stated that Bitcoin will retrace deep enough to convince anyone that the bull run is over, and then it will continue its uptrend.

In another X post, Rekt Capital mentioned that Bitcoin’s downtrend, which began last month, is one to watch for a major trend shift. The analyst remarked that a break of the “multi-week downtrend would result in the beginning of at least a multi-week uptrend” for the flagship crypto.

‘This Is Not The Cycle Top Vibes’

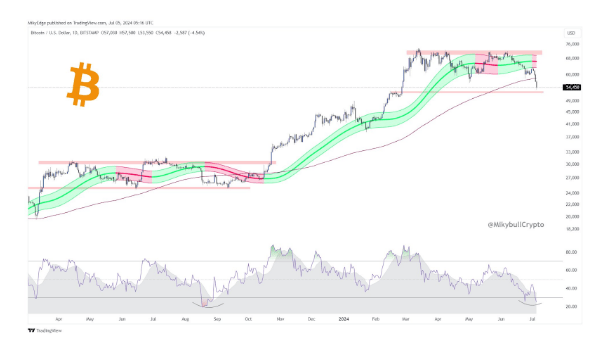

Crypto analyst Mikybull Crypto also believes that the cycle top isn’t in yet despite Bitcoin’s recent decline, stating that this price action “is not the cycle top vibes.” The analyst also said that Bitcoin’s current sell-off bottom might be closer than everyone thinks and noted that this scenario played out in the third quarter of 2023 when most people thought it was over.

The analyst previously mentioned that the cycle top isn’t in yet and simply classified this market downtrend as the “final shakeout” before Bitcoin reaches its peak in this bull run. Mikybull Crypto also claimed that Bitcoin has a cycle top price target of $171,000, meaning that the flagship crypto will still hit new all-time highs (ATHs) before the bull run was considered as being over.

Featured image from Getty Images, chart from TradingView