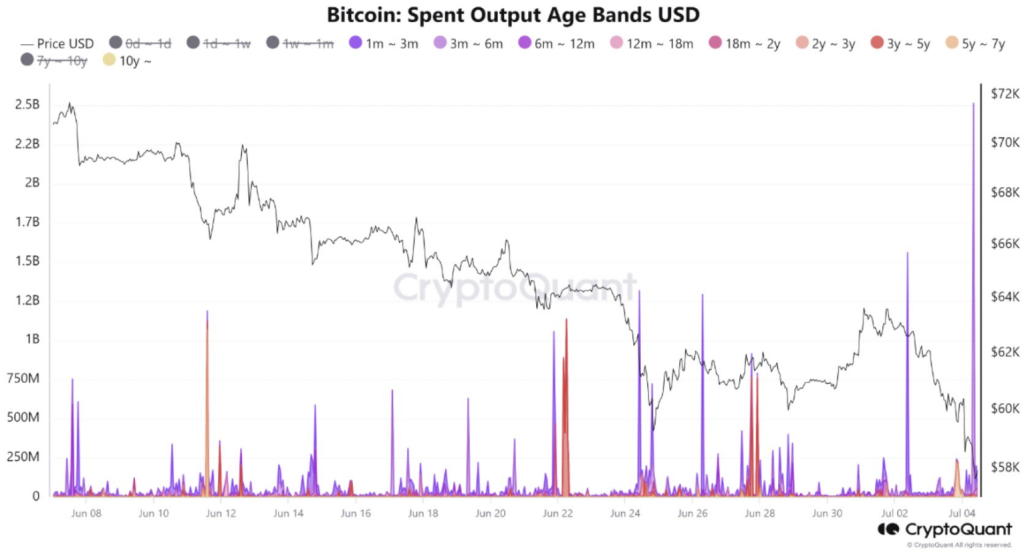

The Bitcoin market is experiencing a wave of uncertainty as a recent analysis by CryptoQuant reveals a significant shift in investor behavior. Roughly $2.4 billion worth of Bitcoin, likely acquired by investors this year, has moved within the network, sparking debate about the reasons behind the exodus.

Short-Term Jitters Drive Sell-Off

Experts believe these outflows are driven by short-term investors who made a foray into the market in early 2023. Back then, anticipation surrounding Bitcoin Exchange-Traded Funds (ETFs) and the mining reward halving – an event expected to reduce supply and potentially boost prices – fueled a buying spree. However, the current bear market seems to have dampened their enthusiasm, leading them to cut their losses.

Beginner investors are capitulating and increasing selling pressure

“Approximately $2.4 billion worth of #Bitcoin aged between 3 and 6 months moved on the network during the drop.” – By @caueconomy

Read more

https://t.co/W46LKwg9Hb pic.twitter.com/C3OzfIMbSo

— CryptoQuant.com (@cryptoquant_com) July 4, 2024

This behavior highlights the difference between true long-term believers and those chasing quick profits. While short-term sentiment is driving the sell-off, it’s important to remember that Bitcoin has weathered similar storms before.

Calm Amidst The Chaos: Long-Term Investors Stay The Course

A beacon of stability in this choppy market is the unwavering confidence displayed by long-term Bitcoin holders. CryptoQuant’s data indicates that investors with holdings older than a year haven’t been swayed by the recent market turmoil. This suggests a strong belief in Bitcoin’s long-term potential, which could act as a buffer against further price drops.

The contrasting behavior between new and veteran investors is a fascinating dynamic. While short-term holders are swayed by market fluctuations, long-term investors understand that Bitcoin is a marathon, not a sprint. Their continued faith in the technology can provide much-needed stability for the entire market.

Uncharted Territory: Market Responds To Investor Tug-Of-War

The million-dollar question remains: how will the market react to this large-scale sell-off by short-term holders? Some experts worry it could trigger a domino effect, leading to further price drops. However, others believe the unwavering confidence of long-term investors will prevent a freefall. The coming weeks will be crucial in determining which force prevails.

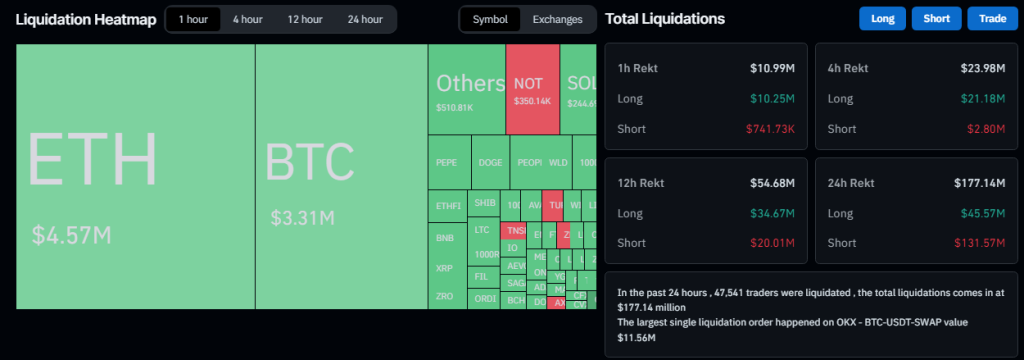

Massive Bitcoin Liquidation

Meanwhile, adding another layer of complexity is the recent liquidation of over $418 million in Bitcoin positions. While this seems alarming at first glance, it’s important to consider Bitcoin’s dominance in the cryptocurrency market (over 50% market share).

This dominance translates to a naturally higher dollar value of liquidated positions for Bitcoin, despite the lower percentage compared to other cryptocurrencies. In fact, the data suggests that Bitcoin fared better than many altcoins during the recent price decline.

The Bitcoin market finds itself at a crossroads. Short-term jitters are causing some investors to jump ship, while long-term holders remain steadfast in their conviction. The interplay between these contrasting forces will determine the future trajectory of the world’s most popular cryptocurrency.

Featured image from Alamy, chart from TradingView