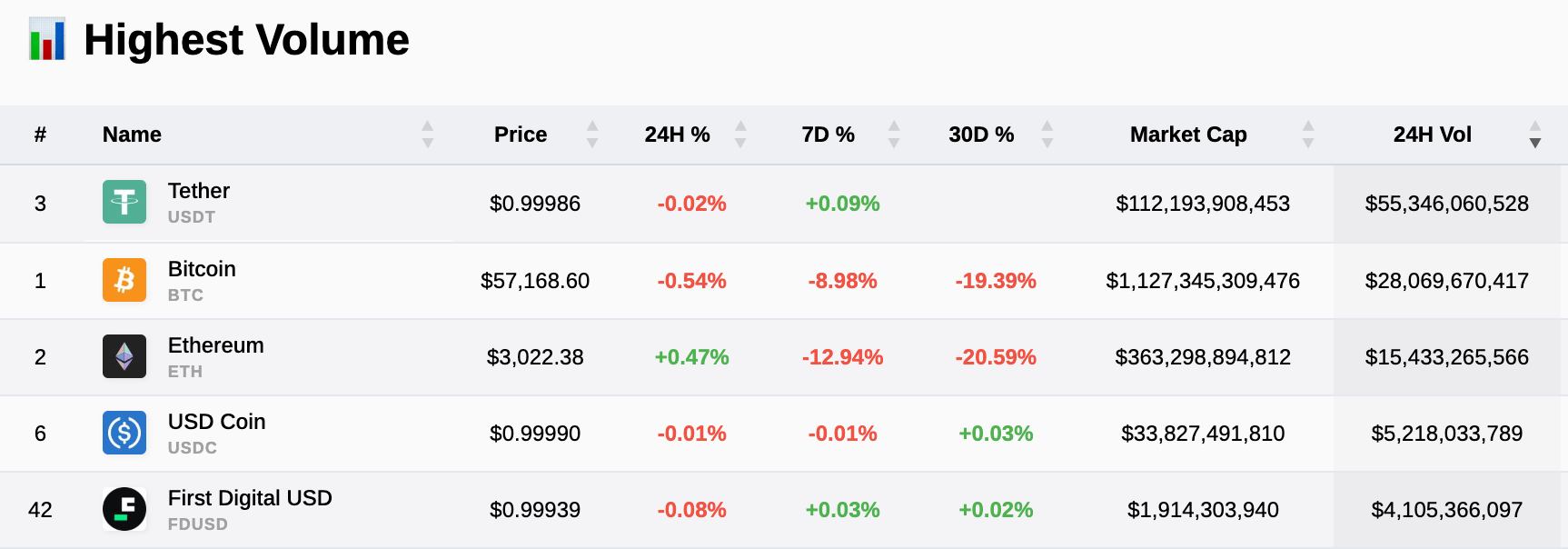

Tether USDT’s 24-hour trading volume exceeds the combined total of the following five digital assets, including Bitcoin and Ethereum.

Reflecting on Tether’s dominance in trading volume provides insight into market liquidity. As CryptoSlate data indicates, Tether (USDT) maintains a higher volume than Bitcoin (BTC), Ethereum (ETH), USD Coin (USDC), Solana (SOL), and First Digital USD (FDUSD), pointing to its significant presence in the market. Specifically, Tether recorded a 24-hour volume of over $55 billion, far surpassing Bitcoin’s $28 billion and Ethereum’s $15 billion.

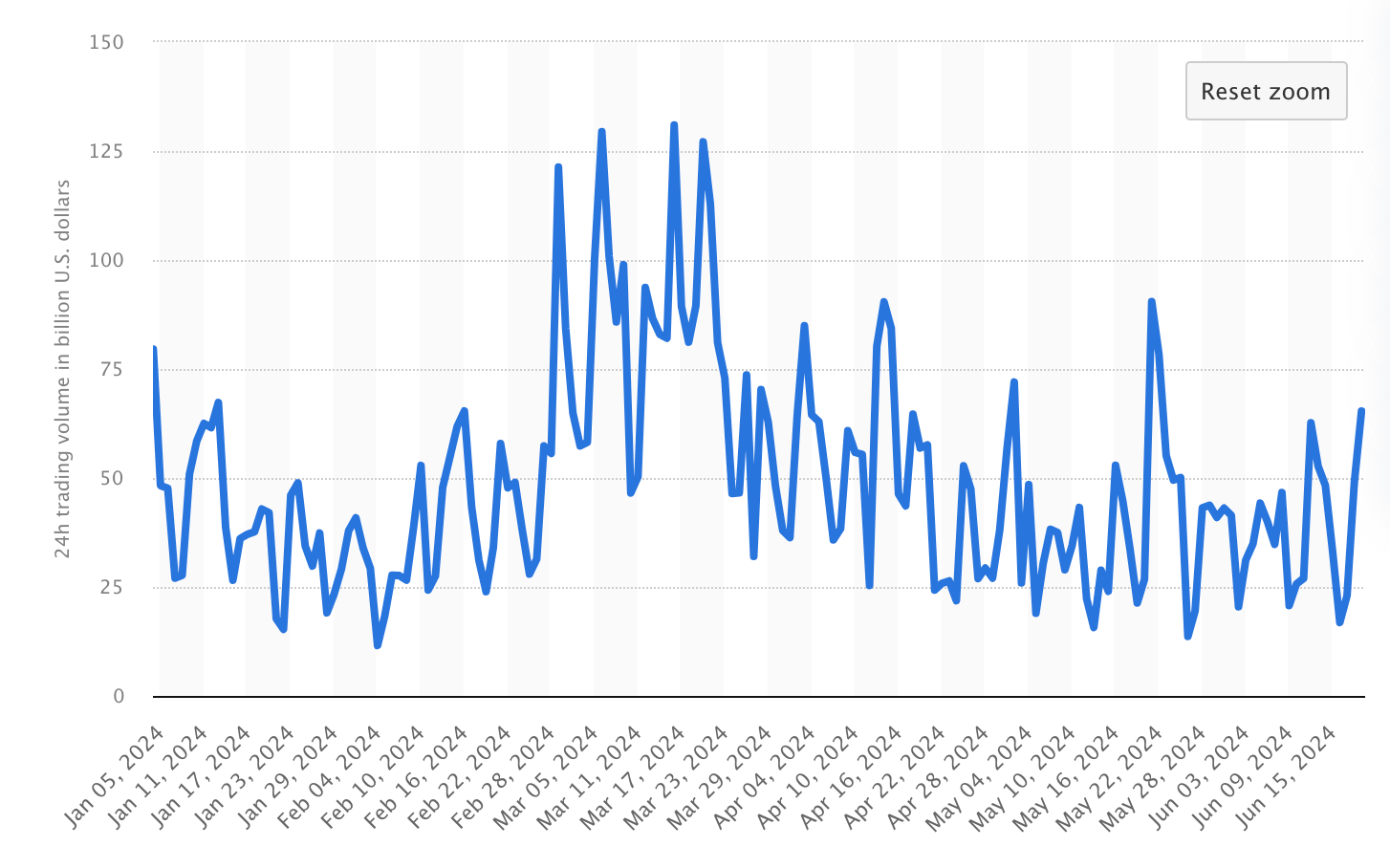

With a market cap of over $112 billion, the trading patterns also show that Tether’s volume has consistently been robust throughout 2024, peaking at $130 billion on March 16. Tether’s stability and frequent use in trading pairs make it a preferred choice for traders seeking to hedge against volatility.

With a market cap of over $112 billion, the trading patterns also show that Tether’s volume has consistently been robust throughout 2024, peaking at $130 billion on March 16. Tether’s stability and frequent use in trading pairs make it a preferred choice for traders seeking to hedge against volatility.

These volume statistics reflect broader market trends as Tether provides liquidity and stability. Tether regularly achieves daily trading volumes exceeding $25 billion, reinforcing its status as a key liquidity provider in the crypto ecosystem.

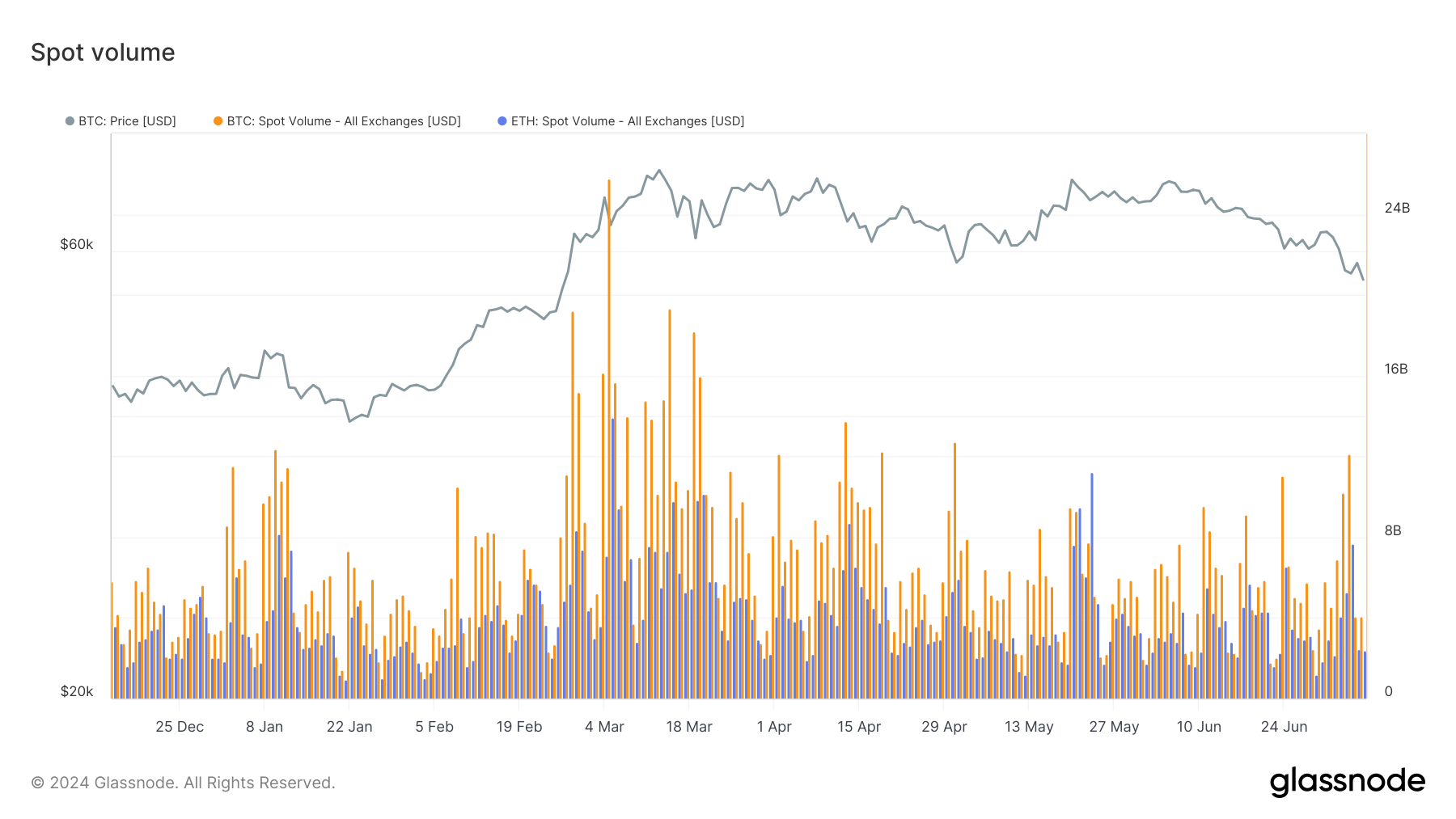

Per Glassnode data, throughout 2024, Bitcoin and Ethereum have seen around $4 – $8 billion per day, far below Tether’s volumes.

The high trading volume of Tether compared to other major digital assets illustrates its integral role in daily trading activities and the broader market strategy that traders and institutions employ. This continuous high-volume trading signifies trust and reliance on Tether’s stability and accessibility, making it indispensable for efficient market functioning.

While Tether has historically faced recounted challenges regarding its reserves and use in illicit activities, these volumes showcase its resilience in combating these claims. Tether’s CEO Paolo Ardoino recently told CryptoSlate that Tether is currently over-collateralized, with the firm’s profits being put back into reserves to strengthen its stability.

Further, Ardoino commented how Senator Warren’s discouragement of accounting firms from engaging with Tether had hindered its ability to use one of the US’s top four accountants for audits. The CEO claimed that Tether is continuously seeking to hire one of the leading companies but has almost given up on it happening any time soon, regardless of their efforts to do so.

The post Tether 24 hour trading volume surpasses Bitcoin, Solana, USDC and Ethereum combined appeared first on CryptoSlate.