The NEAR Protocol blockchain is seeing an increase in in user activity, sparking a great deal of positive vibe for its future. Transaction volumes and active addresses have been up in recent months, pushing the protocol up into the spotlight of the cryptocurrency community.

Market observers point to several factors driving this growth, including the protocol’s focus on scalability, low fees, and its ambitious foray into artificial intelligence (AI) integration.

Active Users Flock To NEAR Scalable Ecosystem

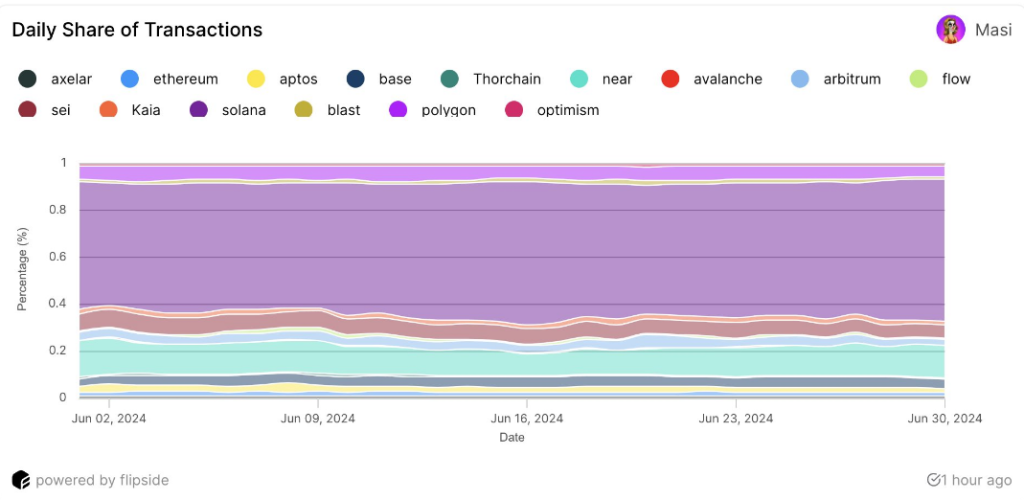

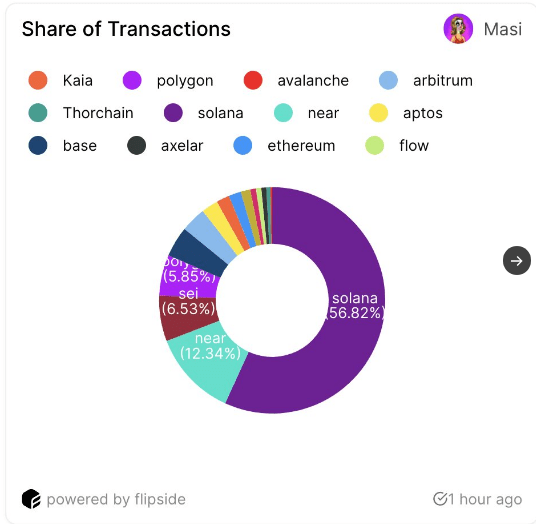

Data suggests a significant rise in user engagement on the NEAR blockchain. According to analyst reports, it boasted the highest number of active addresses (almost 17 million) compared to other top chains in June.

This growth in user figures was in line with other positive metrics, including the network’s impressive success rate (almost 100%!) and low transaction fees. Notably, NEAR also ranked second in terms of total transactions processed (239 million) and average transaction speed (measured in Steps).

In June, @NEARProtocol compared to the popular chains was

#1 in the number of Active Addresses (16.9m)

#1 in low-cost fees (< $0.005)

#1 in Success Rate (99.9%)

#2 in Average STPS (94)

#2 in Number of txns (239m)

55% retention of May Users with 12.3m new UsersMore

pic.twitter.com/HT71ehkIb3

— Masi (@Masi_DN) July 5, 2024

Furthermore, the NEAR ecosystem has managed to retain a significant portion of its user base. Reports indicate a 55% retention rate for users who joined in May, with a staggering 12.3 million new users onboarding in June alone.

AI Integration: A Strategic Play For The Future

Beyond its focus on scalability and user experience, NEAR is making strategic bets on emerging technologies. The establishment of the NEAR AI R&D Lab signifies the protocol’s commitment to integrating AI functionalities into its blockchain. This focus on AI is seen as a potential differentiator, attracting developers and users who are bullish on the future of AI-powered blockchain applications.

The potential applications of AI in the NEAR ecosystem are vast. Imagine a future where AI facilitates faster transaction processing, streamlines smart contract execution, or even personalizes user experiences within DeFi applications built on NEAR. While these applications are still in their nascent stages, the strategic focus on AI positions NEAR as a potential leader in this evolving space.

Price Poised For A Rebound?

The surge in user activity and the protocol’s innovative approach have had a positive impact on the price of NEAR tokens. After experiencing a recent decline, the price of NEAR has shown signs of recovery, with a 5.27% surge in the past 24 hours.

Technical indicators, such as the Money Flow Index (MFI) and the Moving Average Convergence Divergence (MACD), suggest a potential reversal of the bearish trend.

However, analysts caution against overly optimistic price predictions. The cryptocurrency market remains volatile, and the “Fear & Greed Index” currently indicates a cautious market sentiment. While a price forecast suggests NEAR could reach $14.20 by August 7, 2024, it’s crucial to remember that such predictions are inherently speculative.

The coming weeks will be crucial for NEAR. If the user base continues to expand and the protocol successfully integrates AI functionalities, a sustained price increase could be on the horizon. However, the broader market sentiment and potential short-term dips should be factored into any investment moves.

Featured image from Beluga, chart from TradingView