Onchain Highlights

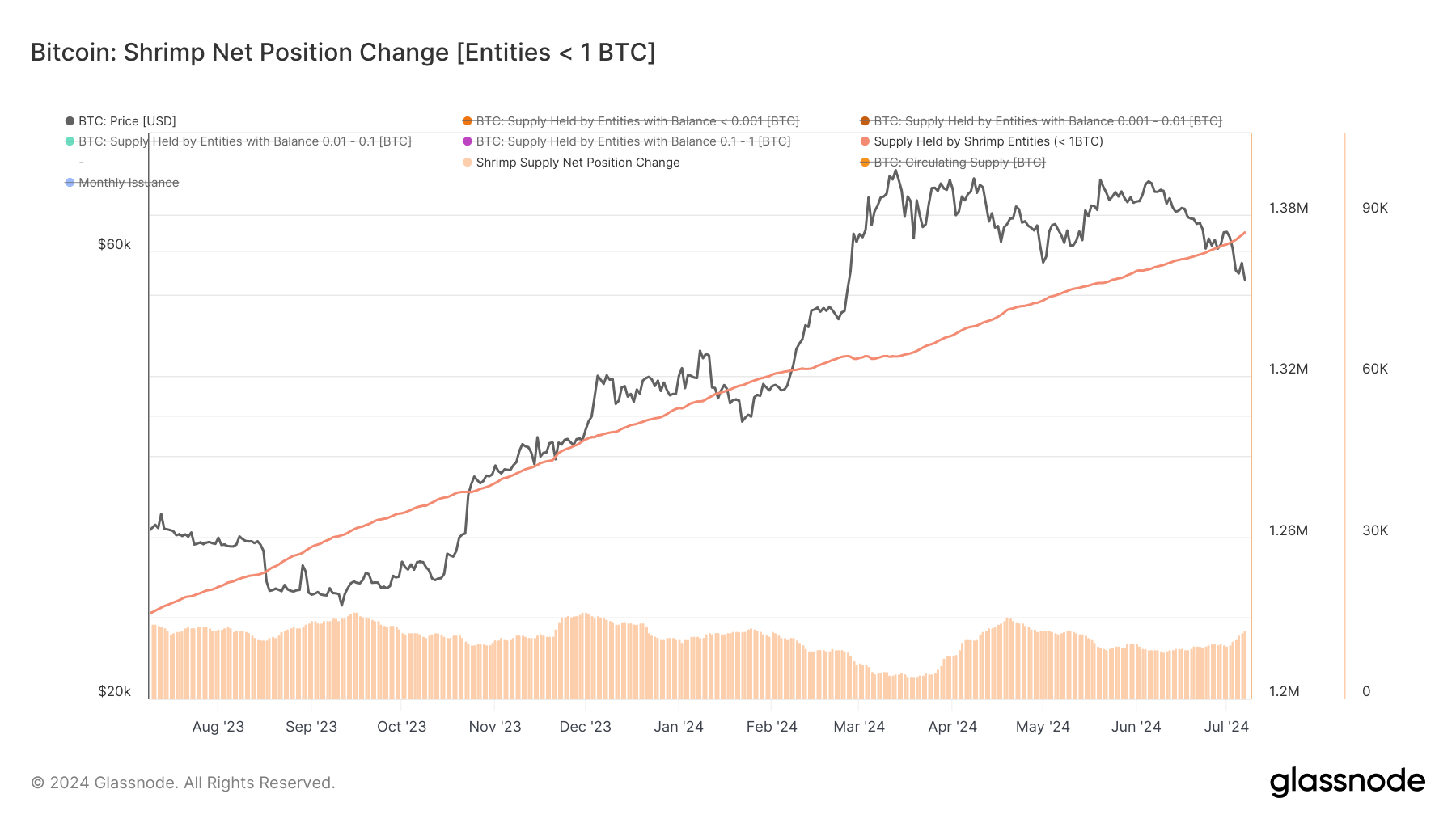

DEFINITION: The “Shrimp” cohort is a widespread catch-all moniker for retail-level investors holding less than one BTC. Historically, this cohort has consistently added to their balance, and thus, looking at relative aggressiveness is usually the most informative. This cohort is also quite sensitive to volatility, with the rate of balance growth often reacting to sharp price changes, both upwards and downwards.

This chart presents the following traces:

Total balance held by Shrimp Cohort (line trace)

Total balance held by Shrimp Cohort (line trace) 30-day net-position change of Shrimp Balance (area trace)

30-day net-position change of Shrimp Balance (area trace)

Bitcoin’s shrimp cohort has displayed notable activity shifts over the past year. Entities holding less than one BTC have shown varying degrees of accumulation, reflecting sensitivity to market volatility. The charts reveal that as Bitcoin’s price increased sharply in early 2024, shrimps significantly increased their holdings, peaking around March 2024. This coincides with the all-time high in Bitcoin.

Post-halving, the accumulation trend by these smaller holders has increased. The 30-day net position change, indicated by the orange area, highlights an increase in net buying. The cumulative balance held by shrimps, while still on a long-term upward trajectory, has seen an increase in growth even during this current correction.

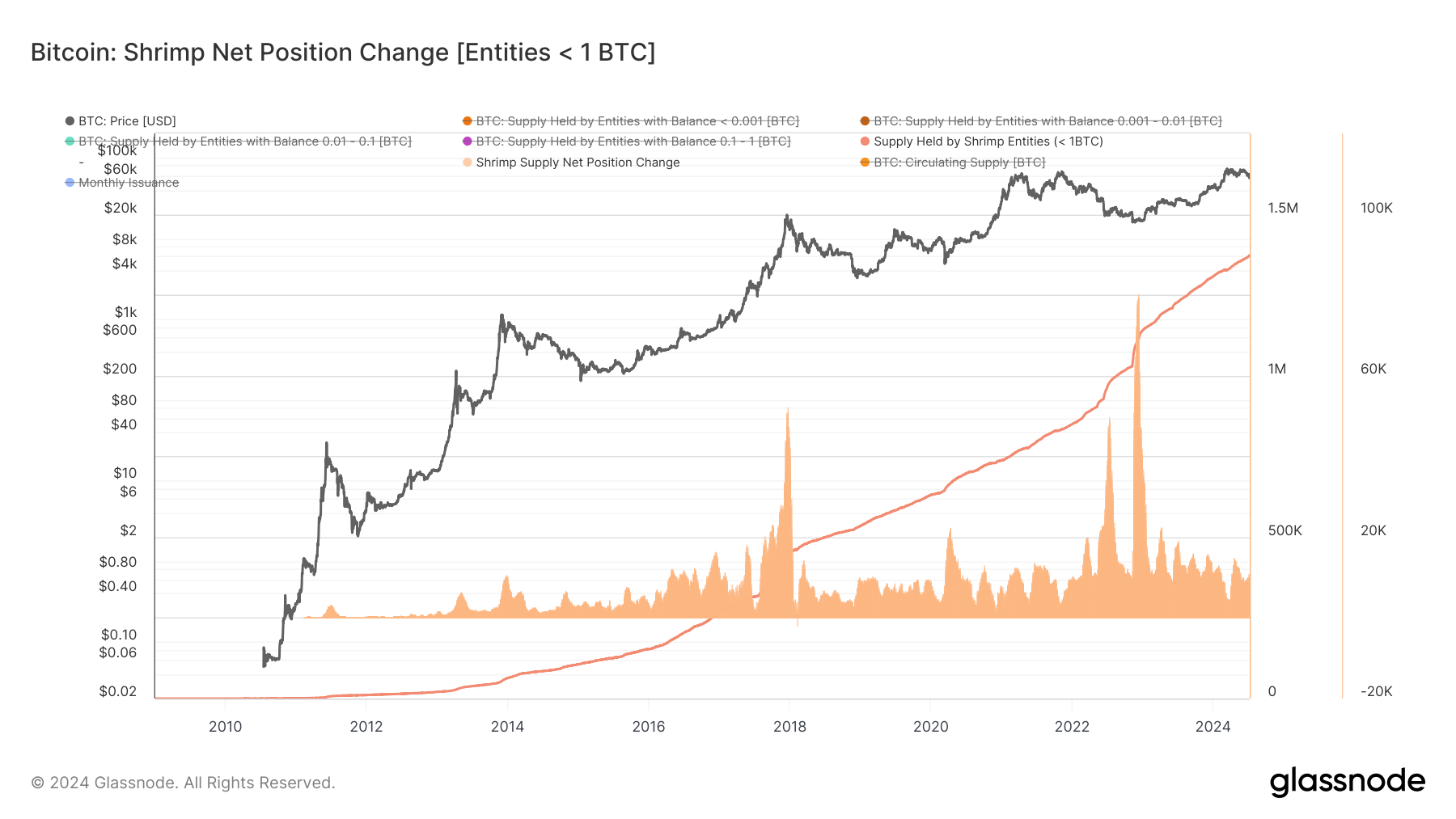

From a long-term perspective, the shrimp cohort has consistently increased their Bitcoin holdings. Despite short-term volatility and market corrections, the overall trend shows a steady rise in the total balance held by these entities since 2010.

This persistent accumulation by retail investors suggests strong underlying confidence in Bitcoin’s long-term value proposition, contributing to the overall stability and distribution of Bitcoin’s circulating supply.

The post Retail Bitcoin holders intensify accumulation amid dip appeared first on CryptoSlate.