Quick Take

The first half of 2024 has witnessed significant developments in the digital assets market, particularly for Bitcoin and Ethereum, as highlighted in a comprehensive report compiled by Glassnode and CME. The report delves into the insights and evolution of the market following the launch of the US Bitcoin ETFs on Jan. 11 and the effect on derivatives markets.

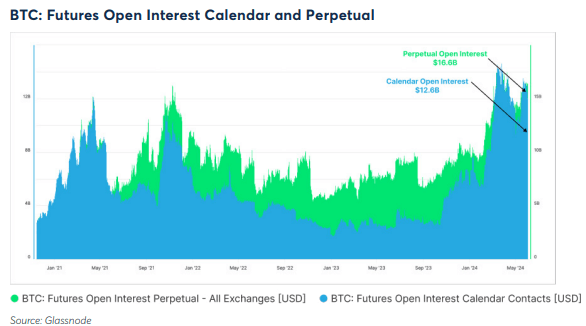

In the crypto industry, two primary futures instruments are utilized: the perpetual swap and the traditional calendar-expiring contract. According to the report, perpetual open interest is currently at approximately $16.6 billion, while calendar open interest stands at $12.6 billion. Historically, perpetual open interest dominated until 2023. However, 2024 has seen a notable increase in calendar expiring futures, attributed to a surge in interest from institutional investors, with a large amount traded via CME Group Instruments.

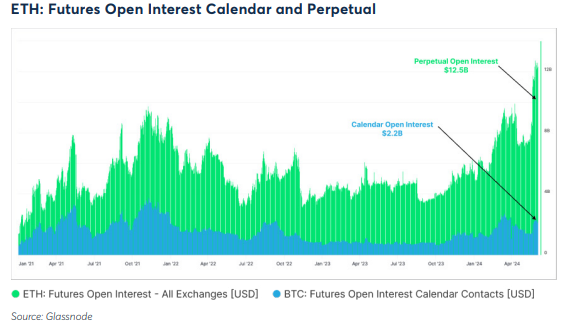

The report shows that this shift is not mirrored in Ethereum, where perpetual open interest remains the dominant choice, with $12.5 billion compared to $2.2 billion in calendar open interest. The upcoming ETF launch in July raises questions about whether this dynamic might shift in Ethereum’s market.

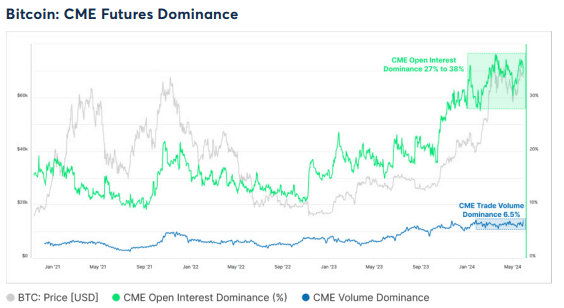

Supporting this trend, Bitcoin CME Futures have shown remarkable dominance, representing over one-third of all open futures contracts positions in Bitcoin. Additionally, according to the report, CME’s trade volume continues to gain market share, currently at 6.5%, which is at a multi-year high.

This report illustrates the growing influence of institutional investors in shaping the futures market, mainly through CME Group’s offerings, and signals potential shifts in market forces with forthcoming developments such as the Ethereum ETF launch.

The post Bitcoin calendar Open Interest surges as institutional interest grows via CME appeared first on CryptoSlate.