Quick Take

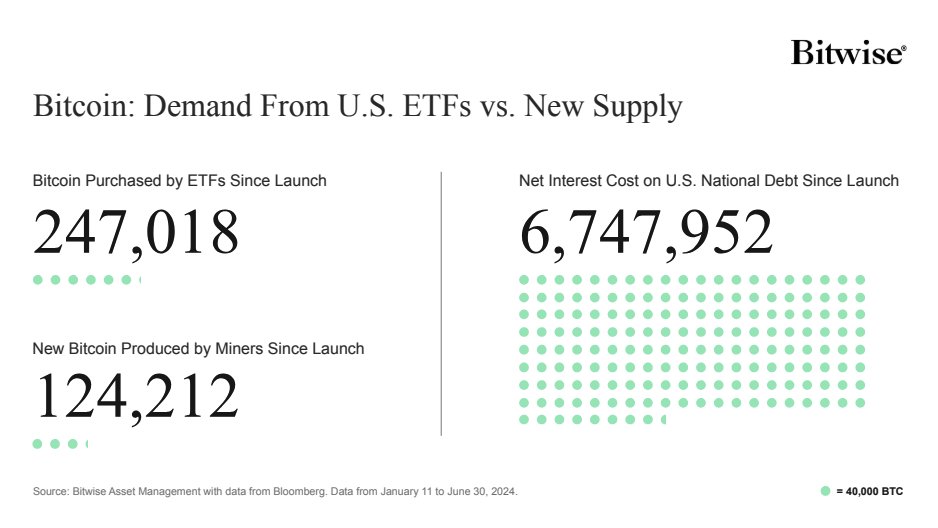

According to an infographic from Jeff Park, head of alpha strategies at Bitwise, Bitcoin ETFs have accumulated a staggering 247,018 Bitcoin since their launch. This is roughly double the 124,212 Bitcoin produced by miners since Jan. 11, the ETF launch date.

This significant purchasing activity highlights the growing demand for Bitcoin amid a supply constraint exacerbated by the April halving, which cut the daily Bitcoin issuance from approximately 900 to 450 BTC.

According to Bitwise, the net interest cost on the US national debt since the ETF launch is equivalent to 6,747,952 Bitcoin. Given Bitcoin’s fixed supply of 21 million, with about 19.7 million currently in circulation, servicing the national debt’s net interest would consume roughly a third of all existing Bitcoin.

Moreover, considering the US national debt stands at nearly $35 trillion, and with Bitcoin priced at around $57,000, the total national debt in Bitcoin terms would be a colossal 614,035,088 BTC. This figure starkly contrasts with Bitcoin’s finite supply, emphasizing the sheer scale of the debt compared to the digital assets’s limited availability.

The post US national debt equates to 614 million Bitcoin at current prices appeared first on CryptoSlate.