Data shows that ‘paper’ Bitcoin has observed a notable surge recently while the cryptocurrency’s spot price has plunged down.

Paper Bitcoin Has Been Rising While Spot BTC Has Stayed Stale

In a new thread on X, analyst Willy Woo has talked about the state of the Bitcoin market. BTC has been seeing a bearish trend recently, with the German Government selling and Mt. Gox distributions being two of the major sources of FUD among investors.

Woo pointed out that Germany sold around 10,000 BTC, with 39,800 BTC still in the government’s custody.

Mt. Gox hasn’t distributed as much BTC yet, with only 2,700 BTC being returned to their owners. The bankrupt exchange still has 139,000 BTC left to distribute, but the bearish impact from these holdings depends on whether the holders receiving the coins want to sell.

It wouldn’t appear that these two entities have added that much actual selling pressure to the market yet. So, what’s been the true culprit behind Bitcoin’s crash? According to the analyst, that would seem to be paper BTC.

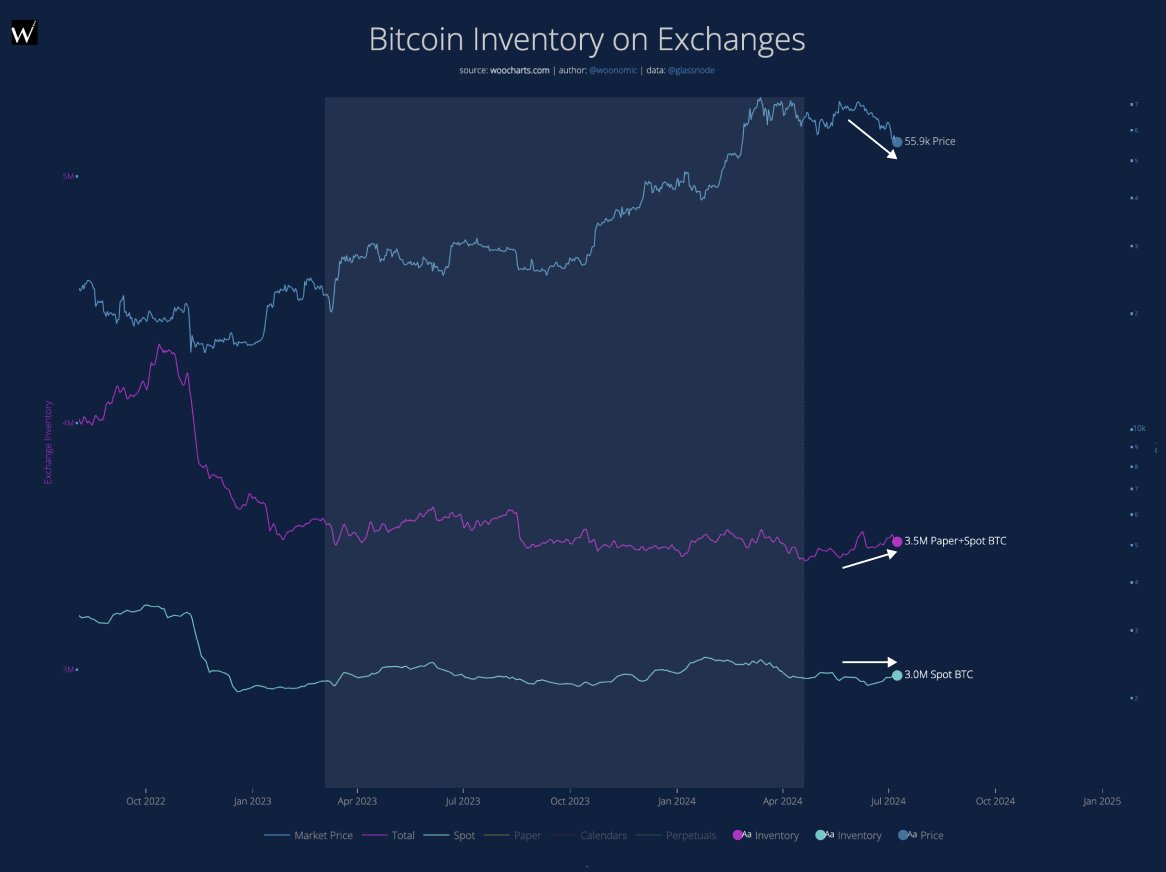

Paper BTC refers to the derivatives products related to the cryptocurrency that don’t need ownership of any actual BTC tokens. Below is a chart that shows BTC’s trajectory during this latest plunge in the asset.

In the graph, the purple line reflects the combined paper and spot BTC inventory currently sitting on the various centralized exchanges in the sector. This inventory has been on the rise recently.

This increase, however, could also be because of spot deposits rather than paper Bitcoin being minted. However, as the blue curve shows, spot BTC has been showing a flat trajectory while the overall inventory has increased. This would confirm that paper BTC has indeed been behind the increase.

In total, 140,000 extra paper BTC has been printed recently. “Now compare that to 10,000 BTC that Germany sold, and you see what caused the dump,” says Woo. Thus, it’s possible that derivatives would have to see a flush if the cryptocurrency had to make some solid recovery.

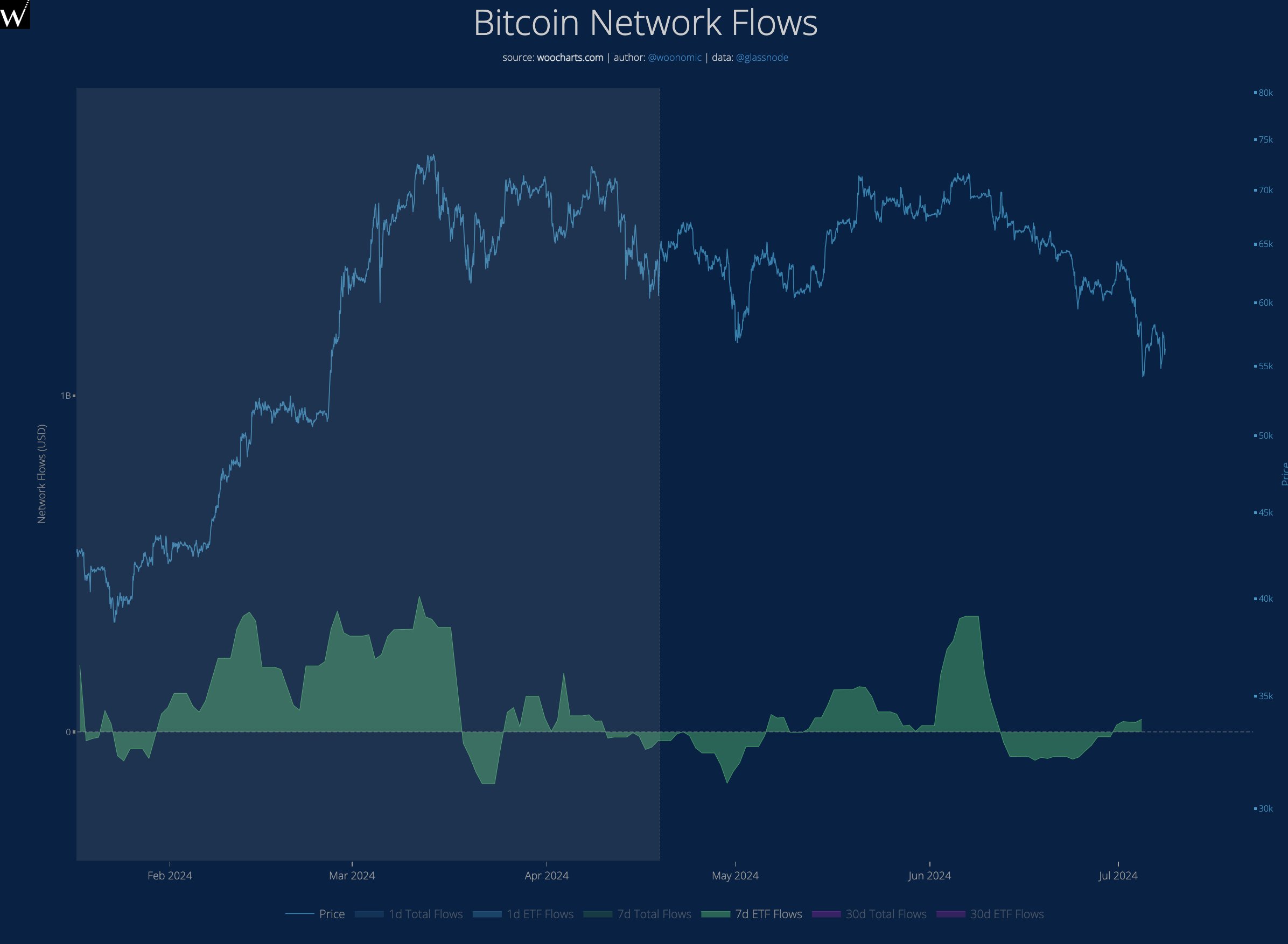

While bearish winds are ahead in terms of the remaining Mt. Gox and German government offloading, a bullish development may also be forming for the coin. As the analyst has explained, the spot exchange-traded funds (ETFs) have started to show early signs of accumulation.

BTC Price

The past month has been a hard time for Bitcoin holders as the asset’s price has declined by more than 17% and dropped to $57,200.