On-chain data shows the Shiba Inu whales have been making large outflows from exchanges recently, a sign that could be bullish for SHIB’s price.

Large Shiba Inu Exchange Wallets Have Been Losing Supply Recently

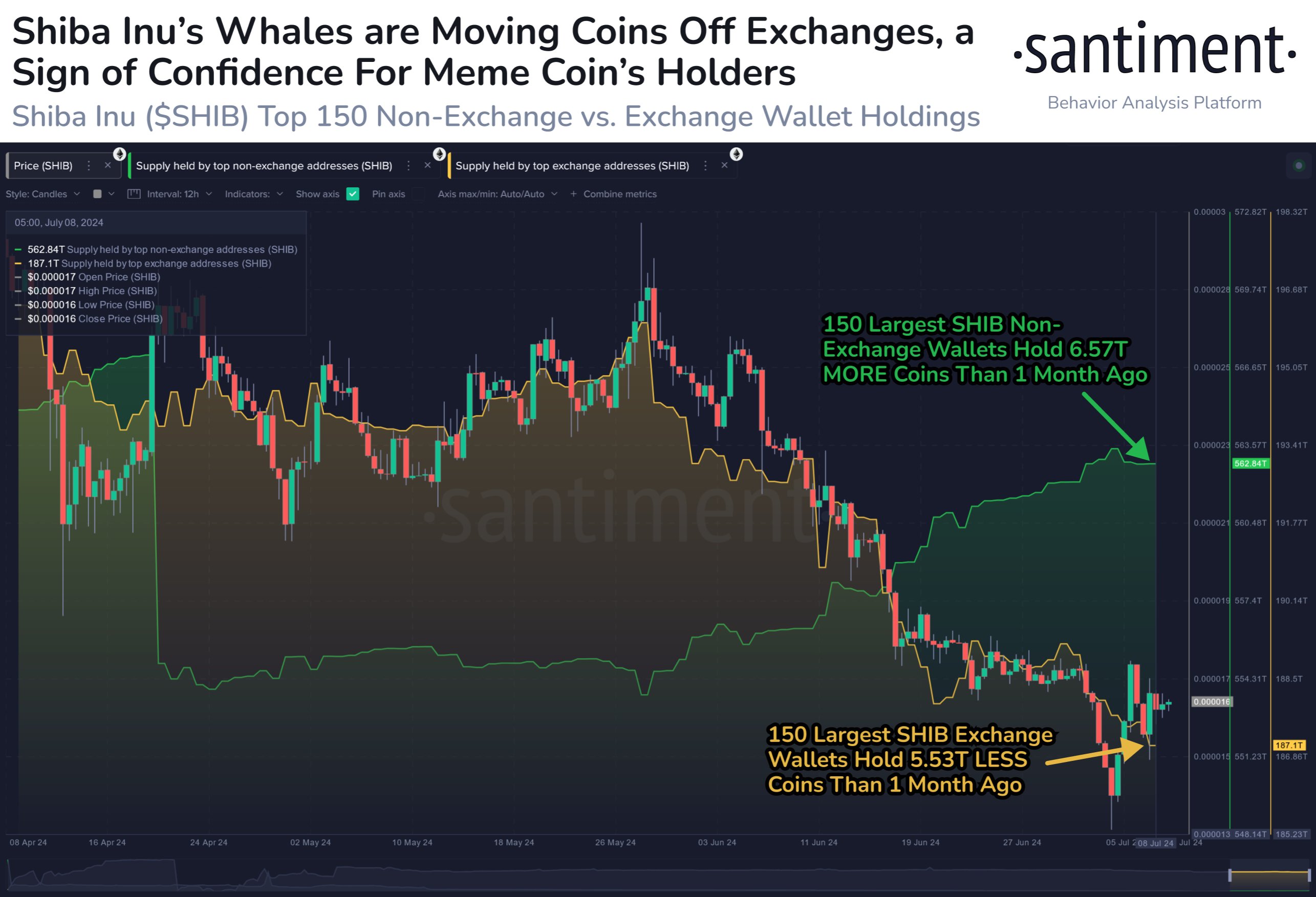

In a new post on X, the on-chain analytics firm Santiment has discussed the trend forming in the holdings of the Shiba Inu whales. The analytics firm has divided these humongous holders into two cohorts: exchange whales and non-exchange whales.

The exchange whales refer to the 150 largest wallets on the network that are affiliated with a centralized exchange. Similarly, the non-exchange whales are the top 150 self-custodial wallets.

Below is the chart shared by Santiment, which shows how the total supply held by these groups has changed over the last few months.

As displayed in the above graph, the top 150 exchange wallets have recently seen their supply drop sharply. More specifically, the exchange whales now hold 5.53 trillion fewer tokens of the memecoin than around a month ago.

It would appear that the Shiba Inu non-exchange whales have absorbed these coins as their holdings have grown by around 6.57 trillion SHIB within the same window.

Since this amount is more than the withdrawals from the top 150 exchange wallets, it would even look like these self-custodial investors have also picked up some coins from smaller hands.

Generally, investors hold their coins on exchanges when they plan to participate in trading shortly. As such, the supply sitting on exchanges can be looked at as the available sell supply of Shiba Inu.

Thus, the recent trend of the exchange whales losing coins to self-custodial investors who may be planning to hold on for the long term can be a positive development for SHIB.

The timing of these outflows may be especially uplifting, as they have come while the price of the memecoin has been sliding down. The accumulation naturally shows that the whales believe the recent lows to have been profitable entry points into the asset.

It now remains to be seen whether the confidence from these humongous holders would pay off and SHIB would finally break away from its bearish trend to start on a fresh surge.

SHIB Price

The past month has been a poor time for investors around the cryptocurrency sector, and SHIB holders haven’t been any different as the memecoin’s price has gone down almost 28% in this period, now trading around $0.00001639.

The chart below shows the trajectory of Shiba Inu in the last thirty days.