Amid the growing market anxiety, a ray of hope emerged for cryptocurrency investors relying on Fetch.ai (FET). A renowned crypto expert predicts that after a dramatic 28% drop over the past month, the coin is set to have a huge comeback.

Fetch.ai Shows Resilience

Although unpredictability has haunted the crypto space, Fetch.ai has surprisingly survived the storm. The value of the token has plunged, but it has steadily recovered and lately climbed by almost 6%. Fetch.ai’s resilience has attracted the attention of market watchers who are now closely monitoring its development.

Given the extreme instability of modern markets, Fetch.ai’s capacity for recovery throughout this period is quite impressive.

Significant Gains Expected Soon

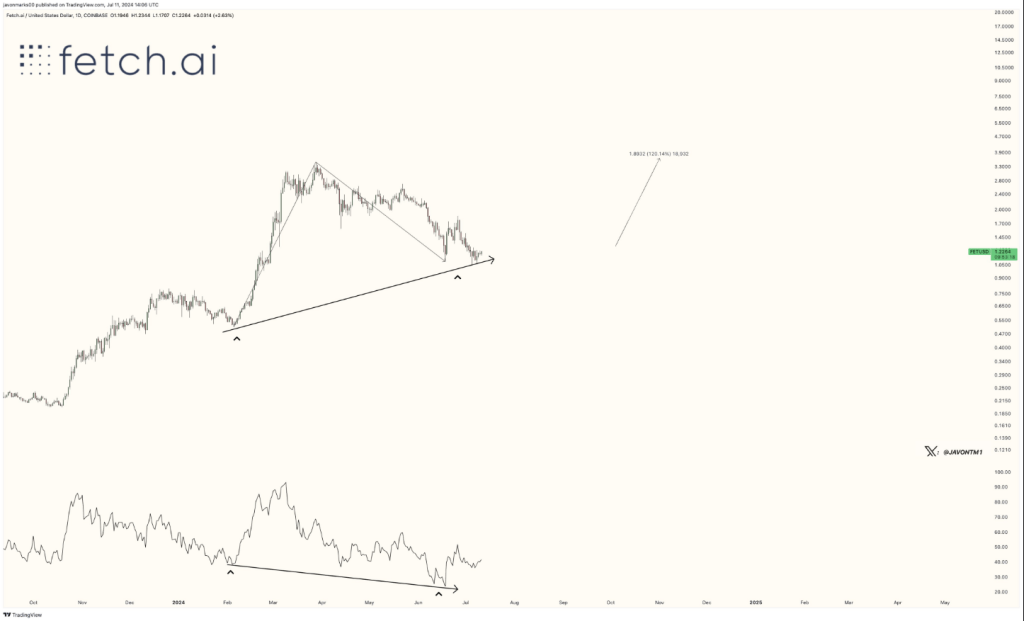

The analysis provided by renowned cryptocurrency expert Javon Marks makes Fetch.ai’s present situation particularly interesting. Marks said that the token is showing a bullish trend known as a “Hidden Bullish Divergence,” which usually implies a minor drop before the upward trend’s continuance.

$FET (FetchAI) maintains a Bullish Pattern here and from current areas, this can be suggesting a near 3X from here in an approximate 180% recovery climb back to the $3.48 areas and even higher can be possible… https://t.co/G36S6jVUQl pic.twitter.com/i5cePC1sfS

— JAVON

MARKS (@JavonTM1) July 11, 2024

Marks expects Fetch.ai’s growth to be 180%. Based on his forecast, the price of the token might climb to $3.48, its all-time high, or even more, thus offering a remarkable return for the company. This would show an amazing 210% increase over its present trade price of $1.127683.

Beyond the short term predictions, FET still has huge potential for the future. Based on the price analysis done by CoinCheckup, it is expected that the coin will maintain its gaining trajectory over the next seven days, rising by 3.20% to get a price of $1.18. Looking further, the long-term projection is still positive; the FET price is anticipated to climb by 6.72% to $1.22 in a year.

Long-Term Growth Prospects

Long term, Fetch.ai has a very promising future. Based on the crypto prediction platform estimate and the analyst’s strong forecasts, this token has the potential to stand out in the digital currency market giving investors the possibility to profit from a significant upside prospect.

As the crypto market continues to deal with its ups and downs, the FET story tells us that tenacity, creativity, and strategic analysis can be the key elements for unlocking major advantages in this dynamic and continually changing environment.

Featured image from Vecteezy, chart from TradingView