After a decline to $53,600 last Friday, the Bitcoin price experienced a major recovery over the weekend, exceeding the $63,000 threshold today. This marks a massive 17% increase since last Friday, reaching this level for the first time in two weeks. The rally can be attributed to several factors that collectively propelled the premier’s cryptocurrency’s price upward.

#1 The “Trump Bitcoin Pump”

The resurgence in the Bitcoin price coincided with the attempted assassination of former President and 2024 presidential hopeful Donald Trump. The incident significantly impacted his odds in the upcoming election, with betting market Polymarket now forecasting a 70% probability of his victory.

Crypto expert Will Clemente III highlighted on X, “Trump’s odds of winning in November are skyrocketing in prediction markets.” He further noted, “Based on Bitcoin’s reaction so far, looks like markets are going to begin pricing in a full Trump victory.”

Alex Krüger, a macro analyst, elaborated on the implications of a potential Trump presidency for the financial markets: “The Trump Trade is now on its way. This what Trump winning, or the expectation of him winning, entails: Bullish for Crypto because Trump’s administration might pursue supportive regulations for cryptocurrencies, fostering innovation and adoption.”

#2 German Selling Exhausted

The recent completion of a large-scale Bitcoin sell-off by the German government also contributed to the price recovery. Germany exhausted its cache of 50,000 BTC seized from Movie2k, completing its final transaction of 3846.05 BTC last Friday.

James “Checkmate” Check, a leading on-chain analyst, remarked on the incredible strength of the BTC price on X, “Folks, Bitcoin just absorbed a 50k BTC market sell order in a few weeks. It dipped ~25%, in a very structured and orderly correction. Last time something like this happened was LUNA selling ~80k $BTC and price dropped from $46k to $25k, and soon after to $17k. Not the same.”

#3 DXY Is Showing Weakness

The weakening US dollar is probably another driver of BTC’s recent gains. The US Dollar Index (DXY), which measures the dollar against a basket of major currencies, fell 1.8% over the last two weeks to a five-week low of 104.

The expectation of an interest rate cut and the growing US government deficit, which reached $1.27 trillion year-to-date in June, have contributed to the dollar’s decline, pushing investors towards riskier assets like Bitcoin and cryptocurrencies.

#4 Bitcoin Miner Capitulation Ends

Joe Burnett, another noted crypto analyst, highlighted via X yesterday that a month-long period of Bitcoin miner capitulation is nearing its end, indicating a potential reversal in downward pressure on Bitcoin’s price. Historically, the end of miner capitulation has been associated with subsequent price increases.

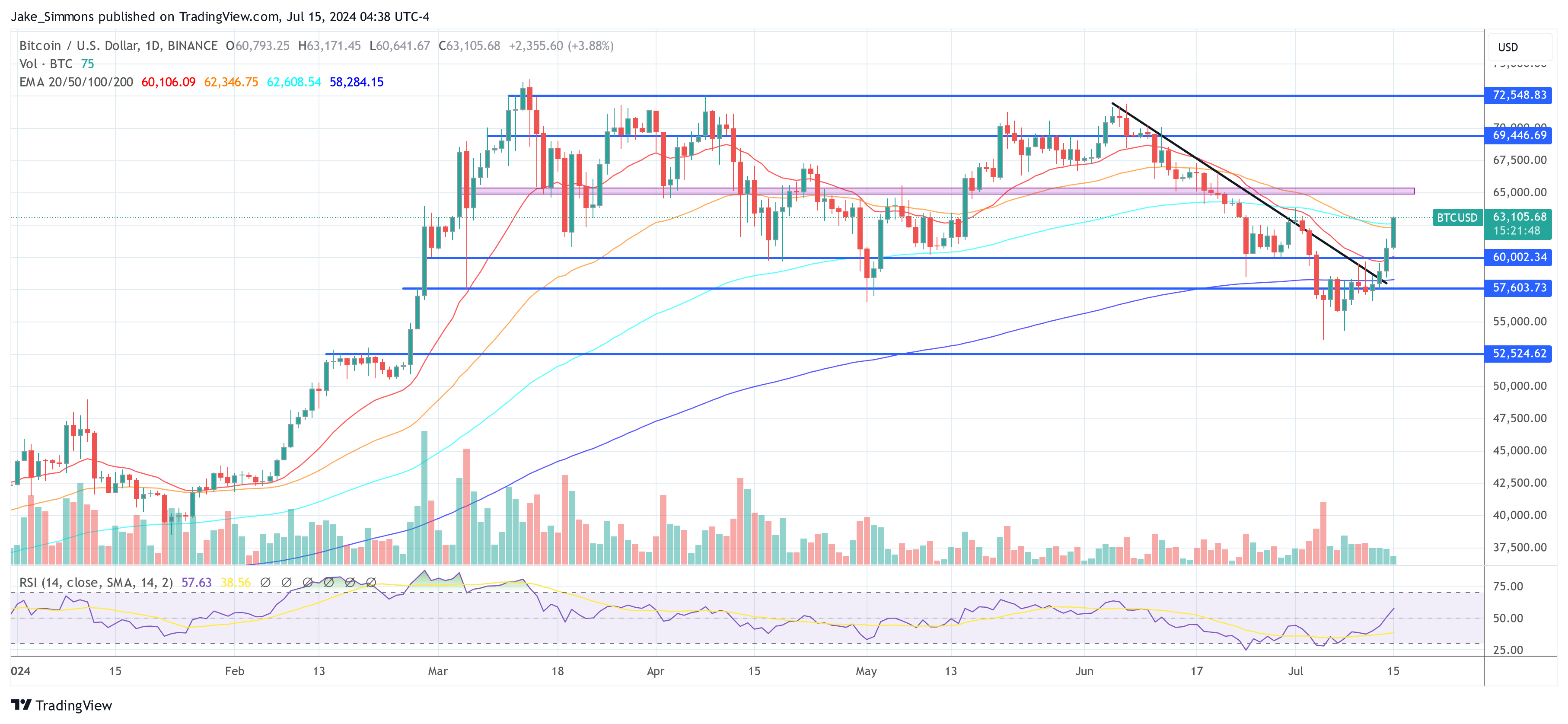

#5 Technical Breakout

From a technical perspective, Bitcoin surpassed the critical 200-day Exponential Moving Average (EMA) and a descending trendline this Saturday. This milestone can be considered a bullish signal among traders, indicating a possible end to the downturn that began in early June.

At press time, BTC traded at $63,105.