With its price going up and down like the rest of the altcoin market, Telegram’s Notcoin (NOT) has somehow attracted a considerable number of investors.

During the last cycle, the coin dropped an uncomfortably steep 20% before making a small 1.2% comeback. Trading moved up by 11%, reaching an impressive $238 million despite recent declines in the market.

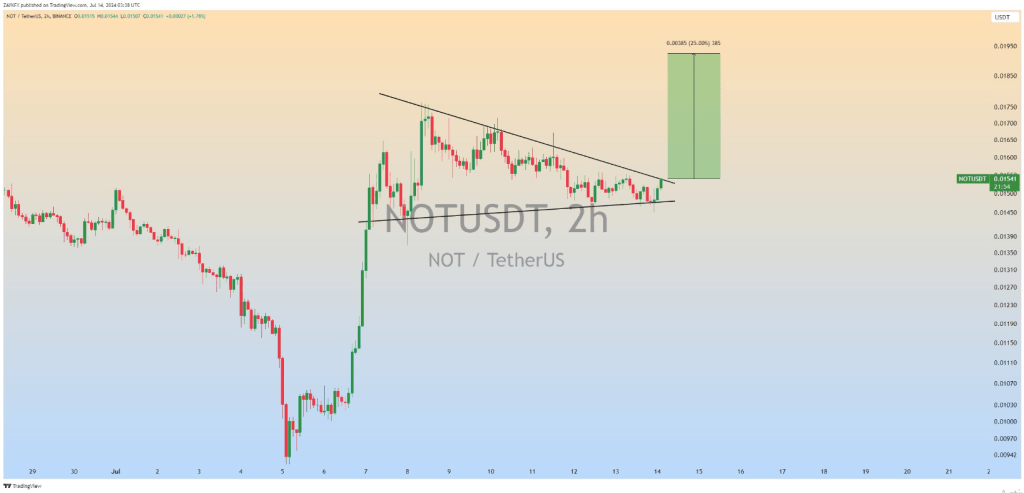

NOT/USDT has caught the radar of ZAYK Charts, which has observed a so-called pennant shape developing that could indicate a price spike is underway.

Based on figures gathered by the analyst, a breach of this pattern could set in motion a 25% rally. At $0.0153, the token faces crucial support points. Whether the price falls or stays the same, $0.01478 or $0.01437 could help.

$NOT Bullish Pennant Formation in 2H Timeframe

Incase of Breakout,Expecting Bullish Wave

#NOT #NOTUSDT #Crypto pic.twitter.com/dKvDVJuYOR

— ZAYK Charts (@ZAYKCharts) July 14, 2024

Based on what ZAYK stated in his observation, the pattern shown on the Notcoin chart is a classic example of a technical pattern which usually indicates that a large price movement is expected soon.

It is likely that the coin will mark the end of the consolidation period and the beginning of a new uptrend if it is able to successfully break above the falling trendline. This would be a positive development with regard to the coin’s price. This would provide investors with an attractive chance to enter the market.

Notcoin Ecosystem Expansion

Apart from the encouraging technological perspective, Notcoin has been advancing the expansion of its ecosystem. In partnership with the 1inch organization, and Sign, an attestation system, the project just kicked off “The Triangle,” an accelerator program.

Laying down the groundwork for progress inside the TON ecosystem is one of the project’s goals. Giving developers and company owners technical direction, instructional tools, and community events allows them to produce this. This behaviour has show Notcoin’s focus and capacity to weather the storm.

Notcoin Price Forecast

The Notcoin price prediction projects that by August 14, 2024 the altcoin will skyrocket by 235% and settle at $0.052105. According to projections, the present mood is positive; the Fear & Greed Index comes out as neutral at 52.

Notcoin has had a 13.77% price volatility over the past 30 days and recorded 12 out of 30 (or 40%) green days. These measures point to a vibrant and favourable market for the performance of the token.

The combination of technical considerations, ecosystem expansion activities, and the optimistic price prognosis implies that Notcoin might be positioned for a strong rise in the next months, ZAYK stated.

Featured image from Pexels, chart from TradingView