MakerDAO, the leading DeFi platform, has revealed a significant $1 billion investment in tokenized US Treasury securities in a move that has rocked the crypto industry. This strategic action is likely to change the basic principles of the decentralized finance (DeFi) ecosystem.

Major Players Boost Tokenization

Widespread praise has been given to MakerDAO’s choice to broaden its portfolio outside of its main Ethereum dependence. With a startling $1 billion allocated to tokenized US Treasuries, the platform is not only lessening its over-concentration on one asset but also supporting the idea and future of tokenized real-world assets (RWAs).

As MakerDAO’s entry into the $2 billion tokenized RWA market establishes a new norm for the sector, this action is expected to drive more development and expansion in this market.

MakerDAO’s $1B Tokenized Treasury Investment: Major Players Dive In!

MakerDAO’s $1B play into tokenized U.S. Treasuries is shaking up the market.

Heavyweights like BlackRock’s BUIDL, Superstate, and Ondo Finance are vying for a piece.

MKR token saw a 5% boost on this news.… pic.twitter.com/ACGOZDeGGg

— Crypto Town Hall (@Crypto_TownHall) July 14, 2024

The participation of major players like BlackRock’s BUIDL, Superstate, and Ondo Finance adds even more to the relevance of this progression. The involvement of these behemoths points to the strategic necessity of tokenizing conventional financial products such as treasuries rather than only a trend.

As these big players spread throughout the DeFi terrain, the convergence of legacy banking and blockchain technology gets increasingly evident.

MKR Token Gains Momentum

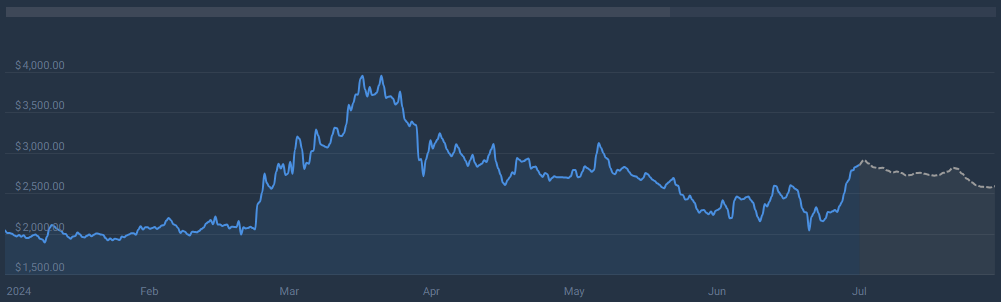

MakerDAO’s native token, MKR, has seen a 30% increase in value following this news, which reflects the good sentiment among traders and investors.

Meanwhile, the most recent Maker price projection shows a 9.22% drop from its present values, the MKR token is predicted to reach $2,597 by August 14, 2024.

But the overall positive outlook combined with a current Fear & Greed Index rating of 52 (Neutral) points to an opportune moment for investors to think about including MKR into their portfolios.

Integrating Crypto And Traditional Finance

Beyond only a financial choice, MakerDAO’s $1 billion purchase in tokenized US Treasuries is a strong declaration about the future for decentralized finance and the junction of conventional financial instruments with blockchain technology.

This action shows the platform’s dedication to pushing past the limits of what is feasible in the DeFi space, leading to fresh challenges and opportunities for the whole ecosystem.

The next months are likely to show more cooperation and involvement between the representatives of big financial institutions and blockchain startups as the crypto community eagerly watches the developments.

The revolutionary action of MakerDAO will surely influence the development of the DeFi market as well as the larger financial scene in the next years.

Featured image from Pexels, chart from TradingView