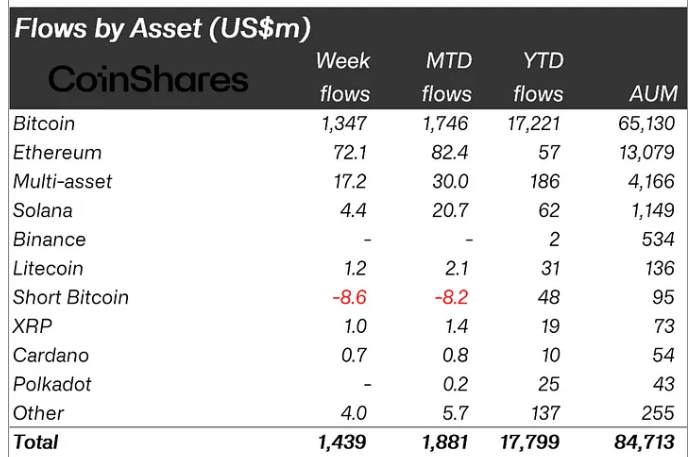

Digital asset investment products experienced consecutive inflows this month, with $1.44 billion recorded last week, per CoinShares‘ latest weekly fund flow report.

This recent inflow raised the year-to-date total to a record $17.8 billion, surpassing the $10.6 billion inflows of 2021.

However, trading volumes stayed low at around $8.9 billion, compared to the seven-day average of $21 billion.

Bitcoin sees the fifth-largest inflow.

A breakdown of the flows showed that Bitcoin saw its fifth-largest weekly inflows on record last week, totaling $1.5 billion. Conversely, short-Bitcoin experienced its largest weekly outflow since April 2024, amounting to $8.6 million.

This movement suggests a shift in market sentiment for the crypto industry. The significant Bitcoin inflows indicate investors’ growing confidence in the asset’s potential for substantial growth, with many investors taking advantage of the recent price decline to enter the market.

James Butterfill, head of research at CoinShares, said:

“We believe price weakness due to the German Government bitcoin sales and a turnaround in sentiment due to lower than expect CPI in the US prompted investor to add to positions.”

Meanwhile, Ethereum-related crypto products attracted $72 million in inflows in anticipation of its spot exchange-traded funds (ETF) launch. This marks its largest inflow since March, bringing its year-to-date flows to $57 million.

Nate Geraci, President of ETF Store, predicted the SEC would approve ETH ETF products for trading this week because the financial regulator “has no good reason for any further delay at this point.”

Furthermore, large-cap alternative digital currencies like Solana, Chainlink, Avalanche, and XRP saw more than $8 million in cumulative inflows.

Regionally, the United States led with $1.3 billion in inflows last week, reflecting a broad positive sentiment. Switzerland set a yearly record with $58 million in inflows, while Hong Kong and Canada saw $55 million and $24 million, respectively.

The post Digital assets see record $17.8 billion YTD inflows as Bitcoin and Ethereum lead the charge appeared first on CryptoSlate.