Changes in futures and options open interest provide insight into market sentiment, liquidity, and potential price movements. Futures and options reveal how traders position themselves and show their expectations for future price action. Open interest measures the flow of money, showing whether new capital is entering or exiting the market.

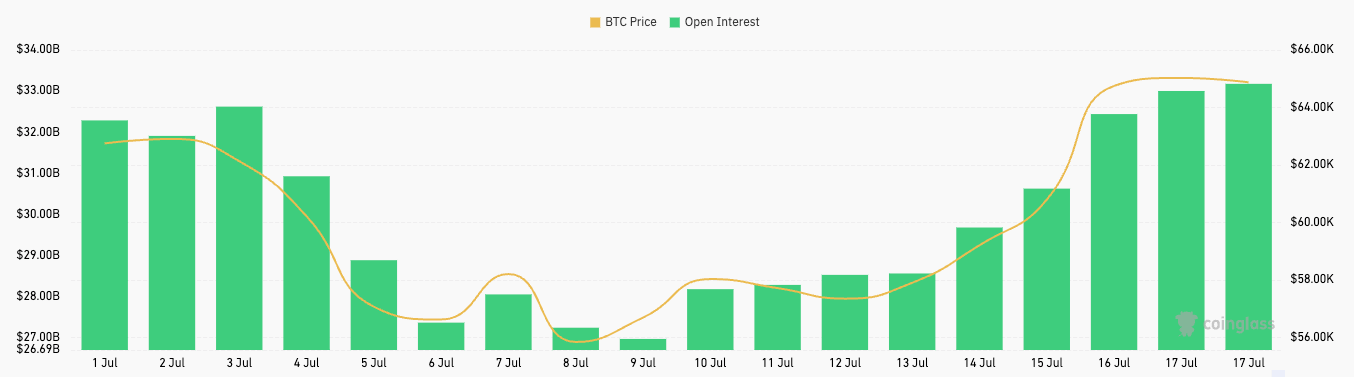

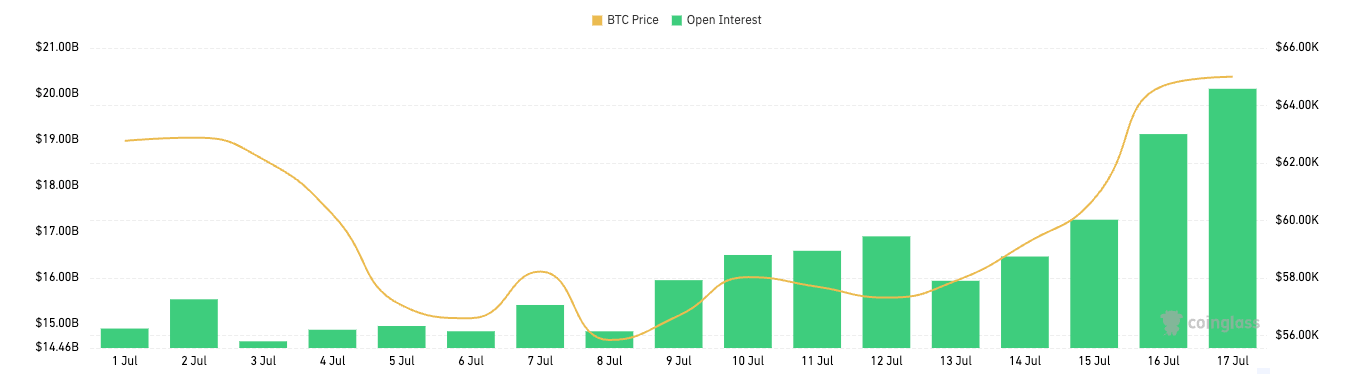

Looking at open interest, we can see that Bitcoin’s recent rally has brought new life into the derivatives market, which saw a relatively calm and uneventful July. This stability reflected the weeks of sideways price action the market saw. The lateral trend turned positive last week, as Bitcoin started at $56,680 on July 9. The price increase started slowly but began picking up pace from July 14 onwards, when the price surged from $59,205 to $65,025 on July 17.

Futures open interest closely mirrored this price action. On July 9, open interest was $26.97 billion and rose steadily, reaching $33.25 billion by July 17. This rapid increase in OI shows that traders were opening more contracts as Bitcoin broke $60,000, most likely anticipating further price increases.

The options market followed the same trend. On July 9, open interest was $15.94 billion. It rose steadily over the following week, reaching $20.11 billion by July 17. Like the futures market, a notable spike in options open interest was seen from July 15 onwards, mirroring Bitcoin’s price increase. This surge also shows a significant increase in activity from traders, who rushed to capitalize on price movements.

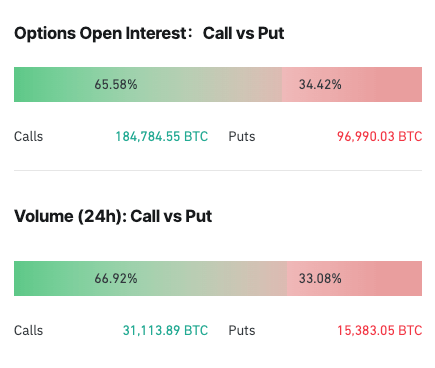

The distribution of calls and puts shows that over 65% of open interest and volume are calls. This means that a smaller percentage of traders are hedging against downside risks and anticipating further price increases on which they want to capitalize. Options provide a mechanism for traders to leverage their positions with controlled risk, which is particularly attractive during periods of price volatility.

The synchronized rise in both futures and options open interest alongside the price increase shows how integrated the Bitcoin market is. As the spot price rallies, it attracts more futures contracts and prompts increased options activity, indicating a comprehensive response from the market using complex trading instruments.

Furthermore, the correlation between open interest and price shows that the derivatives market loves positive price action. Sideways price action leads to significantly lower open interest in futures and options, while price increases attract new money into the derivatives market.

The post Bitcoin’s rally rekindles the derivatives market appeared first on CryptoSlate.