Crypto investment products saw their third straight week of inflows last week, reaching $1.35 billion. This has pushed the total inflows for July to surpass $3 billion, according to CoinShares’ latest weekly report.

Notably, ETP trading volumes also rose significantly last week, increasing by 45% week-on-week to $12.9 billion. However, this significant volume only accounts for 22% of the overall crypto market volume.

Positive sentiments

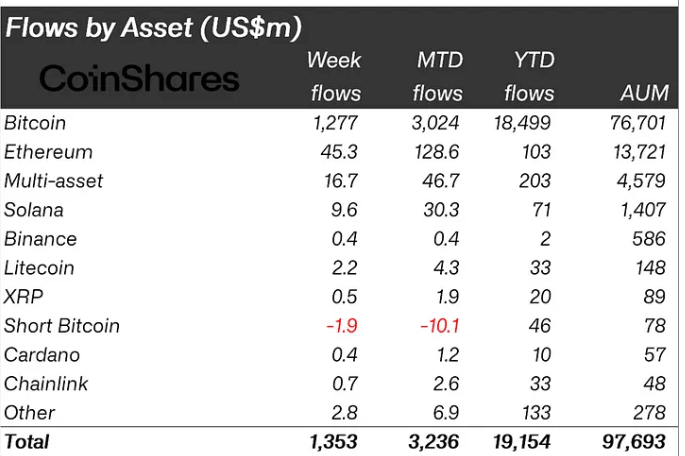

Bitcoin-related products led the inflows, contributing 95% of the total with $1.27 billion. The flows were dominated by BlackRock’s IBIT and Fidelity’s FBTC, whose BTC ETFs saw nearly $1 billion in inflows last week.

Conversely, short-bitcoin ETPs saw outflows of $1.9 million, bringing total outflows since March to $44 million, representing 56% of assets under management (AuM).

James Butterfill, head of research at CoinShares, explained that this trend indicates the enduring positive investor sentiment since Bitcoin completed its halving event in April.

Ethereum-related products also saw positive movement, with $45 million in inflows last week. This brought its year-to-date (YTD) inflows to $103 million, overtaking Solana.

The rise in Ethereum inflows is linked to the anticipated launch of its spot exchange-traded funds (ETFs). Last week, the Chicago Board Options Exchange (Cboe) announced that five products—21Shares’ CETH, Fidelity’s FETH, Franklin Templeton’s EZET, Invesco’s QETH, and VanEck’s ETHV—will start trading on July 23, pending regulatory approval.

Solana saw $9.6 million in inflows last week but lags behind Ethereum with $71 million YTD. Litecoin was the only other altcoin with over $1 million in inflows, recording $2.2 million last week. Chainlink, Cardano, and Binance collectively saw $1.5 million in inflows.

Butterfill added that blockchain equities faced outflows of $8.5 million last week despite most ETFs outperforming world equity indices.

Regionally, the US and Switzerland had significant inflows of $1.3 billion and $66 million, respectively. In contrast, Brazil and Hong Kong experienced minor outflows of $5.2 million and $1.9 million, respectively.

The post July crypto inflows surpass $3 billion milestone, driven by Bitcoin ETF demand appeared first on CryptoSlate.