Bitcoin ownership in the United States spans diverse demographics and political orientations, challenging common assumptions about its supporters, according to a new report.

The Nakamoto Project’s recent survey on Bitcoin adoption provides a comprehensive analysis of ownership trends among Americans. Conducted in partnership with Qualtrics, the study involved a representative sample of 3,538 adults collected in two stages from November 2023 to March 2024.

The survey aimed to identify key factors influencing Bitcoin adoption and ownership in the United States, distinguishing itself from previous surveys by its population-level scope and specific focus on Bitcoin. One of the report’s authors, Troy Cross, summarized the findings on X,

“Our survey of 3,538 adults in the US found bitcoin ownership:

-covers the full spectrum of political identity

-is skewed young and male

-correlates weakly with a unique profile of moral values

-correlates strongly with knowledge of bitcoin”

The findings reveal that Bitcoin ownership is not significantly influenced by political orientation. Despite the polarized political rhetoric surrounding Bitcoin, the data indicates that Bitcoiners span the political spectrum, with a tendency towards moderate views.

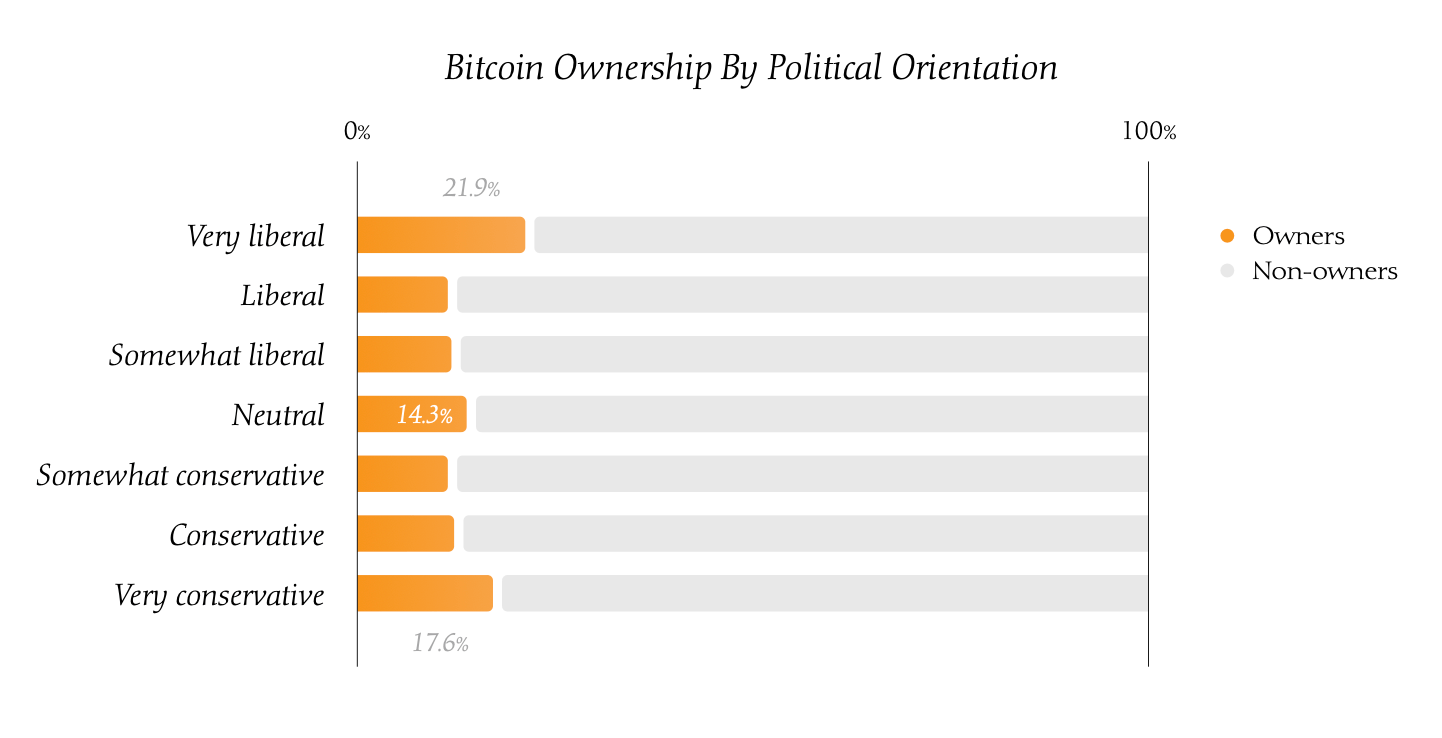

The survey showed that 21.9% of very liberal respondents and 17.6% of very conservative respondents own Bitcoin, compared to 14.3% of moderates. The data do not support the notion that Bitcoin ownership is predominantly a right-wing or libertarian phenomenon, as Bitcoin owners reflect the broader American political landscape.

In total, around 45% identify as liberal and 41% as conservative, indicating mostly bipartisan support for Bitcoin.

The report states,

“What correlates most strongly with Bitcoin ownership is not who you are, so to speak, but how much you know about Bitcoin, and whether you think it is useful, trustworthy, and good.

The 14% of Americans who own Bitcoin, it turns out, are not members of some particular political tribe. Rather, they are simply Americans who have taken the time to study the technology and formed positive attitudes about it.”

Demographically, Bitcoin owners are similar to the general U.S. population in terms of race, ethnicity, income, education, and financial literacy. However, there are notable differences in age and gender; Bitcoin ownership skews younger and male. The survey found that younger individuals are more likely to own Bitcoin, with a significant concentration among those under 35 years old. Additionally, 46.1% of Bitcoin owners are male, compared to 52.3% female in the general population.

The study employed the Moral Foundations Theory to explore the moral and ethical values of Bitcoin owners. Bitcoiners exhibit a blend of liberal and conservative moral foundations, prioritizing cultural liberty, equality, and proportionality while aligning with conservatives on purity and loyalty. However, these moral foundations were less predictive of Bitcoin ownership than other factors.

Key predictors of Bitcoin ownership identified in the survey include knowledge about Bitcoin, belief in its utility, trust in the Bitcoin protocol, and the perceived morality of Bitcoin. These variables were highly correlated with each other and with Bitcoin ownership. Respondents who demonstrated higher levels of knowledge about Bitcoin trusted its technology, believed in its practical utility, and perceived it as morally good were more likely to own Bitcoin.

Trust in the Bitcoin protocol and its perceived morality emerged as significant differentiators between Bitcoin owners and non-owners. While non-owners tended to be neutral or negative about Bitcoin’s trustworthiness and morality, owners expressed strong positive sentiments in these areas. This suggests that individuals who trust Bitcoin’s technology and believe in its social and moral value are more inclined to adopt it.

The findings indicate that Bitcoin ownership in the US is driven more by individual knowledge and attitudes toward Bitcoin rather than demographic or political factors. The study challenges the perception of Bitcoin ownership as a politically or demographically distinct phenomenon, highlighting that the 14% of Americans who own Bitcoin are diverse and broadly representative of the wider population. The survey highlights the importance of education and positive perceptions in driving Bitcoin adoption.

The Nakamoto Project’s survey provides valuable insights into the demographics, political orientations, and key factors influencing Bitcoin ownership in the United States. It reveals that Bitcoiners are not confined to any particular demographic or political group but are united by their knowledge, trust, and positive perceptions of Bitcoin.

The post US Bitcoiners lean liberal but report shows politics less divisive than many think appeared first on CryptoSlate.