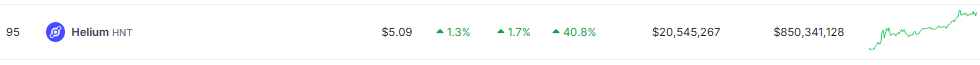

Some altcoins today are seeing a strong and consistent bullish attitude with their traders, and Helium is one of those. The latest market data shows that the token is up nearly 41% since last week.

This is largely sustained by continuing efforts to make the network robust and usable in everyday life. Its entry into the telecommunication industry also helped carry this momentum in the long run.

Helium: Mobilizing Userbase

Helium’s mobile arm is the reason why HNT is at the top of its game this week. Last week, July 16, the Helium Mobile X account announced that the platform has hit the 100,000 subscriber mark. This influx of users also brought attention to the Helium network as a whole.

We just hit 100,000 sign-ups!

We want to extend a huge thank you to our community for helping us reach this insane milestone!

Together, we’re innovating the telco industry

pic.twitter.com/Fb5lvQ1Mni

— Helium Mobile

(@helium_mobile) July 15, 2024

According to their website, accompanying the 100,000 users that joined up is the deployment of nearly 15,000 hotspots within the same timeframe. Helium Mobile also has a Carrier Offload program which, even though it’s still in the beta phase, has already shown some promise with over 190,192 offload subscribers.

The Carrier Offload program makes it possible for non-Helium Mobile users to connect to hotspots that are part of the beta deployment. This development will help the network by slowly but surely introducing the network to the general public.

Even if the Carrier Offload program is discontinued, the aggressive pricing of Helium Mobile at $20 a month will make it competitive to the average consumer, which will introduce them to the whole Helium ecosystem as a whole.

Bullish? Not So Much…

As the market moves forward, the sudden surge in the price of HNT will eventually stall and ride the wave downwards. Long-term holders of the token will see this extreme jump as a sign to sell, and push the token down to the $4.465 support line.

This leaves the bulls in an awkward position: either to hold or join the bearish wave and then anchor on the $4.465 line. If HNT does fall to the $4.465 line and the bulls are successful in defending this level, the $8 ceiling might be in reach.

This, however, is if they are successful in defending. If the ears do win the deadlock in the next couple of days, they can bring the token down to $3 or $2.

But volatility-wise, it may also help in taking the $8 line if they are lucky. Helium’s innovation within the telecommunication space will help secure the much-needed investor confidence to ride the coming wave.

Featured image from SVET, chart from TradingView