With a huge sell-off of Bitcoin, the Germany has fundamentally changed the bitcoin scene. Germany has recently offloaded an astounding 49,850 BTC within a few weeks. Executed across many exchanges including Coinbase, Kraken, and Bitstamp, the transactions helped to reduce possible value loss.

Apparently, the German government started these sales because of worries about a notable drop in the value of Bitcoin. With the average price for a Bitcoin about $57,000, the total earnings came to a little over $2.8 billion.

Fascinatingly, Germany lost out on an extra $400 million in possible gains while Bitcoin is presently valued at $66,425. Germany now only holds less than one BTC.

Strategic Bitcoin Moves By The US Government?

The US government has been making news with its own smart BTC moves as the dust settles following Germany’s huge Bitcoin sell-off.

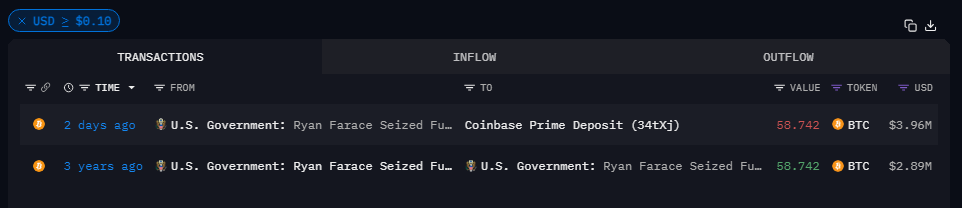

Blockchain intelligence platform Arkham Intelligence found on July 22, 2024 a noteworthy transaction involving the movement of 58.742 BTC from a government wallet to Coinbase Prime Deposit. Valued at about $4 million, this move has generated interest and worries among the crypto community.

The US’ possession of around 213,200 BTC, with a valuation of approximately $14.4 billion, consists mostly of assets confiscated from criminal entities. The seizure of 69,370 BTC from the notorious Silk Road case in August 2023 was the most publicized of these seizures.

Adding to the intrigue is this most recent move, which comes after a previous transaction that took place on June 26 and saw the US government transferring 4,000 Bitcoin to the same Coinbase wallet.

Some people are concerned that the United States may follow Germany’s example and begin a large sell-off as a result of these developments.

Germany & US Bitcoin Moves: Market Effects

Investors and market experts have not missed the significant changes governments have made on Bitcoin. Already, Germany’s sell-off illustrated the significant influence such policies may have on investor confidence and market stability. The worry of a comparable US government action has added even another level of uncertainty to the market.

Bitcoin’s price has been going up and down a lot, so the market mood has been tight. Bitcoin is currently selling at $66,420, which shows how the market feels about these government actions. It has lost more than 2% in the last 24 hours.

These changes are causing reevaluation of investor tactics. Although some view the government sell-offs as a sign of caution, others view them as possibilities for market corrections. The state of cryptocurrencies is still much shaped by the behavior of big BTC holders, especially governments.

Featured image from Pexels, chart from TradingView