Bitcoin is bearish at press time, fading last week’s strong gains. Even though buyers expect prices to recover and break above $69,000, bears have been unyielding, even piercing the upper range of the current consolidation.

At spot rates, Bitcoin is down 6% from last week’s highs and roughly 12% from all-time highs. Contracting prices also mean lower lows from all-time highs, a bearish signal.

Bitcoin Whales Ramping Up Purchase

Despite this confluence of bearish signals, there are hints that buyers are accumulating at spot rates. As prices breach $66,000, the primary support, on-chain data shared by Ki Young Ju on X, points to strength, at least looking at whale behavior.

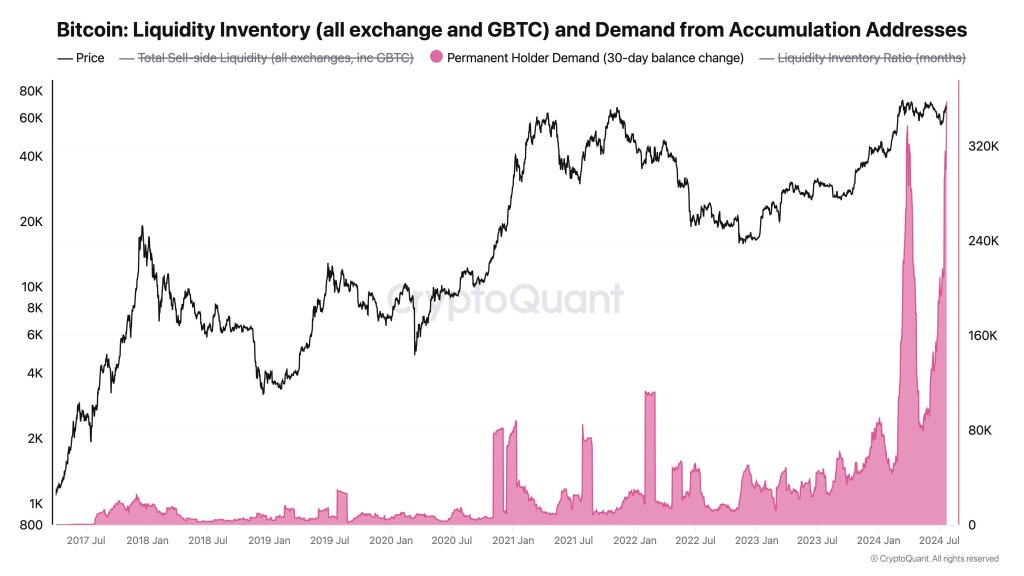

Though prices might be inching lower, Ju, the CEO of CryptoQuant, notes that whales have been aggressively buying in the past few weeks. Over the past month alone, 358,000 BTC were moved to permanent holder addresses. These wallets tend to HODL and not get shaken off by price volatility, as seen with retailers when prices drop.

Most importantly, these addresses are not associated with spot Bitcoin ETF issuers or miners. So far in July, BlackRock, Fidelity, and other spot ETF issuers, like Bitwise, have bought over 53,000 BTC on behalf of their clients.

The fact that coins are moving to these wallets suggests that whales are confident of what lies ahead and are unwilling to offload their stash, coming at a time when spot Bitcoin ETF issuers are scooping more coins from circulation.

Mt. Gox Distribution Soaked Impressively Well By The BTC Market

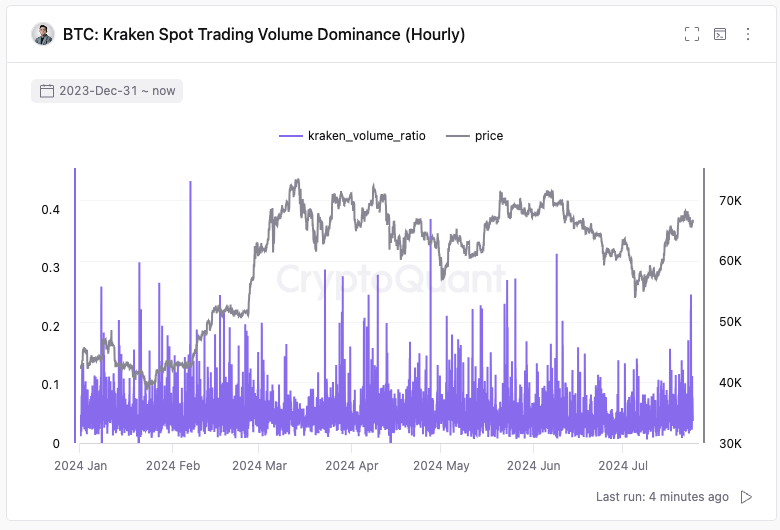

Interestingly, whales are gulping more BTC and HODLing just when Kraken, a crypto exchange, had completed their Mt. Gox creditor repayment process. The BTC market was concerned that Mt. Gox distribution would cause a blood bath from late June to early July.

However, looking at events in the past few days, the market seemed to have handled any sell-off well without causing much volatility. In a post on X, Ju said that spot trading volume and exchange flows remain normal on Kraken.

Amid this development, more users are flowing back into the crypto market. The Mt. Gox repayment via Kraken coincides with a marked increase in USDT and stablecoin liquidity. Historically, any upsurge of USDT inflows to exchange has preceded sharp price gains in Bitcoin.