Quick Take

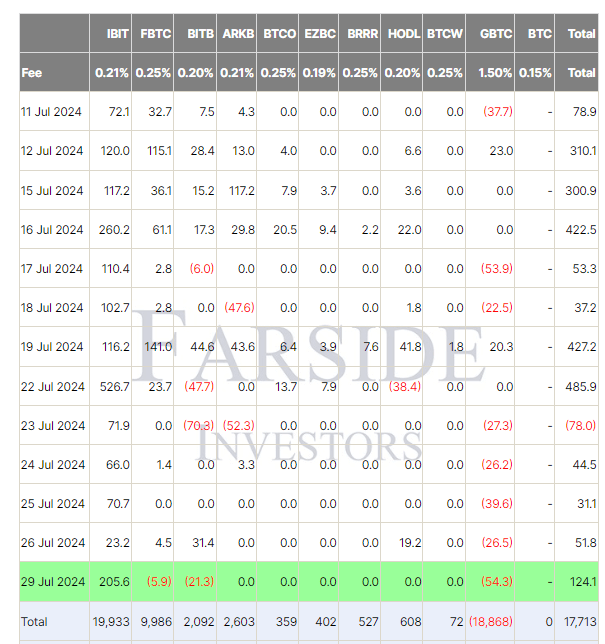

Recent data from Farside showed significant movements in Bitcoin and Ethereum exchange-traded funds (ETFs). Bitcoin ETFs experienced a $124.1 million inflow on July 29, capitalizing on Bitcoin’s price dip to $66k. BlackRock’s IBIT ETF stood out with an impressive $205.6 million inflow, marking the largest inflow since July 22 and bringing IBIT’s net inflows to $19.9 billion. In contrast, Grayscale’s GBTC ETF recorded a $54.3 million outflow, escalating its total net outflows to $18.9 billion. Other Bitcoin ETFs, including Bitwise’s BITB and Fidelity’s FBTC, also faced outflows of $21.3 million and $5.9 million, respectively. Despite these outflows, the total inflows into Bitcoin ETFs now stand at $17.7 billion.

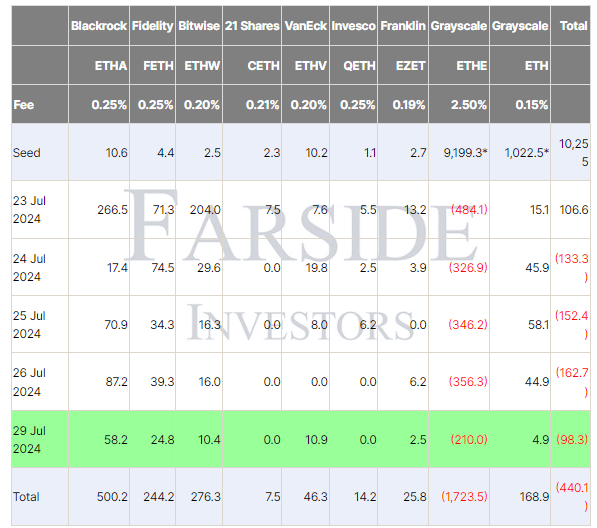

In contrast, Ethereum ETFs continued to experience outflows, with a substantial $98.3 million outflow on July 29. This trend is primarily driven by Grayscale’s ETHE ETF, which saw a $210 million outflow, pushing its total outflows to $1.7 billion. Among the nine Ethereum ETF issuers, six recorded inflows led by BlackRock’s ETHA ETF with a $58.2 million inflow, raising its total net inflow to $500.2 million. Despite some positive inflows, the total net outflows for Ethereum ETFs increased to $440.1 million. This data illustrates the contrasting trends in investor sentiment towards Bitcoin and Ethereum ETFs.

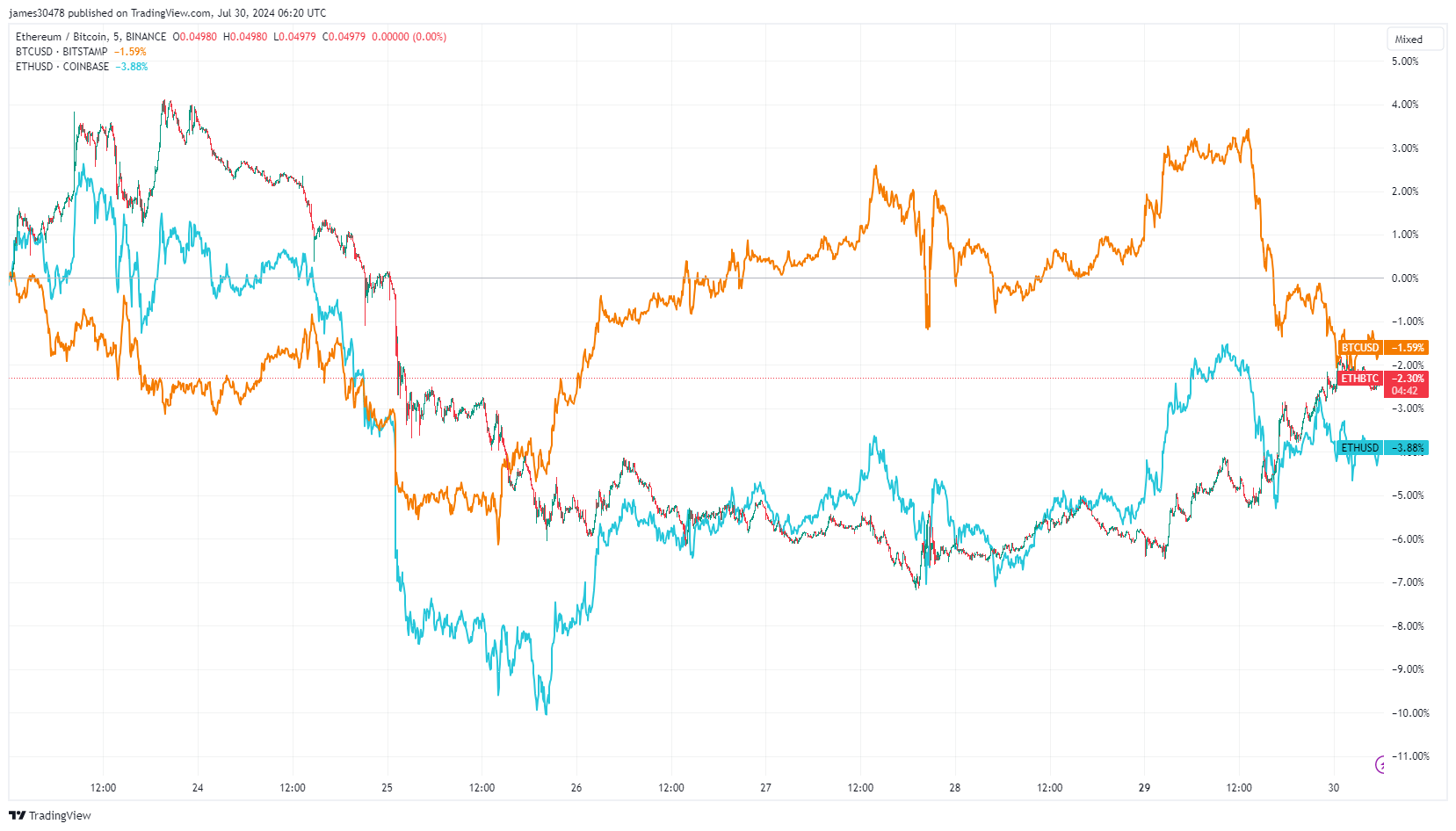

Since the launch of the ETH ETFs on July 22, BTCUSD has decreased by 2.3%, ETHUSD has dropped over 6%, and ETHBTC has fallen by 4%.

The post Bitcoin ETFs see $124.1M in inflows as Ethereum struggles with outflows appeared first on CryptoSlate.