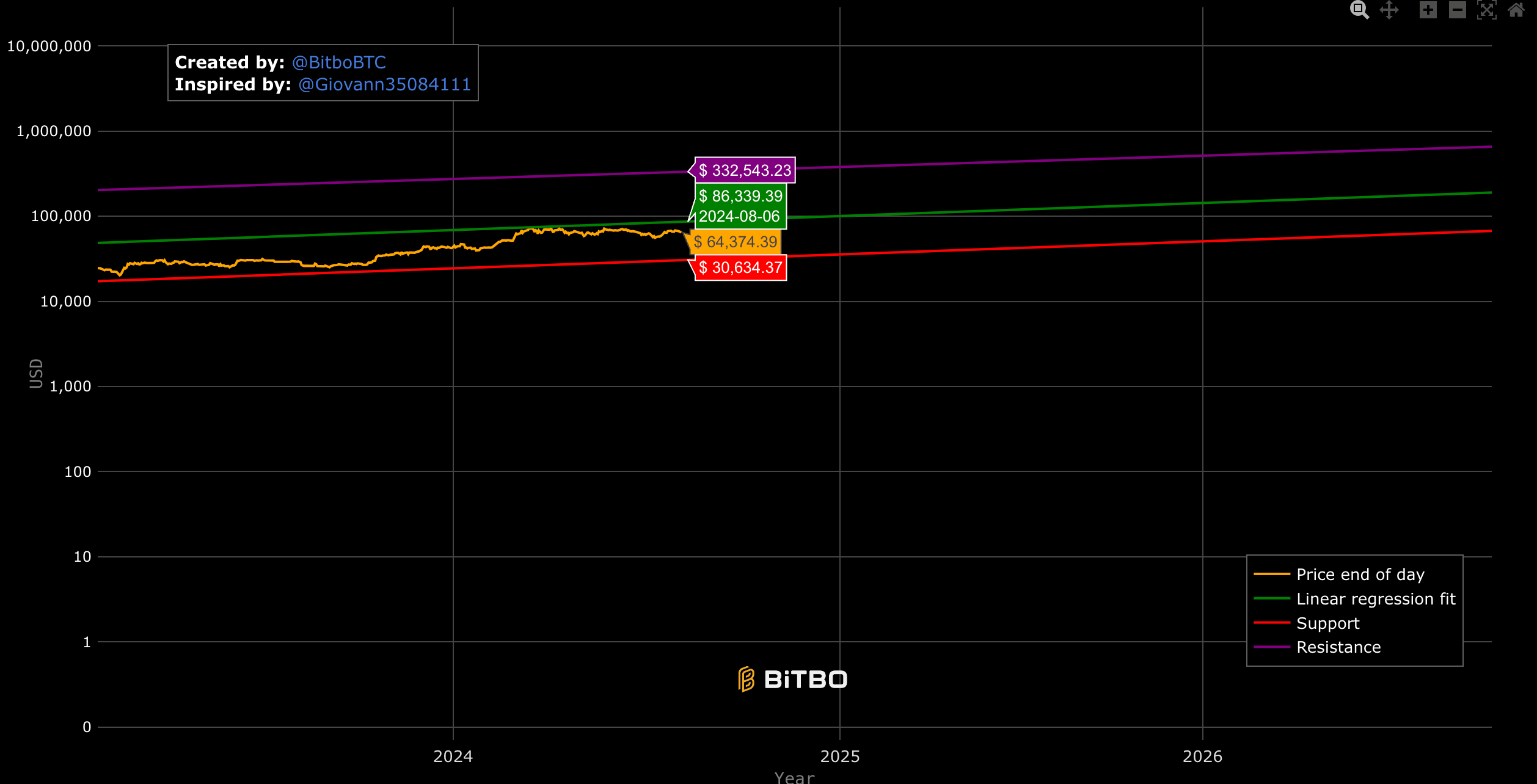

Giovanni Santostasi’s Bitcoin Power Law model suggests Bitcoin’s price will not fall below $30,000 again, indicating a floor for future valuations. The model shows Bitcoin’s price trajectory will continue to rise, with its current ‘fair price’ at $86,339 and potential ceiling at $332,543.

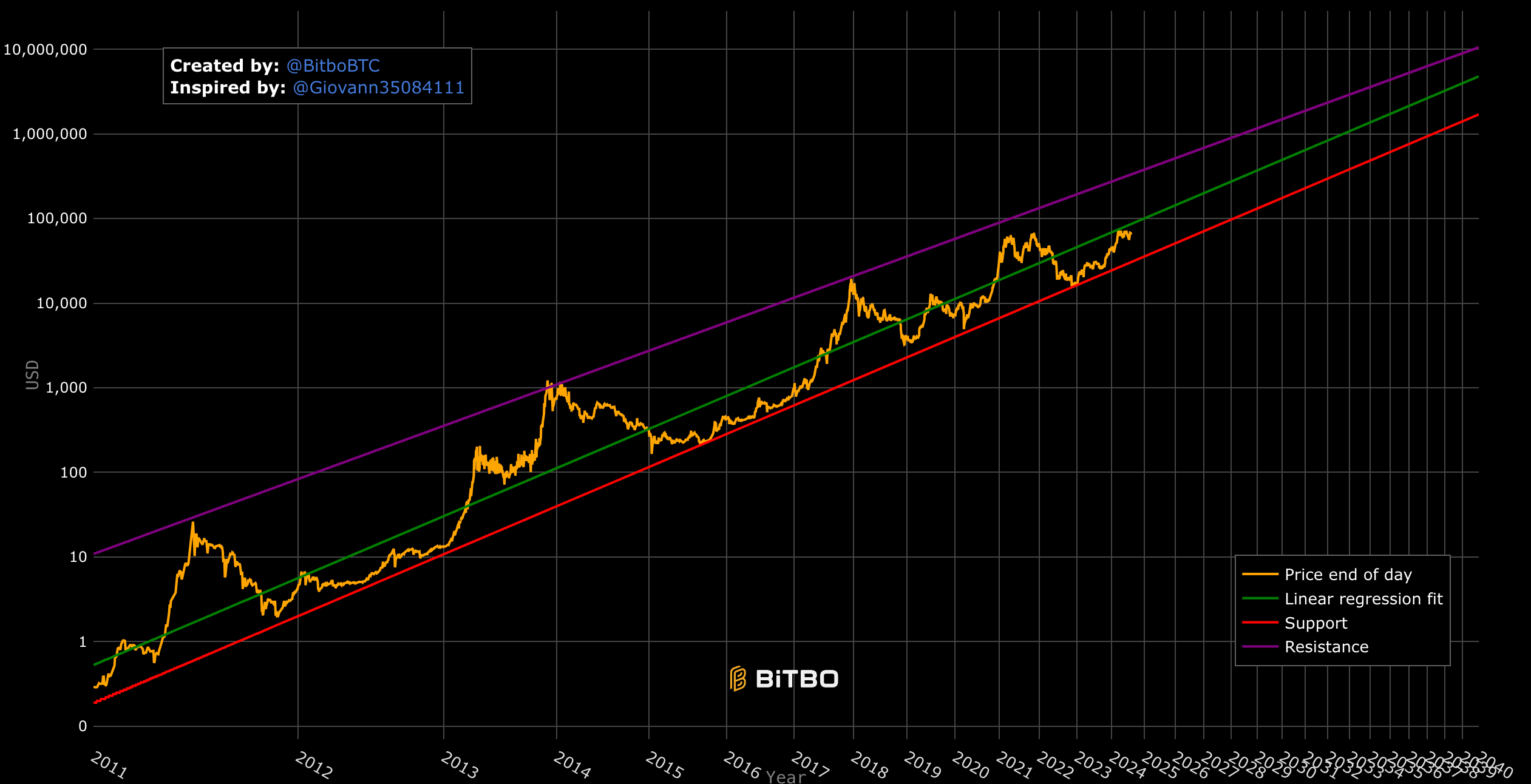

As depicted in the charts from Bitbo, the model uses linear regression to establish support and resistance bands, which have historically contained Bitcoin’s price movements. The support band, derived from past price data, suggests a lower boundary that Bitcoin’s price should not breach, while the resistance band indicates an upper boundary.

The model predicts that Bitcoin should reach $100,000 per coin before 2028 and will not drop below this price after 2028. Furthermore, it forecasts that Bitcoin could hit $1,000,000 between 2028 and 2037 and maintain this level thereafter.

The model’s foundation lies in the power law distribution, a statistical relationship where one quantity varies as the power of another. This distribution has been observed in various natural phenomena and financial markets, providing a robust framework for long-term price predictions. The power-law model’s application to Bitcoin suggests a consistent upward trend, aligning with the asset’s historical performance despite its volatility.

Critics of the model argue that it relies heavily on historical data, which may not account for future market forces or unforeseen events. They caution that while the model provides a structured approach to understanding Bitcoin’s price movements, it should not be taken as an absolute predictor of future prices. Nonetheless, the Power Law model offers a compelling perspective on Bitcoin’s potential growth, reinforcing the belief among some analysts that Bitcoin’s price will continue to rise over the long term.

Unlike the Stock-to-Flow model, the Power Law has never been invalidated. If this continues, the fair price at the next halving should be around $290,000 in 2028.

The post Bitcoin power law model suggests $30K floor, $1M potential this cycle appeared first on CryptoSlate.