The global economic market has now so far shown increasing signs of instability which appears to have impacted the overall crypto investment sector negatively. Recent data from CoinShares has revealed a reversal in the flow of funds, with crypto investment products experiencing significant weekly outflows.

As reported by CoinShares, this outflow marks the first time in over a month that the net balance has tipped from “accumulation to liquidation,” highlighting investor anxiety amid recession fears in the United States.

Deciphering The Crypto Fund Flows: Was There Any Green?

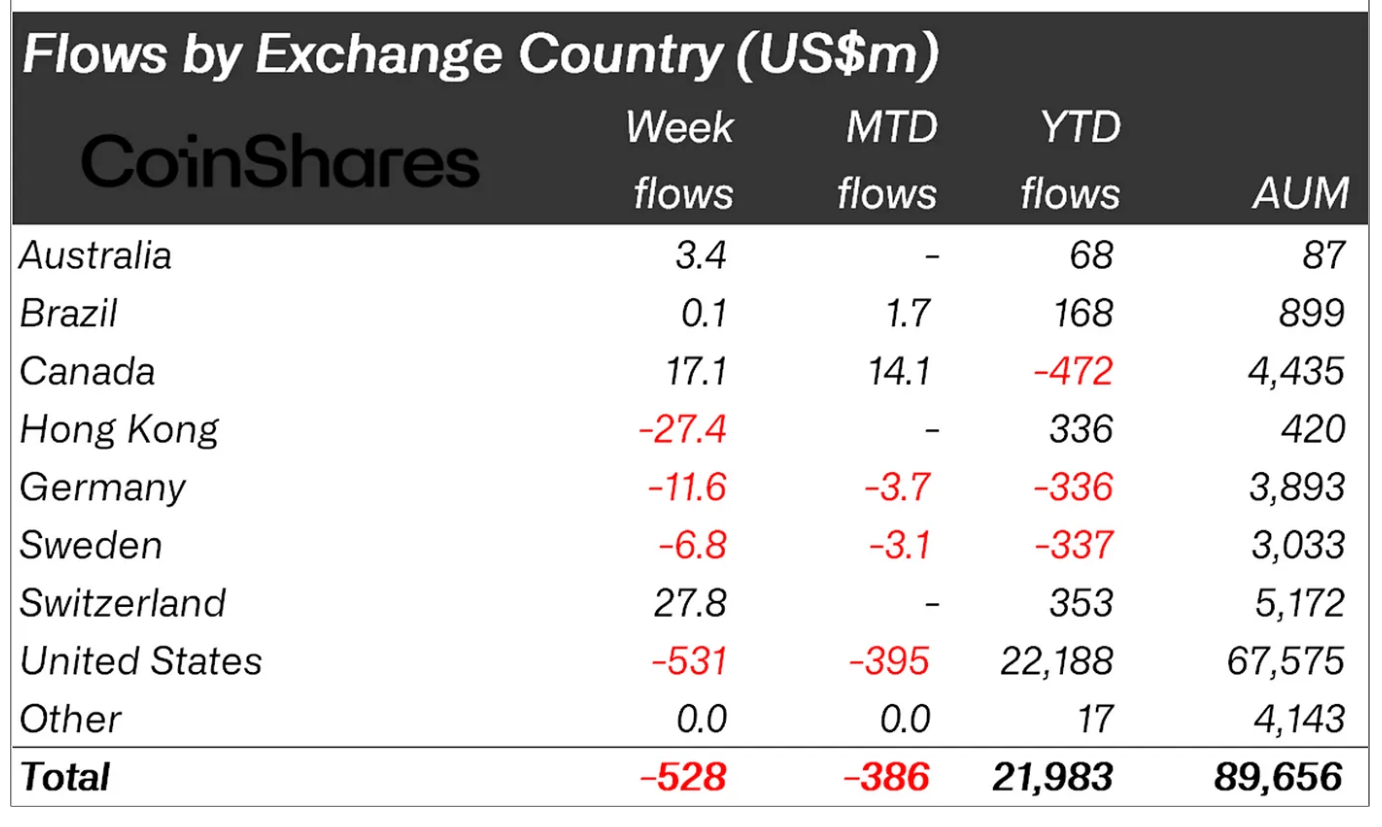

Analyzing the geographical distribution of these outflows presents a nuanced view of the current market stance. The report from CoinShares revealed that US-based funds were the hardest hit, recording net outflows of $531 million.

Related Reading: Bitcoin’s Price Potential: Analyst Maps Path To $700,000 And Beyond

This figure was heavily influenced by a significant sell-off on Friday, where net outflows totalled $237.4 million, overshadowing any inflows earlier in the week.

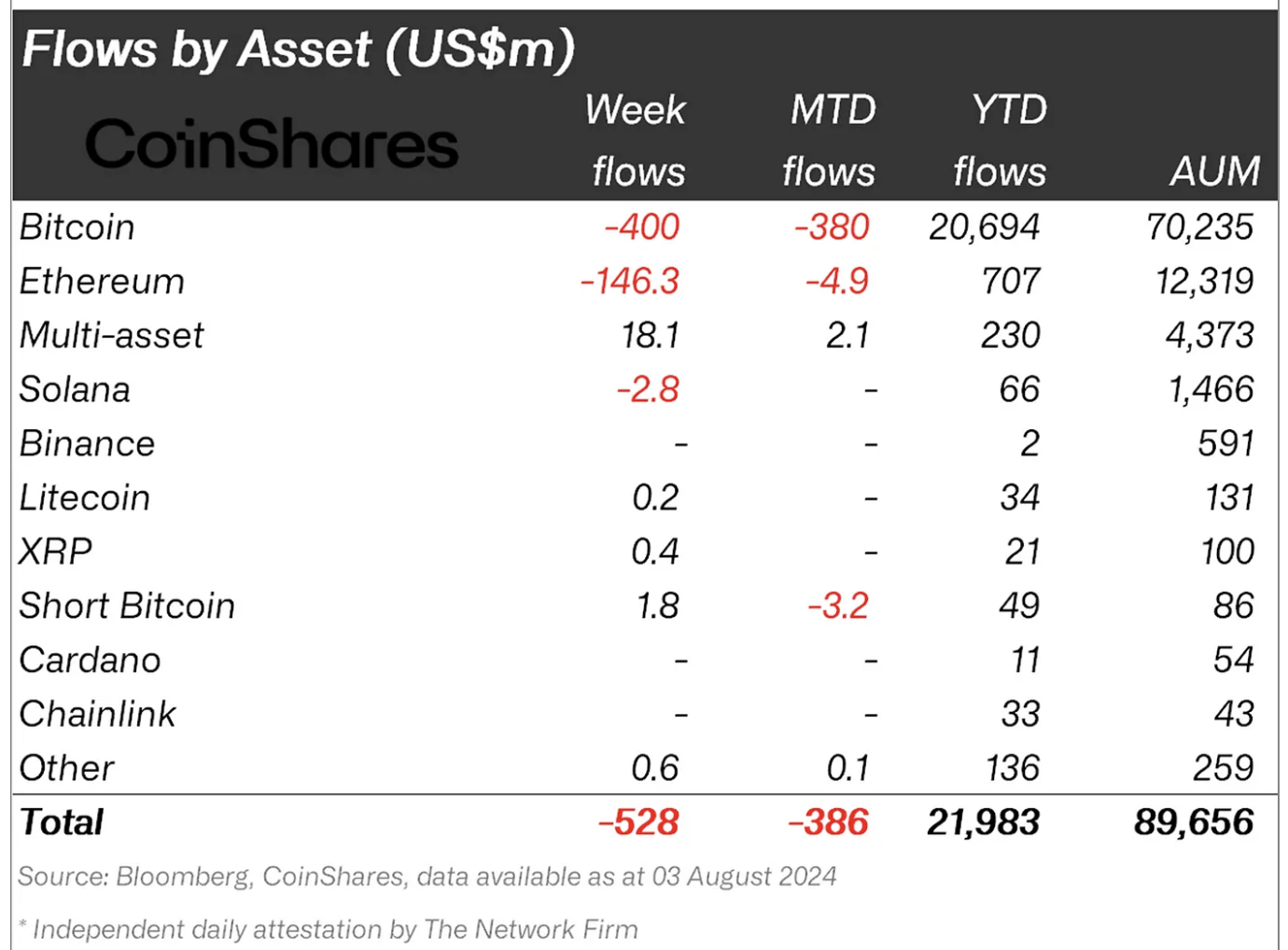

The bulk of these withdrawals were from Bitcoin-based products, which saw a $400 million exit, ending five weeks of consecutive net inflows. Notably, there was a slight uptick in investments into Short Bitcoin funds, which garnered $1.8 million, marking their first significant inflows since June.

Conversely, certain regions displayed resilience or even optimism amidst the downturn. Swiss and Canadian markets bucked the trend by registering net inflows of $28 million and $17 million, respectively.

This suggests that some investors are viewing the price declines as buying opportunities, possibly anticipating a market recovery. Ethereum-specific products also mirrored this volatile trend. Globally, Ethereum investment vehicles reported net outflows of $146 million.

The US spot Ethereum ETFs were particularly affected, with $169.4 million leaving these funds. However, this was part of a larger narrative where new Ethereum ETFs saw roughly about $433.6 million in net inflows, only to be overshadowed by $603 million in net outflows from Grayscale’s ETHE fund.

Behind The Outflows

The total of $528 million withdrawn from various crypto asset investment products last week alone comes on the heels of several notable economic pressures.

James Butterfill, the Head of Research at CoinShares, particularly attributed this exodus to mounting concerns over what they believe to be “a reaction to fears of a recession in the US, geopolitical concerns and consequent broader market liquidations across most asset classes.”

This mass withdrawal, according to Butterfill also coincided with a sharp market correction that erased roughly $10 billion from the total Exchange Traded Products (ETP) Assets Under Management (AUM) at the week’s close.

Regardless of this, so far, both Bitcoin and Ethereum appears to currently be seeing a slight rebound in their respective value. Currently, Bitcoin trades at $54,633 more than 2% from its lowest point of $49,221 seen earlier today.

Ethereum on the other hand has also reclaimed its price above $2,400 trading at $2,448, at the time of writing. The current trading price marks an increase from its 24-hour low of $2,171.

Featured image created with DALL-E, Chart from TradingView