Yesterday, August 5, LINK, the native currency of Chainlink, a decentralized Oracle provider, plunged to a six-month low. Changing hands at around $8, LINK fell by 64% from March highs, breaking out from a bull flag, signaling weakness. The correction was across the board, and leading altcoins like Solana and Cardano also posted sharp losses.

LINK Holders Accumulating, Outflows From Exchanges Spike

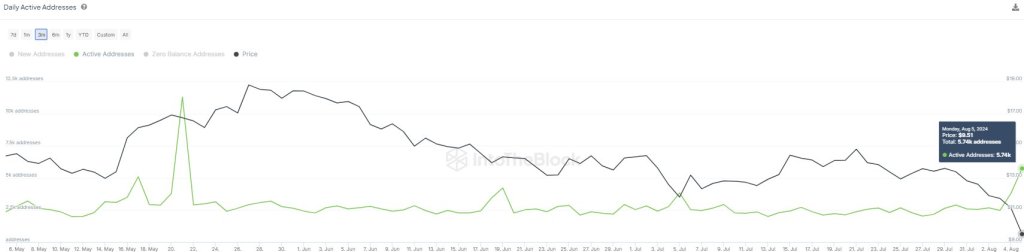

However, as the markets bled, breaking below key support levels, smart investors saw this as an opportunity to accumulate. According to IntoTheBlock data on August 6, yesterday, there was a marked increase in the number of active LINK addresses, rising to levels not seen in roughly three months.

The uptick in active addresses coincided with a spike in outflows from exchanges. This development suggests that users were more keen to accumulate LINK, not sell, despite falling asset prices.

Outflows from centralized exchanges like Binance and Coinbase are usually considered net positive. With users controlling coins via their non-custodial wallets, they can’t readily sell for other liquid coins or stablecoins.

Over the years, prices tend to recover steadily afterward whenever there is extreme fear, especially among LINK holders. Like the events of March 2020, when crypto prices flash crashed due to a COVID-19-led collapse, aggressive investors can consider such drops an opportunity to buy.

In March 2020, LINK fell by a whopping 70%. However, months later, as the money printers were powered on, crypto prices rose, lifting LINK by nearly 35X at its 2021 peak.

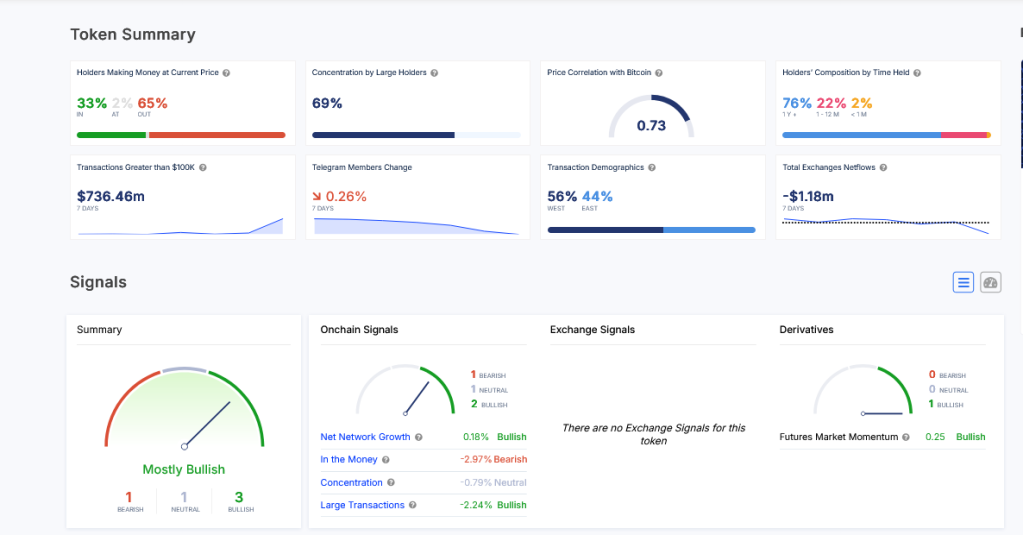

Similar to what happened then, the drop in prices coupled with outflows from exchanges and accumulation among entities makes it likely that LINK will bounce back strongly.

Most Holders Are In Red, But Partners Are Interested In Chainlink Solutions

So far, IntoTheBlock data reveals that 65% of LINK holders are in losses, and only 32% are in green. Encouragingly, though, most LINK holders are “diamond hands” and have been holding their stash for over a year.

The more long-term holders or addresses holding the coin or token for over 155 days, the more resilient prices are in the wave of liquidation.

Besides price action, optimism is high among LINK holders. Chainlink is a leading decentralized oracle provider offering services to DeFi and NFT protocols.

At the same time, Chainlink Labs, the middleware developer, continues to strike quality partnerships. Recently, 21Shares integrated Chainlink’s Proof-of-Reserve on Ethereum to enhance transparency.