Onchain Highlights

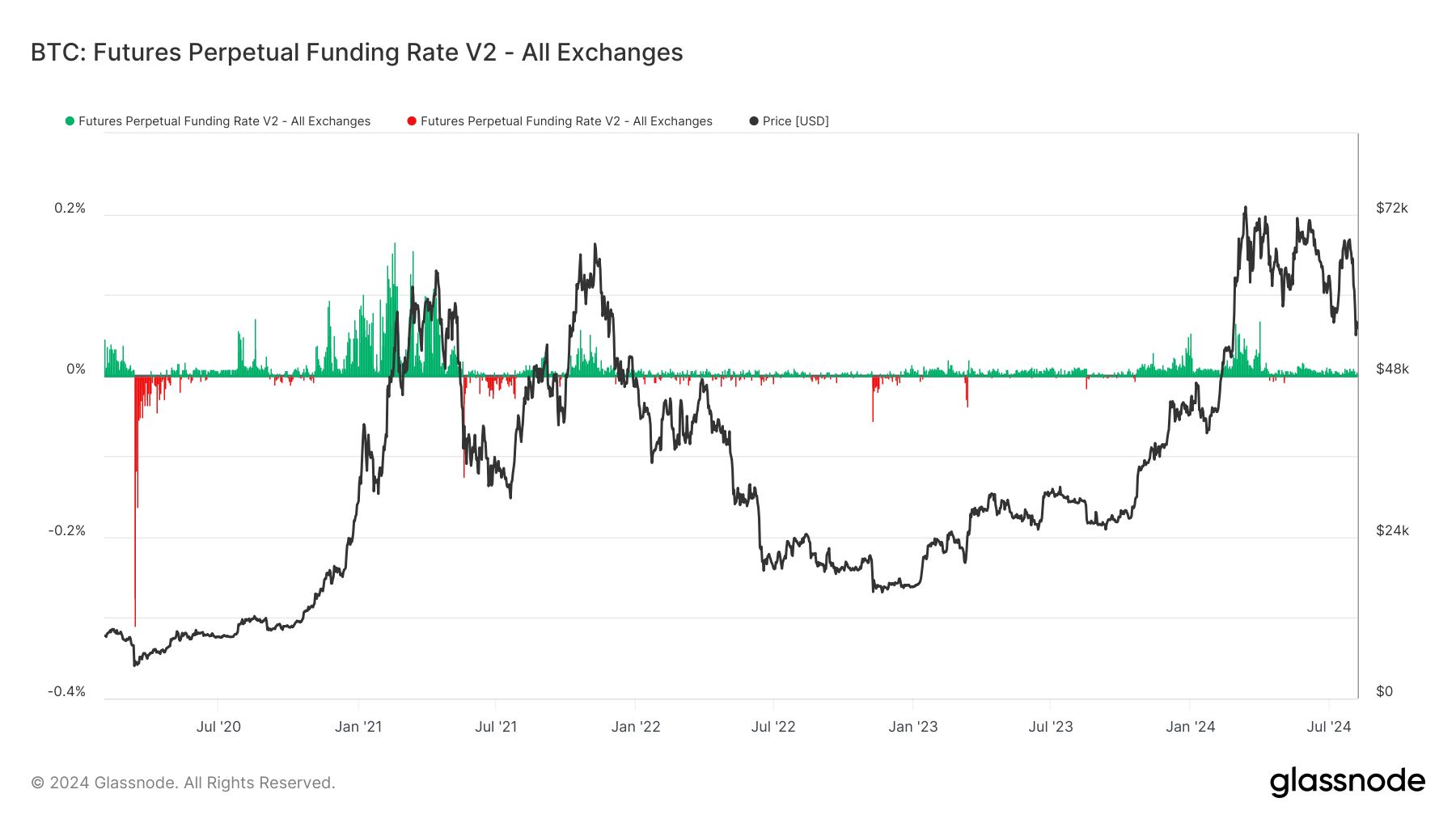

DEFINITION: The average funding rate (in %) set by exchanges for perpetual futures contracts. When the rate is positive, long positions periodically pay short positions. Conversely, when the rate is negative, short positions periodically pay long positions.

Bitcoin futures perpetual funding rates across all exchanges offer a comprehensive view of market sentiment. As the first chart indicates, there was a notable spike in funding rates during the initial phase of 2021, corresponding with Bitcoin’s significant price surge to around $64,000 in April 2021.

This period saw positive funding rates, implying that long positions were dominant, necessitating periodic payments to short positions.

Moving forward, the period from mid-2021 to early 2022 illustrates a volatile yet generally declining trend in both Bitcoin’s price and funding rates. The sharp decline in prices around the end of 2021 and the beginning of 2022 is coupled with intermittent negative funding rates, indicating moments when short positions were more prominent and shorts paid longs.

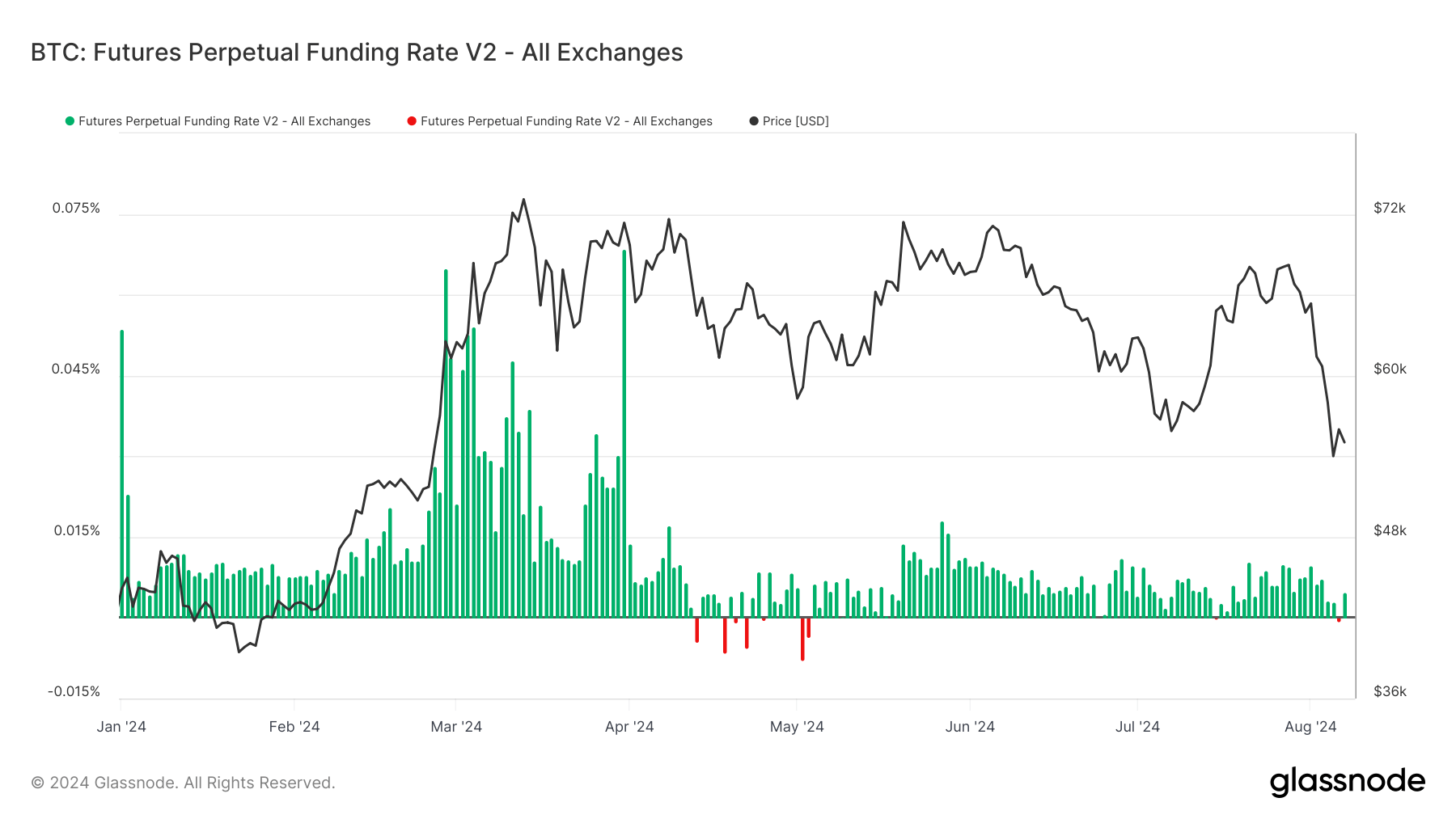

The second chart, focusing on the year 2024, highlights a relatively stable but low funding rate environment, with occasional dips into negative territory. This corresponds with a gradual price decline from the peak in mid-2024 to lower levels around $55,000 in August 2024.

The consistency of funding rates near zero during this period suggests a market equilibrium with balanced leverage between long and short positions.

The post Bitcoin funding rates showcase market sentiment shifts from 2021 to 2024 appeared first on CryptoSlate.