Quick Take

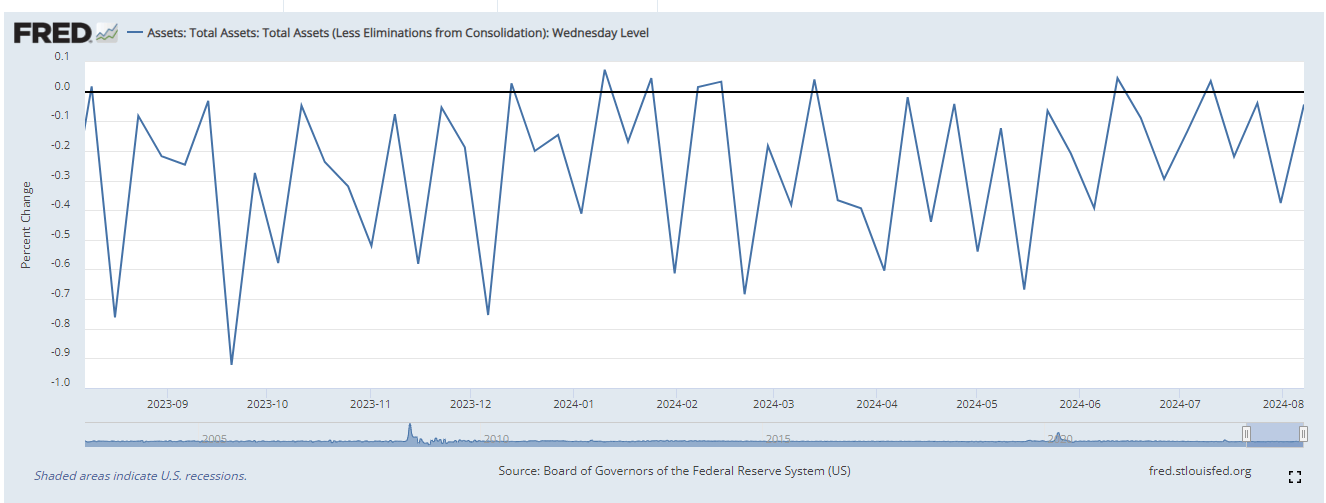

FRED shows that the Federal Reserve’s balance sheet continues to experience gradual quantitative tightening (QT), with a negligible $3.1 billion decline, bringing the total to $7.2 trillion. This marks one of the smallest QT moves in the past year, indicating a cautious approach by the Fed. While the overall trend is a long-term decrease, there have been instances of quantitative easing (QE) where the balance sheet increased week-over-week.

Meanwhile, US debt continues its rapid ascent, surpassing $35.1 trillion, highlighting ongoing fiscal challenges. The M2 money supply, which includes cash in hand and short-term deposits, stands at $21 trillion, according to FRED, meaning the US has more debt outstanding than money in circulation—a concerning metric for economic stability.

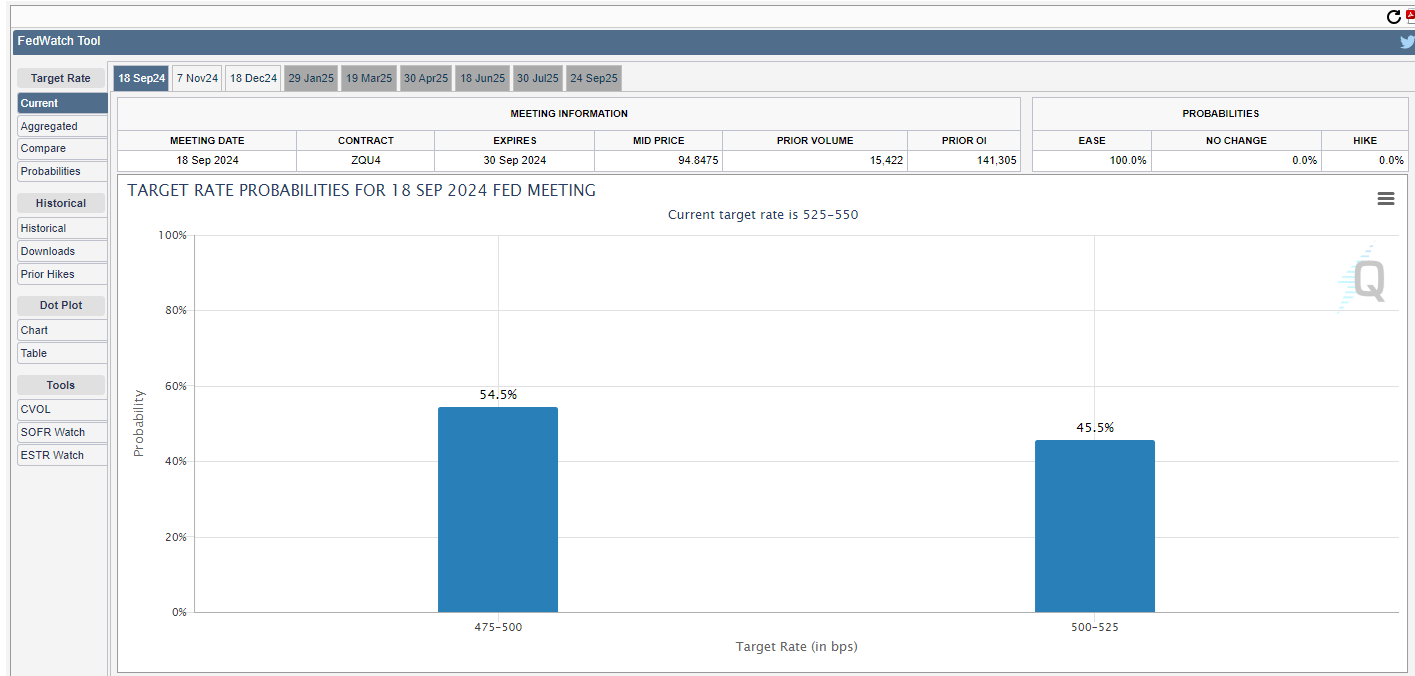

In the financial markets, recent volatility has seen a rally following a sharp drop earlier in the week. Investors are now pricing a 100% chance of a rate cut at the upcoming Federal Reserve meeting on Sept. 18. The market is split between expecting either 50 basis points (bps) or a 25 bps cut, reflecting uncertainty about the Fed’s next move in its monetary policy. This uncertainty continues to keep market participants on edge.

Bitcoin is currently trading around $60,000, reflecting a 4% increase over the past week.

The post Market braces for rate cuts as Fed’s Quantitative Tightening slows appeared first on CryptoSlate.