The Bitcoin price began Friday, August 16 from beneath the $57,000 level, following a sudden 7% fall on Thursday. While the premier cryptocurrency is showing good signs of recovery, a prominent crypto analyst has explained how the latest price decline may have pushed the BTC price into a bearish phase.

Bitcoin MVRV Drops Below 1-Year SMA – Impact On Price?

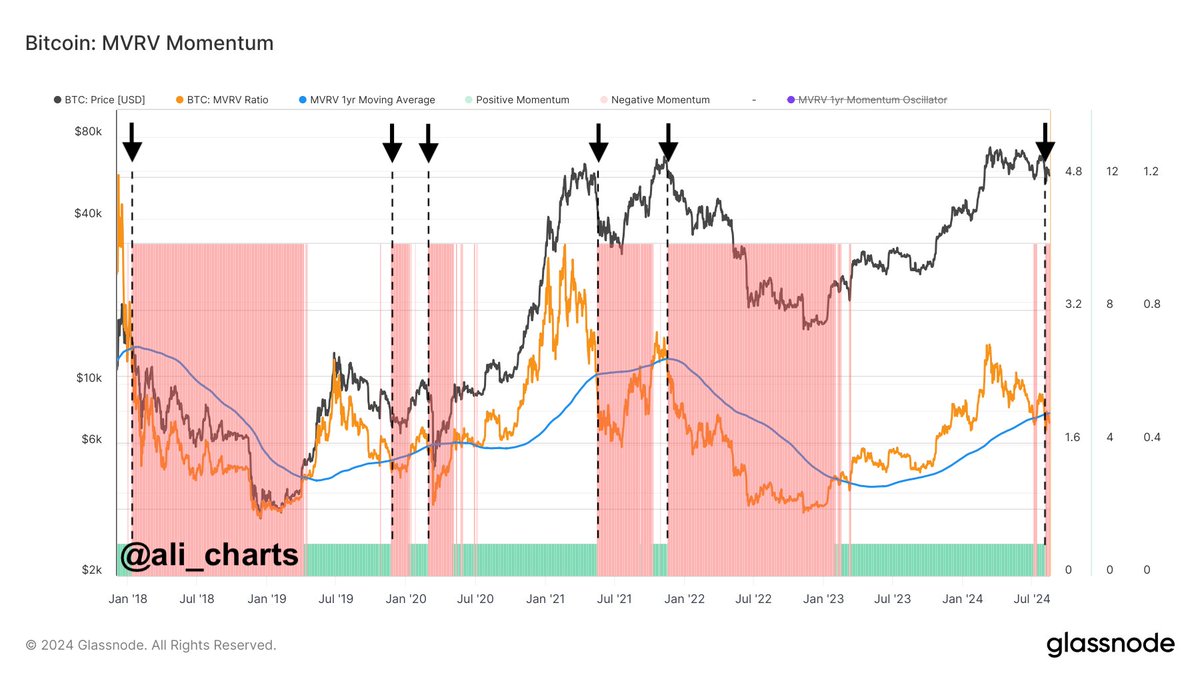

In a post on the X platform, popular crypto analyst Ali Martinez shared that the Bitcoin price has experienced a shift in its cycle following the latest price dip. This on-chain revelation is based on the Glassnode MVRV (Market Value to Realized Value) Momentum indicator, which serves as a tool for identifying macro market trends.

The MVRV Momentum indicator primarily consists of the MVRV ratio and the 1-year simple moving average (SMA). When the MVRV ratio breaks above this SMA, it indicates a transition into the bull market. Meanwhile, a break below the 1-year simple moving average signals a shift to the bearish phase.

Typically, strong breaches above the MVRV 1-year SMA suggest that large volumes of Bitcoin were acquired below the current price, showing that the holders are now in profit. On the flip side, when there is a strong break beneath the moving average, it indicates that large volumes of BTC were purchased above the current price, with the holders in the red.

According to Martinez, the BTC cycle transitioned to a bearish phase after the Bitcoin price slumped below $61,500. This latest significant break of the MVRV ratio beneath the SMA shows that a significant amount of BTC was acquired above $61,500. However, the coins are now in loss, which may potentially lead to heavy distribution by investors who want to cut back their losses.

When a large number of investors are in the red, there is an increased pressure to sell, which could put further downward pressure on the Bitcoin price. Ultimately, this could lead to a situation where falling prices result in more asset offloading, thereby strengthening the momentum of the bearish phase.

Bitcoin Price At A Glance

As of this writing, the price of Bitcoin continues to hover around $59,000, reflecting a 2.5% increase in the past 24 hours. Nevertheless, the premier cryptocurrency is down by nearly 3% on the weekly timeframe, according to data from CoinGecko.