Amidst the general financial market crash in early August, Ethereum (ETH) lost about 30% of its value, falling to $2,226 per unit. Notably in the last few weeks, the prominent altcoin has shown much resilience climbing back into the $2,600 price region. Albeit, this recent price retracement is accompanied by much uncertainty on how long Ethereum can sustain such upward momentum. Commenting on this dialogue, CryptoQuant analyst ShayanBTC has postulated that Ethereum may likely resume its bearish course.

Ethereum Price To Suffer From Sellers’ Dominance

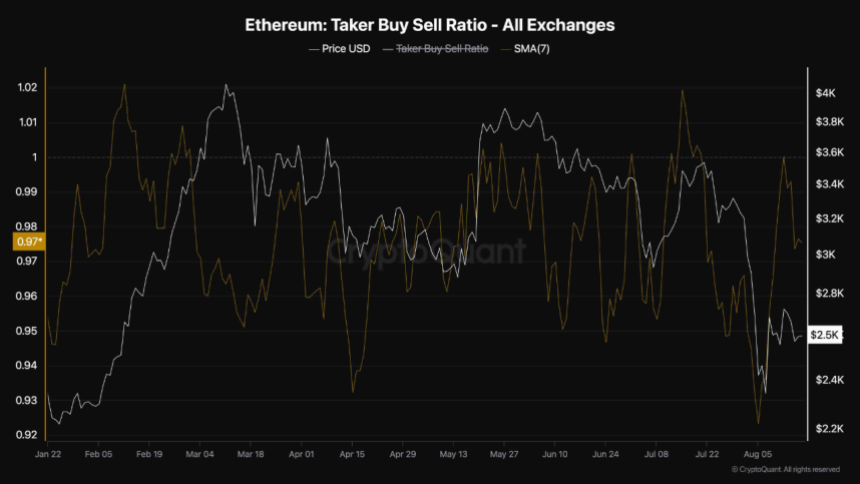

In a QuickTake post on Saturday, ShayanBTC shared that the Taker Buy/Sell Ratio indicated that Ethereum may be set for more price loss in the coming days. To explain, the Taker Buy/Sell Ratio is an analysis tool that gauges the balance between aggressive buying and selling activity. It is calculated based on the volume of taker buy orders and taker sell orders.

As common with other indicators, a Taker Buy/Sell ratio above one suggests there is an upward market momentum with more aggressive buyers than sellers and a ratio below one represents a downward market pressure with the opposite scenario.

According to ShayanBTC, after recently failing to surpass the $3000 price resistance, Ethereum’s Taker Buy/Sell Ratio declined drastically as evidenced by the asset’s price movement. As expected, the metric also experienced a rebound following ETH’s recent price gains. Albeit, the Taker Buy/Sell Ratio could not rise above 1 staying in the zero region, which indicated a lack of sufficient buying pressure allows the sellers to retain market control.

However, ShayanBTC reports that the TakerBuy/Sell Ratio has once again declined indicating that sellers are preparing to offload their assets, potentially causing an Ethereum price fall. The analyst calls for caution, stating that the ETH market will require a massive rise in demand to avoid resuming the downward price movement.

ETH Price Overview

According to data from CoinMarketCap, Ethereum currently trades at $2,610 reflecting a minor 0.61% gain in the last day. However, the asset’s performance on larger time frames is still unimpressive with a decline of 23.93% in the last month.

With persistent gains, the most prominent altcoin is set to encounter an early resistance at the $2,700 price region. If buying pressure proves sufficient, ETH could move past this barrier rising as high as $3,000. On the other hand, a massive selling pressure as indicated by the Taker Buy/Sell ratio can force the asset’s price as low as $2300.