Quick Take

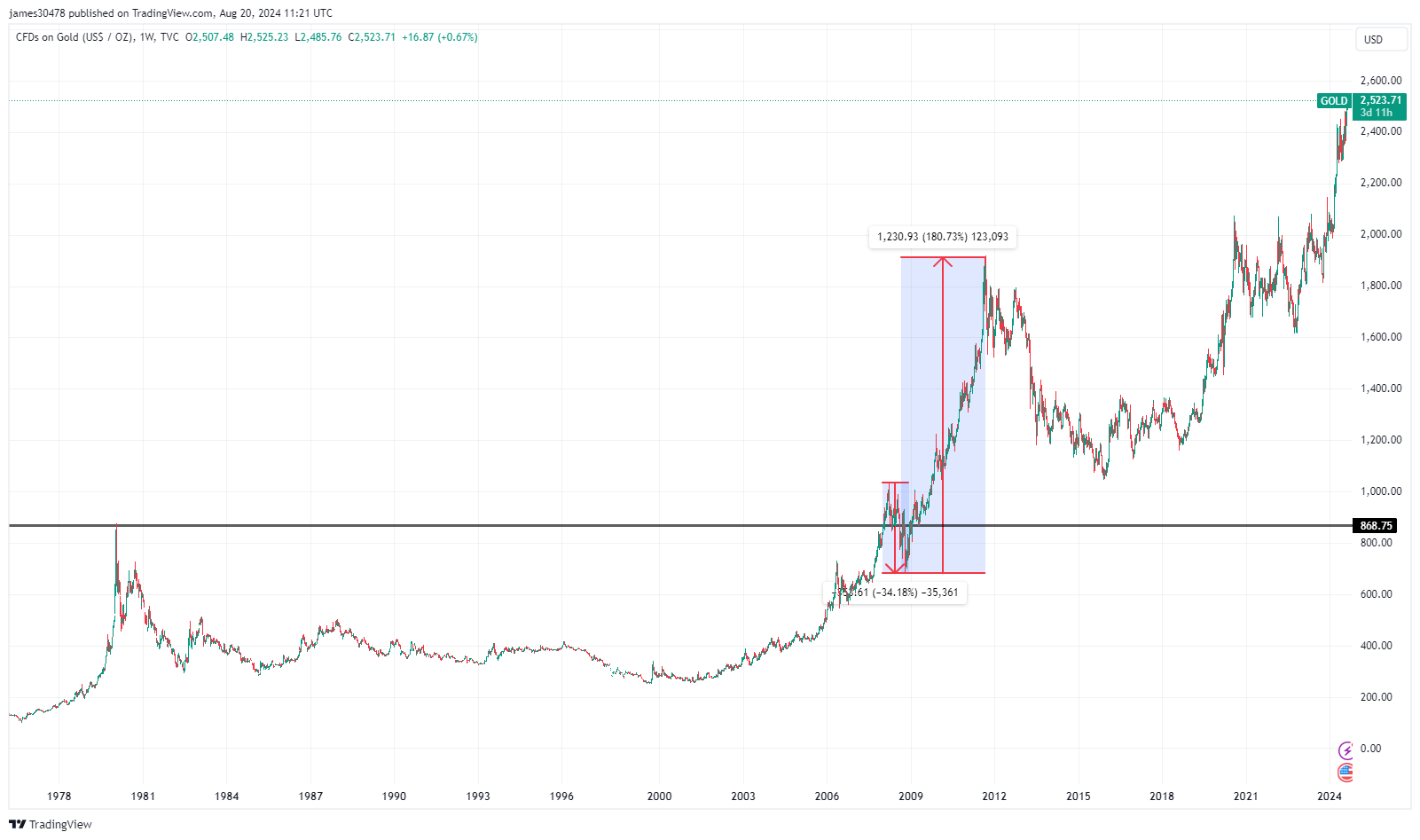

The current financial landscape is complex and intriguing. Gold has recently reached all-time highs, surpassing $2,500, while US equities continue their upward trajectory, with indices on the verge of setting new records. Simultaneously, the US Dollar Index (DXY) has been weakening, recently breaking below 102 and approaching year-to-date lows. This decline is part of a coordinated global effort by central banks to diminish the dollar’s strength, which can stifle global markets if the DXY remains too strong.

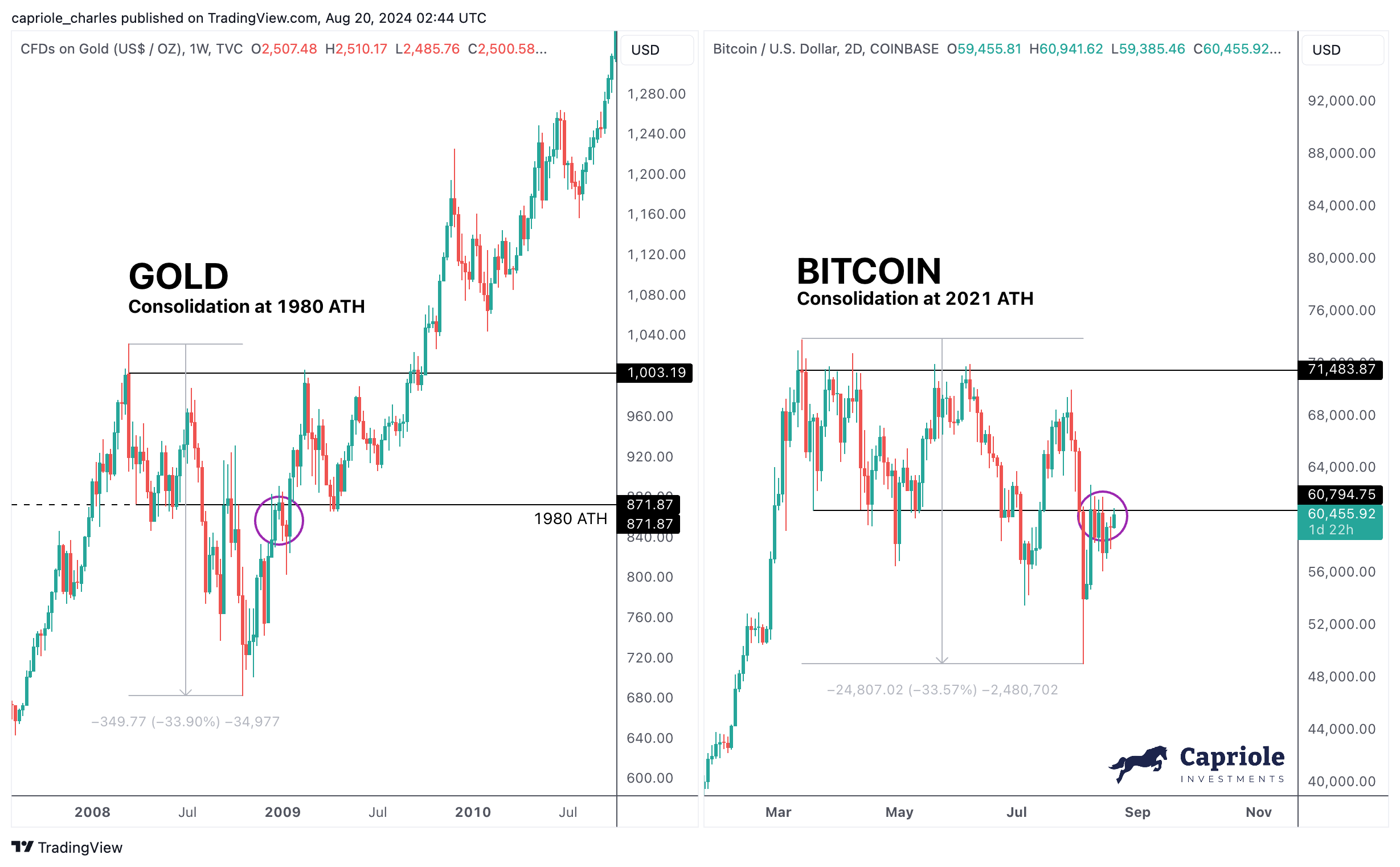

In the digital asset markets, Bitcoin (BTC) is consolidating around $60,000, a range it has maintained for six months, mirroring its 2021 highs. This consolidation occurs despite significant selling pressure from entities like the German government and Mt. Gox. Additionally, the VIX volatility index had surged, partly due to the unwinding of the Yen carry trade, contributing to an even further disconnect between Bitcoin and other markets.

Capriole Investments has drawn parallels between Bitcoin’s current behavior and gold’s performance in 2008. In 2008, gold consolidated near its 1980 all-time high for nine months, the first time it had done so since the 2004 launch of the Gold ETF GLD, before surging 180% over the next four years.

Similarly, Bitcoin, following the launch of its ETF in January, has been consolidating for the first time since the launch and around its previous high in 2021. Charles Edwards, Founder of Capriole Investments, shared on X back in July that if Bitcoin follows a similar trajectory to gold, it could drop to around $48,000, which it did in August 2024. If it continued to follow the same structure, Bitcoin would surge to around $140,000 by May 2025.

“That would be the same as Bitcoin potentially dipping again to around $48K, then ripping straight to $140K with no dips by around May 2025.”

The post Bitcoin consolidation hints at significant surge, mirroring gold’s 2008 trend appeared first on CryptoSlate.