Crypto analyst Quinten François recently highlighted a cycle indicator that suggests the Bitcoin bull run is just about to begin. The crypto analyst highlighted several fundamentals that paint a bullish picture for BTC heading into this bull run.

The Bitcoin Bull Run Could Be Two Months Away

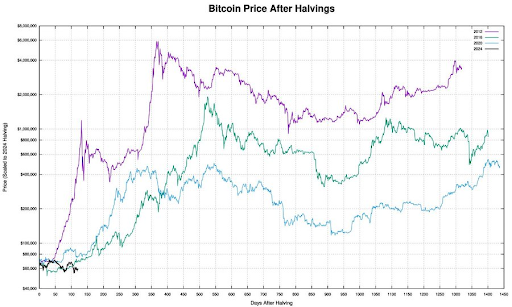

In an X (formerly Twitter) post, Quinten reminded the crypto community that the average cycle starts 170 days after the Bitcoin halving. He added that it has been 121 days since the halving event, meaning the bull run could be two months away and possibly begin sometime in October.

In a subsequent X post, the crypto analyst highlighted Bitcoin’s perfect setup for the bull run that is about to begin. He remarked that the German government is done selling its BTC holdings while outflows from Grayscale’s Bitcoin Trust (GBTC) have drastically reduced. Furthermore, Quinten noted that global liquidity is about to explode again, meaning more liquidity will likely flow into Bitcoin soon enough.

FTX creditors are also said to be on the verge of receiving their repayments, and Quinten believes that most of this cash will flow into Bitcoin. Meanwhile, BTC supply on exchanges is historically low, which indicates that investors are aggressively accumulating the flagship crypto. Most of these investors are believed to be mainly institutions, as the crypto analyst noted that they are stacking more than 450 BTC, which is mined daily.

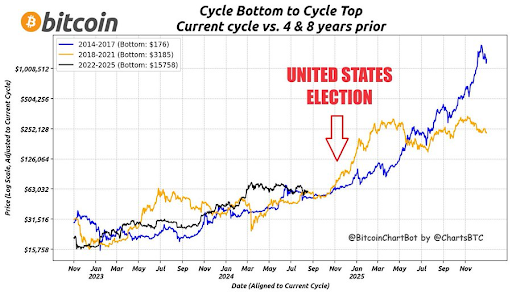

Having highlighted these bullish fundamentals, Quinten asserted that the boring summer months are almost over and that the bull run for Bitcoin and other cryptocurrencies is about to start. As to how high BTC could reach in this bull run, Quinten shared a chart showing that the flagship crypto could rise to as high as $250,000 at the peak of this market cycle.

This price prediction was based on Bitcoin’s price movement in previous cycles from its cycle bottom to cycle top. Quinten believes the US election could significantly impact BTC’s price as he highlighted how the fourth quarter of the year looks good for the flagship crypto.

What The Bull Run Will Look Like

Crypto analyst Smiley Capital recently provided insights into what the bull run could look like when it finally begins. He stated that Bitcoin will rally so hard that it “paralyzes the entire market.” He added that there will be periods of consolidation for Bitcoin after “face-melting rallies,” which will lead to a reset in the open interest (OI). Once that is done, BTC will once again continue its uptrend.

Meanwhile, after BTC was done, Smiley claimed that Ethereum would have an even stronger rally, bringing the entire market up. This will lead to altcoins having “weeks, months of inhumane moves.” However, the analyst warned that there would be short-term corrections to wipe out leverages but suggested that these coins will enjoy even greater rallies from such lows.

At the time of writing, Bitcoin is trading at around $60,600, up over 2% in the last 24 hours, according to data from CoinMarketCap.