Quick Take

Bitcoin

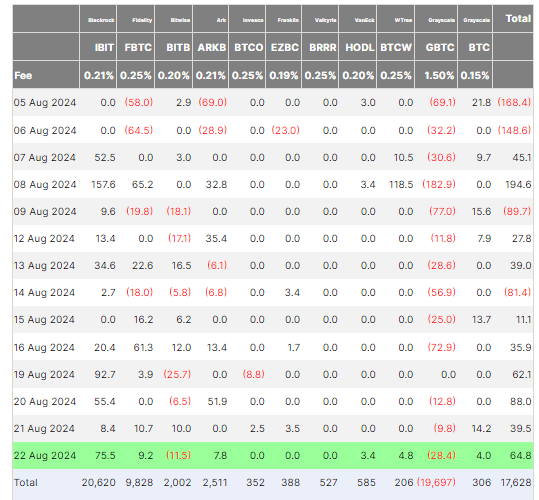

Bitcoin ETFs continued their positive momentum, recording their sixth consecutive trading day of inflows on Aug. 22, with a total inflow of $64.8 million. BlackRock’s IBIT led the surge, attracting $75.5 million, bringing its total net inflow to an impressive $20.6 billion. Other inflows included Fidelity’s FBTC with $9.2 million, Ark’s ARKB with $7.8 million, WisdomTree’s BTCW with $4.8 million, and VanEck’s HODL with $3.4 million.

Grayscale’s BTC also contributed with a $4 million inflow. However, there were outflows from Grayscale’s GBTC, which saw a $28.4 million decline, and Bitwise’s BITB, which lost $11.5 million. Despite these outflows, the total inflows for Bitcoin ETFs stand strong at $17.6 billion.

Ethereum

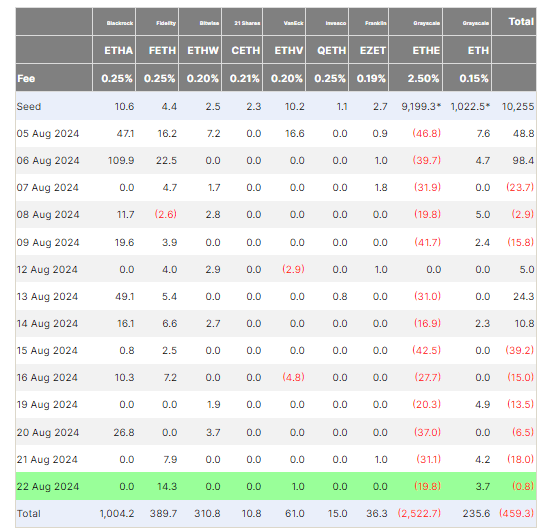

In contrast, Ethereum ETFs experienced a net outflow, continuing their recent trend. The sector saw a modest $0.8 million outflow overall on Aug. 22. Grayscale’s ETHE was the biggest contributor to this decline, with a $19.8 million outflow, while Fidelity’s FETH partially offset the loss with a $14.3 million inflow. The cumulative outflows for Ethereum ETFs now total $459.3 million, highlighting the ongoing divergence in investor sentiment between Bitcoin and Ethereum ETFs.

The post Bitcoin ETFs record sixth consecutive trading day of inflows amid BlackRock surge appeared first on CryptoSlate.