On-chain data shows that Bitcoin investors have recently been participating in accumulation at a rate five times that of miners’ production.

Bitcoin Investors Have Been Doing Significant Net Accumulation Recently

In a new post, analyst James Van Straten talked about how the demand among Bitcoin investors currently compares against the monthly issuance on the network.

The “monthly issuance” here refers to the amount of Bitcoin miners have “issued” on the network during the past month. Miners produce new BTC when they mine new blocks and receive block subsidies as compensation.

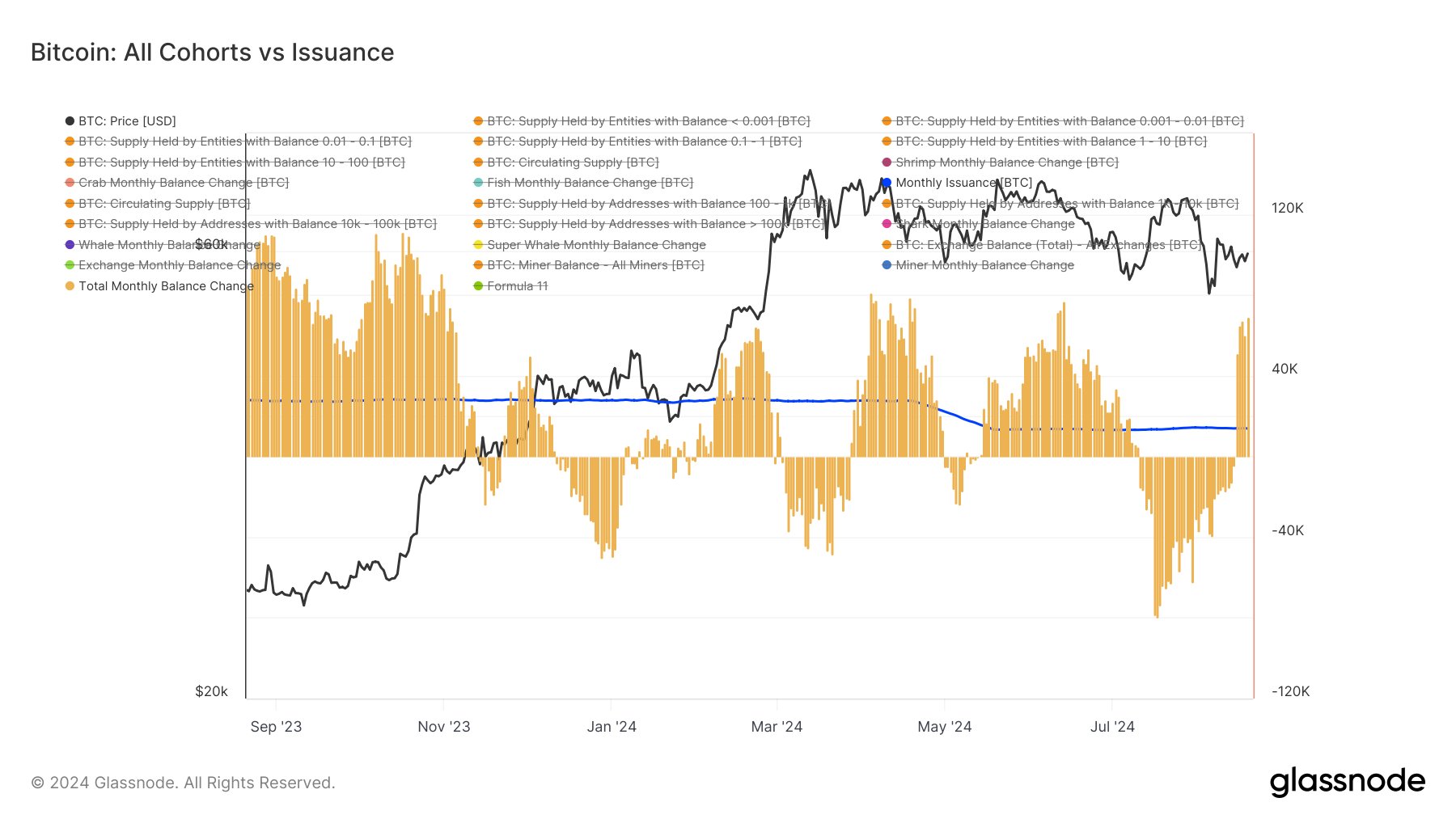

The chart below shows how the Bitcoin monthly issuance has stacked against the monthly balance changes of all BTC investor cohorts over the past year.

The investor cohorts here include all types of holders, ranging from the measly shrimps to the humongous whales. The chart shows that the balance change of the combined market had turned highly negative last month, but it gradually increased in value and has now flipped into positive territory with a sharp spike.

Investors didn’t want to buy Bitcoin at the levels it was trading at in July, as they had instead preferred to sell, but the trend shift suggests the recent price levels have been much more enticing.

As the chart shows, this strong accumulation has significantly outweighed the issuance. The monthly issuance stands at 14,000 BTC, while the investors have added a net 70,000 BTC to their wallets over the past month, meaning that they have bought five times as much as miners have minted.

As for how the investors can accumulate more than what the miners are producing, the answer is simple: the cohorts here exclude exchange-related wallets.

Reserves of centralized exchanges represent the selling pressure present in the market, so when investors shift coins to these platforms, the balance change of all cohorts shows a net negative value.

The recent strong accumulation from the Bitcoin investors is naturally a positive sign, as it suggests the cohorts are pulling a net amount of supply out of the wallets of these central entities.

However, it remains to be seen how long the market continues to be in accumulation mode, as it has only been a few days since the metric flipped positive.

BTC Price

Bitcoin had made another foray above the $61,000 mark earlier in the day, but it seems like the asset has found rejection once more as it has retraced down to $60,600. The chart below shows the recent trajectory of cryptocurrency.