Injective piques investors’ interest as on-chain developments continue on the platform. These new integrations and information excite investors, bumping the token’s price by over 21%. The continuous positive developments are expected to further steer the INJ on the bullish path.

Given the conditions and positive developments of Injective, its investors and traders have chosen the status of INJ as a prime crypto for its native token, providing values to users and traders.

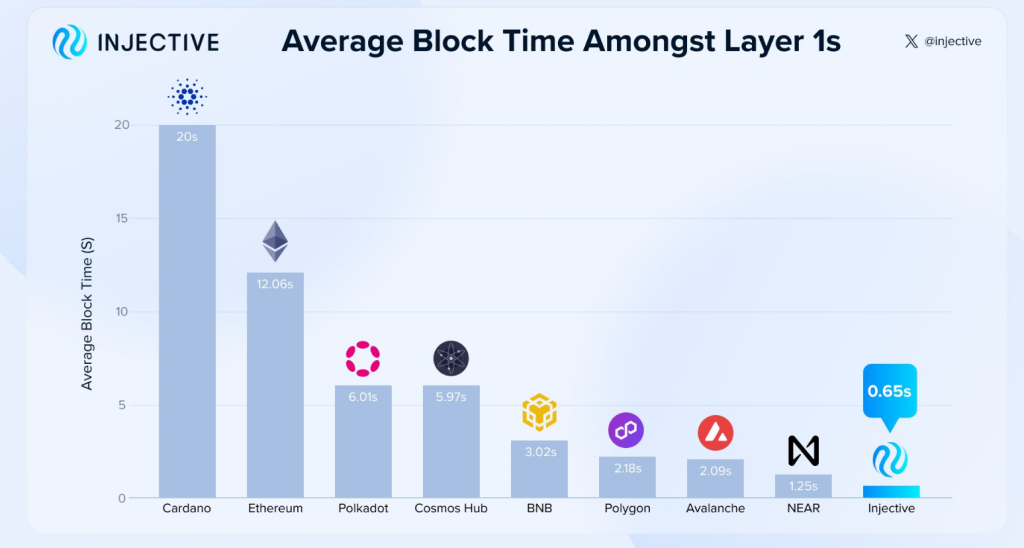

‘Fastest Layer 1 Blockchain’ Slashed Blocktimes To Just 0.65 Seconds

Injective recently posted a thread detailing the platform’s most recent achievement: slashing finality times to just 0.65 seconds. The platform’s finality times were compared to other layer 1 blockchains like Near, BNB, and Ethereum. According to the thread, the network’s finality times are caused by “carefully engineered optimizations focused on several key areas from optimized state synchronization and data handling to enhanced resource management.”

1/5 Injective continues to push the boundaries of blockchain scalability, with recent upgrades delivering the fastest speeds imaginable.

Injective block times have now been slashed to just 0.65 seconds, making it one of the fastest layer 1 blockchains ever created

pic.twitter.com/lFN3W1w2Ve

— Injective

(@injective) August 21, 2024

This helps improve user experience on-chain while providing developers with a robust platform to build on. Another aspect that Injective is looking towards is the institutional aspect of crypto. The extremely low block times will help attract traditional financial institutions to the platform with speeds rivaling that of the top crypto networks.

Injective Integrates With Balance, Expanding Network Services

This week, Injective also announced the integration of Balance, a cross-chain decentralized finance platform (DeFI), on the Injective mainnet. The integration opens new opportunities for investors and traders as it introduces new assets like bnUSD, Balance’s native stablecoin.

The partnership also enables overcollateralized loans on the platform. This enables users to use any asset as collateral, giving them up to two-thirds of the collateral’s value as a loan. With a low 2% fixed interest, users on the platform can flexible loan terms with fast block time finality with Injective.

INJ Faces Rejection On This Level, But With A Possible Rebound

As of press time, the token’s momentum, although still significantly bullish, is facing rejection on the $0.39 ceiling, trapping the token in the narrow $0.36-$0.39 range. This range might pressure the bulls to lose momentum in the short term.

At this point, the token’s correlation with Bitcoin and its most recent developments has squeezed the last bit of bullishness out of INJ, possibly opening the doors to a downward trajectory in the coming days.

With the relative strength index signaling that the bulls are nearly or already exhausted, investors and traders should expect the bears to attempt a breakthrough on the $0.36 floor before stabilizing on the token’s current trading range. If the bulls are unsuccessful in defending this trading range, the price floor of Injective might move back to $0.32 soon.

Featured image from Snopes, chart from TradingView