According to on-chain data, a dormant Bitcoin (BTC) wallet created over a decade ago has suddenly reawakened, transferring over $1 million worth of BTC to an unknown address. This unexpected yet substantial transaction comes as Bitcoin’s price surges past $64,000.

Decade Old Bitcoin Wallet Springs Back To Life

An old Bitcoin wallet established 10.7 years ago has executed a large-scale BTC transaction on August 19. Blockchain tracker and analytics system, Whale Alert, disclosed on X (formerly Twitter) that the address had contained 19 BTC, worth about $13,259 in 2013.

The Bitcoin wallet which has been inactive for years, most likely due to strategic HODLing, now boasts impressive gains of about 8,844%, fueled by the cryptocurrency’s consistent yet dramatic price increase since 2013. Additionally, the sudden wallet activation comes as Bitcoin’s price surges past the $64,000 price mark after experiencing a significantly bearish phase.

With Bitcoin’s current price, the 19 BTC moved by this decade-old wallet address is now worth over $1,185,944, marking a significant profit with a gain of $1,172,685. The transaction records also show that the anonymous sender transferred the Bitcoin to an unknown address, incurring a fee of 0.000047 BTC.

Typically, when a Satoshi era Bitcoin wallet suddenly springs back to life, it often indicates a potential for increased market activity. Dormant wallets that move substantial amounts of Bitcoin tend to impact market liquidity and price movements. Meanwhile, smaller Bitcoin transactions could capture the interest of the crypto community, prompting speculations.

Bitcoin Turns Bullish With $64,000 Price Surge

Over the past few months, the price of Bitcoin has struggled to rebound to its March all time high of more than $73,000. The cryptocurrency witnessed sudden price crashes and constant fluctuations due to large scale market liquidations and shifts in investor sentiment.

After a long period of consolidation, Bitcoin is finally showing signs of a bullish rebound. CoinMarketCap’s data shows that the cryptocurrency surged by 5.33% in the last 24 hours, and is now trading at $64,311. Over the past week, Bitcoin also recorded an 8.6% increase, underscoring the cryptocurrency’s renewed strength and potential for a major price recovery.

Many analysts are viewing the cryptocurrency’s steady price increase as a bullish signal, potentially indicating a substantial price reversal from bearish trends.

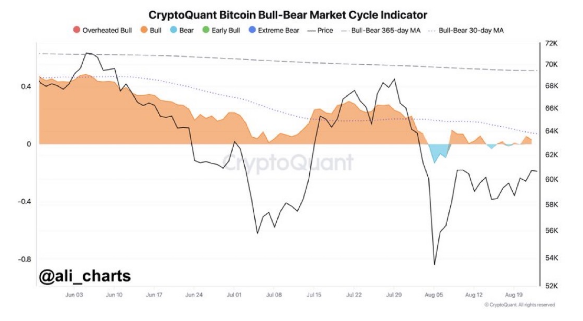

Popular crypto analyst, Ali Martinez noted in an X post that the Bitcoin bull-bear market indicator has oscillated between bearish and bullish since early August. However, with the cryptocurrency experiencing new price gains, the indicator has now switched back to a bullish stance.

Additionally, a crypto market expert identified as ‘Milkybullcrypto,’ highlighted that Bitcoin is finally breaking out of the bullish reversal price pattern. He emphasized that the cryptocurrency’s monthly bull flag now has a price target of $100,719.

Featured image from CNBC, chart from TradingView